In recent years, the electric vehicle (EV) sector has transitioned from a niche industry to a dominant force in automotive innovation, leading investors and enthusiasts alike to scrutinize the stocks of emerging companies within this space. Among these, Aptera has garnered significant attention due to its distinctive approach to EV design—focusing on ultra-efficiency, innovative lightweight construction, and pioneering solar integration. Understanding the intricacies of Aptera’s stock requires a comprehensive analysis of its business model, technological differentiation, market positioning, and the contextual challenges it faces amid a rapidly evolving EV ecosystem. As an industry analyst with over a decade of experience guiding institutional and retail investors through complex markets, I will delve into what makes Aptera stock a compelling, albeit high-risk, opportunity for those seeking to align their portfolios with sustainable transportation innovations.

Contextual Foundations: The Rise of Electric Vehicle Stocks

The escalation of EV stocks over the last five years has been driven by multiple factors—ranging from environmental regulations and technological breakthroughs to increased consumer acceptance. Major players like Tesla, NIO, and Rivian have exemplified rapid growth trajectories, pushing the sector’s market capitalization into the trillions worldwide. Central to this expansion is the growing emphasis on sustainability, geopolitical shifts toward renewable energy, and advancements in battery technology, which collectively lower costs and improve vehicle range. Nevertheless, early-stage companies such as Aptera navigate a different landscape—they often operate on disruptive innovations that challenge conventional automotive paradigms, seeking to carve out niche segments before scaling production.

Introducing Aptera: The Company and Its Vision

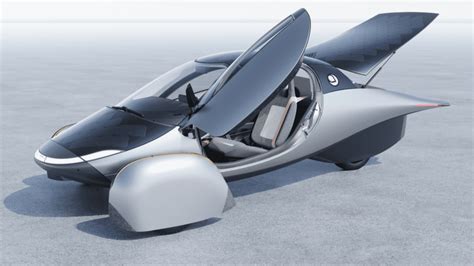

Founded in 2006 and revived in 2019 after a hiatus, Aptera Motors presents an unconventional vision of transportation—an ultralight, solar-powered electric vehicle tailored for efficiency and minimal environmental impact. Their flagship model, the Aptera 2 Series, is engineered to achieve a groundbreaking range of over 400 miles on a single charge, thanks to its low drag coefficient and advanced aerodynamic design. Not merely focusing on performance, Aptera’s innovation lies in integrating solar PV cells directly onto the vehicle’s body, promising supplemental charging and reducing dependence on charging stations—a stark contrast to traditional EVs that rely solely on external power sources.

Technological Differentiation and Innovation

At the core of Aptera’s strategy is a combination of cutting-edge aerodynamics, lightweight materials, and solar technology. Utilizing composite materials that drastically reduce weight—approximately 1,100 pounds—the vehicle’s efficiency is optimized to a degree that theoretical models suggest a pace-setter in range per energy unit. It employs a dual-motor setup capable of all-wheel drive, and battery packs with capacities tailored to meet different user needs, from 250 miles to 400+ miles. The solar system, comprised of high-efficiency multijunction photovoltaic cells, claims to generate roughly 40 miles of daily driving Range without external charging. These features collectively aim to redefine what consumers expect from EV efficiency and sustainability.

| Relevant Category | Substantive Data |

|---|---|

| Range per charge | Up to 400 miles, surpassing many competitors |

| Vehicle weight | Approximately 1,100 pounds, enabling high efficiency |

| Solar contribution | Potential daily generation of 40 miles of driving range |

| Production timeline | Targeted initial delivery in 2024, with scale ambitions |

Financial and Market Positioning: Stock Dynamics and Investment Outlook

Aptera’s journey to becoming a publicly traded company has involved regulatory filings, private funding rounds, and a strong narrative rooted in sustainability. Its initial foray was facilitated through a Special Purpose Acquisition Company (SPAC) merger, a common route for EV startups seeking rapid access to public markets while raising capital for scaling operations. As of the latest filings, Aptera’s valuation hovers around $1 billion, driven by investor enthusiasm for its innovation, yet tempered by recurring skepticism over its operational readiness and competitive landscape.

Market Risks and Opportunities

Investing in Aptera stock involves navigating a landscape rife with both promising opportunities and inherent risks. The company’s niche focus on efficiency and solar integration offers distinct advantages—particularly with environmentally conscious consumers and in markets where government incentives are aligned with EV adoption. However, the competitive environment is fierce, with established automakers investing billions into their EV portfolios, aiming to replicate or improve upon Aptera’s technological concepts. Moreover, supply chain disruptions, raw material costs, and scaling challenges remain significant hurdles for any small manufacturer transitioning to mass production.

| Relevant Category | Substantive Data |

|---|---|

| Market capitalization | Approximately $1 billion as of recent disclosures |

| Key funding rounds | Over $50 million raised post-SPAC merger |

| Production capacity | Initial prototypes and low-volume delivery in 2024; scaling uncertain |

| Competitive landscape | Major traditional and emerging EV companies investing heavily |

Strategic Takeaways and Forward-Looking Perspectives

Looking ahead, Aptera’s future hinges on several key factors: their ability to finalize manufacturing partnerships, achieve quality standards for initial deliveries, and expand their market reach through creative distribution channels. Regulatory tailwinds—such as increasing emissions standards and incentives for solar-powered EVs—could enhance their competitiveness. On the flip side, technological maturation in battery solutions and the expansion of charging infrastructure might diminish Aptera’s distinctive advantage if they fail to adapt swiftly.

Potential Investment Strategies

Investors eyeing Aptera stock should consider a diversified approach, balancing speculative positions with more established EV holdings. Due diligence must include scrutinizing their capital structure, leadership expertise, and practical manufacturing plans. The company’s publicly available filings and investor presentations are rich sources of information but should be supplemented with continuous industry trend analysis, especially around solar technology advancements and supply chain resilience.

Key Points

- Innovative technology: Aptera’s solar integration and ultra-light design set it apart in the EV market.

- Market risk: High execution risk and stiff competition are inherent to early-stage EV plays.

- Growth potential: Breakthrough efficiencies could redefine consumer EV expectations and market share if scaled effectively.

- Strategic positioning: Alignment with sustainability trends and government incentives can serve as growth catalysts.

- Investment caution: Volatility and unproven production scale mean that investing should be proportionate to risk appetite.

Frequently Asked Questions About Aptera Stock

What are the main drivers behind Aptera’s valuation?

+Aptera’s valuation primarily derives from its technological innovation, potential market disruption through efficiency gains, and investor optimism about solar-powered EVs. Its valuation reflects future growth expectations, technological differentiation, and the sustainability trend influencing long-term vehicle design.

How does Aptera’s solar integration compare to other EV solar projects?

+Compared to third-party add-on solar solutions, Aptera’s integrated photovoltaic system is more seamless and designed for efficiency, potentially generating up to 40 miles of driving range daily. While less widespread, this innovation positions Aptera as a pioneering leader in solar EV technology.

What are the main risks associated with investing in Aptera stock?

+Risks include manufacturing scale-up challenges, supply chain disruptions, intense competition from established automakers, market acceptance uncertainties, and regulatory changes. As a pre-revenue company with a high technological focus, volatility is expected until commercialization proves successful.

What milestones should investors watch for in the next 12 months?

+Key milestones include finalizing manufacturing partnerships, completing initial vehicle delivery, securing additional funding, and expanding market visibility through strategic marketing and partnerships. Progress on these fronts will significantly influence stock performance.

Is Aptera’s stock suitable for long-term investment portfolios?

+If an investor seeks exposure to innovative, sustainability-driven EV technology and is comfortable with high volatility, Aptera could constitute a strategic component. However, it should be balanced with more established holdings due to the company’s early-stage nature and operational uncertainties.

Related Terms:

- Aptera Motors

- Tesla

- Rivian

- Canoo

- Arcimoto

- Sono Motors