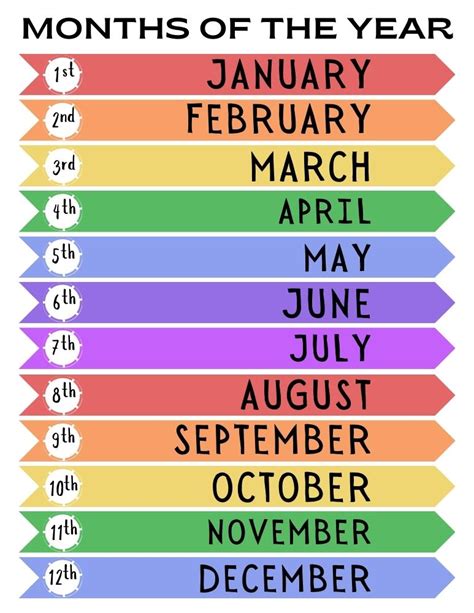

The concept of time and its measurement has been a cornerstone of human civilization, allowing us to make sense of our existence and plan for the future. One of the most common units of time is the year, which is defined as the time it takes the Earth to orbit the Sun once. However, when we talk about time in terms of months, the calculation becomes a bit more complex. For instance, the statement "4 years in 50 months" seems counterintuitive at first glance, as the standard calendar year consists of 12 months. To unpack this, let's delve into the details of time measurement and explore how such a scenario could occur.

Understanding Time Measurement Basics

To grasp the idea of “4 years in 50 months,” we need to understand the basic units of time and how they interrelate. A year is approximately 365.25 days, accounting for the extra quarter of a day that necessitates a leap year every four years. This standardization allows for a predictable and organized way to measure time over long periods. However, when considering financial or business contexts, years can sometimes be measured in terms of months for simplification or specific calculation purposes.

Financial Years and Calendar Years

In some contexts, such as financial planning or business operations, a year might not strictly follow the calendar year. For example, a company’s financial year could start in April and end in March of the following year. This discrepancy can lead to variations in how time is measured and reported. The concept of “4 years in 50 months” could potentially arise from such a non-standard measurement, where the traditional 48 months (4 years * 12 months/year) are condensed or otherwise adjusted due to specific circumstances or accounting practices.

| Time Frame | Months in Standard Year | Adjusted Months |

|---|---|---|

| 4 Years | 48 Months | 50 Months (Adjusted) |

Practical Applications and Considerations

The concept of “4 years in 50 months” might seem abstract, but it has practical implications in fields such as finance, where time periods are crucial for calculating interest, returns on investment, and project timelines. For instance, in a scenario where an investment compounds monthly, the number of months can significantly affect the final yield. Understanding and accurately calculating these time frames are essential for making informed decisions.

Impact on Financial Calculations

In financial calculations, the difference between 48 months and 50 months can have a noticeable impact, especially in compounds or accruals that are time-sensitive. For example, if an investment grows at a monthly rate, the additional two months could result in a higher total return. This underscores the importance of precise time measurement in financial planning and analysis.

Key Points

- The concept of "4 years in 50 months" can arise from non-standard time measurement practices, particularly in financial or business contexts.

- Understanding the basis of this measurement is crucial for accurate financial planning and analysis.

- The difference between standard and adjusted months can significantly impact financial calculations, especially in compounding interest scenarios.

- Accurate time measurement is essential for making informed decisions in fields such as finance and business operations.

- Non-standard year measurements can stem from factors like financial year start dates, accounting practices, or regulatory requirements.

Conclusion and Forward-Looking Perspectives

In conclusion, the notion of “4 years in 50 months” highlights the complexities and variations in time measurement, particularly in specialized contexts. As our understanding of time and its applications evolves, so too must our approaches to measuring and utilizing it. For professionals and individuals alike, grasping these nuances is vital for navigating the intricacies of financial and operational planning. By recognizing the potential for adjusted time frames and their implications, we can better navigate the complexities of our temporal landscape.

What are some common reasons for non-standard year measurements?

+Non-standard year measurements can stem from various factors, including the start date of a financial year, specific accounting practices, or regulatory requirements that dictate how time is measured and reported.

How can the difference between 48 and 50 months impact financial calculations?

+The additional two months can result in higher returns for investments that compound monthly, due to the extra periods of growth. This effect can be significant over longer periods or with higher growth rates.

What is the importance of understanding non-standard time measurements in business and finance?

+Understanding non-standard time measurements is crucial for accurate financial planning, analysis, and decision-making. It helps in predicting outcomes, managing risks, and optimizing returns, especially in scenarios where time-sensitive calculations are involved.