Arizona State University (ASU) is renowned for its commitment to providing students with comprehensive support to ensure their academic success and financial stability. One of the key components of this support system is the array of financial aid options available to students. Financial aid is crucial as it helps bridge the gap between the cost of attending university and what a student or their family can afford. In this article, we will delve into five ways ASU aid can support students in pursuing their higher education goals.

Understanding the Landscape of Financial Aid at ASU

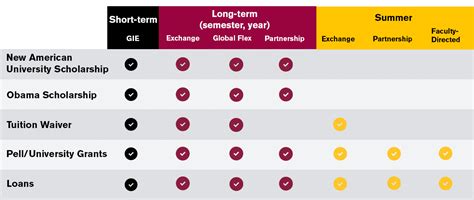

The financial aid landscape at ASU is diverse, encompassing various types of aid such as grants, scholarships, loans, and work-study programs. Each of these options has its unique characteristics, eligibility criteria, and application processes. For instance, grants and scholarships are considered gift aid, meaning they do not have to be repaid, whereas loans must be repaid with interest. Work-study programs, on the other hand, provide students with part-time jobs to help them earn money for expenses.

1. Grants: A Key Component of ASU Aid

Grants are a fundamental form of ASU aid, offering students financial assistance that does not require repayment. The eligibility for grants is often based on financial need, which is determined by the information provided on the Free Application for Federal Student Aid (FAFSA). ASU participates in various federal and state grant programs, such as the Federal Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG), to support students with significant financial need.

| Type of Grant | Description |

|---|---|

| Federal Pell Grant | Awarded to undergraduate students who have not earned a bachelor's or professional degree and demonstrate significant financial need. |

| Federal Supplemental Educational Opportunity Grant (FSEOG) | For undergraduate students with exceptional financial need, with priority given to Pell Grant recipients. |

2. Scholarships: Recognizing Academic Excellence and Need

Scholarships are another vital form of ASU aid, recognizing students’ academic achievements, talents, and service. Unlike grants, scholarships may be merit-based, need-based, or a combination of both. ASU offers a wide range of scholarships, from university-wide awards to those specific to certain colleges or departments. The application process for scholarships can vary, with some requiring separate applications and essays, while others consider all admitted students automatically.

3. Loans: A Financial Aid Option with Repayment Terms

Loans are a type of ASU aid that must be repaid, usually with interest. While they can provide necessary funding, it’s crucial for students to understand the terms of their loans, including interest rates, repayment schedules, and any potential forgiveness options. Federal loans, such as Direct Subsidized and Unsubsidized Loans, and the Federal Perkins Loan, are common types of loans available to ASU students. Private loans from banks, credit unions, and other lenders are also an option, though they typically have less favorable terms than federal loans.

4. Work-Study Programs: Earning and Learning

Work-study programs offer students a unique opportunity to earn money for their educational expenses through part-time employment. The Federal Work-Study (FWS) program is a significant component of ASU aid, providing jobs both on and off campus. These jobs are designed to be flexible, allowing students to balance their work commitments with their academic schedules. The pay from work-study jobs is typically minimum wage or higher, and the funds are paid directly to the student, who can then use them for any education-related expenses.

5. ASU’s Commitment to Affordability and Accessibility

ASU is dedicated to making higher education accessible and affordable for a diverse range of students. This commitment is reflected in the university’s comprehensive financial aid packages, which are designed to meet the unique needs of each student. From tuition reimbursement programs to emergency loans, ASU provides a wide array of financial resources and services to support students throughout their academic journey.

Key Points

- ASU offers a variety of financial aid options, including grants, scholarships, loans, and work-study programs, to support students in achieving their academic goals.

- Understanding the different types of financial aid and their eligibility criteria is crucial for maximizing the support available.

- Filing the FAFSA early is essential for determining eligibility for federal, state, and institutional aid.

- ASU's commitment to affordability and accessibility is evident in its comprehensive financial aid packages and additional support services.

- Students should carefully consider the terms of any loan, including repayment requirements and potential forgiveness options, before accepting the loan.

What is the first step in applying for ASU aid?

+The first step in applying for ASU aid is to complete the Free Application for Federal Student Aid (FAFSA), which determines eligibility for federal, state, and institutional financial aid.

How do I apply for scholarships at ASU?

+ASU offers a variety of scholarships, some of which require a separate application, while others consider all admitted students automatically. It's essential to check the ASU website for specific scholarship opportunities and application deadlines.

What is the difference between a grant and a loan?

+A grant is a form of financial aid that does not have to be repaid, whereas a loan must be repaid, usually with interest. Grants are typically awarded based on financial need, while loans can be need-based or non-need-based.

In conclusion, ASU aid encompasses a broad spectrum of financial assistance programs designed to support students in their academic pursuits. By understanding the different types of aid available, including grants, scholarships, loans, and work-study programs, students can make informed decisions about their financial aid options and maximize the support available to them. ASU’s commitment to affordability and accessibility underscores its role as a leader in higher education, dedicated to helping students achieve their full potential.