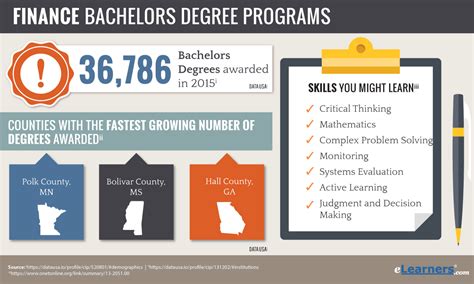

A Bachelor's degree in Finance is a highly sought-after credential that can lead to a wide range of exciting and rewarding career opportunities. With a strong foundation in financial principles, theories, and practices, finance graduates can pursue careers in various fields, including corporate finance, investments, banking, and financial planning. In this article, we will explore the various career paths available to individuals with a Bachelor's degree in Finance, highlighting the key responsibilities, required skills, and growth prospects for each role.

Primary Career Paths for Finance Graduates

Finance graduates can pursue a variety of career paths, depending on their interests, skills, and career goals. Some of the primary career paths for finance graduates include:

Financial Analyst

Financial analysts play a critical role in helping organizations make informed investment decisions. They analyze financial data, identify trends, and provide recommendations to management. According to the Bureau of Labor Statistics (BLS), the median annual salary for financial analysts is $85,660. To succeed as a financial analyst, one needs to possess strong analytical skills, attention to detail, and excellent communication skills.

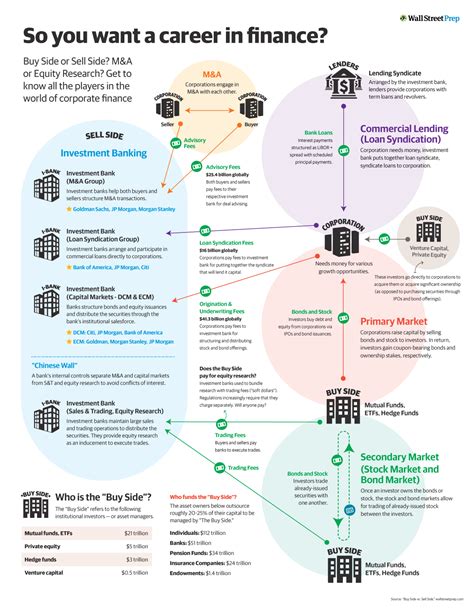

Investment Banker

Investment bankers work with clients to raise capital, advise on mergers and acquisitions, and manage financial transactions. This role requires strong analytical skills, excellent communication skills, and the ability to work well under pressure. The median annual salary for investment bankers is $100,000, according to the BLS. To succeed as an investment banker, one needs to possess a strong understanding of financial markets, excellent networking skills, and the ability to think strategically.

Financial Planner

Financial planners help individuals and families create personalized financial plans, including investment strategies, retirement planning, and estate planning. This role requires strong analytical skills, excellent communication skills, and a deep understanding of financial markets. The median annual salary for financial planners is $94,170, according to the BLS. To succeed as a financial planner, one needs to possess a strong understanding of financial planning principles, excellent communication skills, and the ability to build strong relationships with clients.

| Career Path | Median Annual Salary | Required Skills |

|---|---|---|

| Financial Analyst | $85,660 | Analytical skills, attention to detail, excellent communication skills |

| Investment Banker | $100,000 | Strong analytical skills, excellent communication skills, strategic thinking |

| Financial Planner | $94,170 | Strong understanding of financial planning principles, excellent communication skills, relationship-building skills |

Key Points

- A Bachelor's degree in Finance can lead to a wide range of career opportunities, including financial analyst, investment banker, and financial planner.

- Finance graduates need to possess strong analytical skills, excellent communication skills, and a deep understanding of financial markets to succeed in their careers.

- The median annual salaries for finance careers range from $85,660 to $100,000, depending on the role and industry.

- Staying up-to-date with industry trends, networking with professionals, and continually developing skills are essential for finance professionals to remain competitive in the job market.

- Finance graduates can pursue certifications, such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP), to enhance their career prospects and earning potential.

Secondary Career Paths for Finance Graduates

In addition to primary career paths, finance graduates can also pursue secondary career paths, including:

Portfolio Manager

Portfolio managers are responsible for managing investment portfolios for individuals, institutions, or companies. This role requires strong analytical skills, excellent communication skills, and a deep understanding of financial markets. The median annual salary for portfolio managers is $115,000, according to the BLS.

Risk Management Specialist

Risk management specialists identify and assess potential risks to an organization’s financial well-being and develop strategies to mitigate those risks. This role requires strong analytical skills, excellent communication skills, and a deep understanding of financial markets. The median annual salary for risk management specialists is $95,000, according to the BLS.

Financial Consultant

Financial consultants provide expert advice to individuals and organizations on financial matters, including investment strategies, financial planning, and risk management. This role requires strong analytical skills, excellent communication skills, and a deep understanding of financial markets. The median annual salary for financial consultants is $90,000, according to the BLS.

| Secondary Career Path | Median Annual Salary | Required Skills |

|---|---|---|

| Portfolio Manager | $115,000 | Strong analytical skills, excellent communication skills, deep understanding of financial markets |

| Risk Management Specialist | $95,000 | Strong analytical skills, excellent communication skills, deep understanding of financial markets |

| Financial Consultant | $90,000 | Strong analytical skills, excellent communication skills, deep understanding of financial markets |

Emerging Trends and Opportunities in Finance

The finance industry is constantly evolving, with emerging trends and opportunities creating new career paths and opportunities for finance graduates. Some of the emerging trends and opportunities in finance include:

Fintech

Fintech, or financial technology, refers to the use of technology to improve financial services and products. This trend is creating new career opportunities for finance graduates, including roles in digital payments, blockchain, and artificial intelligence.

Sustainable Finance

Sustainable finance refers to the integration of environmental, social, and governance (ESG) factors into financial decision-making. This trend is creating new career opportunities for finance graduates, including roles in sustainable investing, ESG analysis, and climate finance.

Financial Inclusion

Financial inclusion refers to the provision of financial services to underserved or marginalized populations. This trend is creating new career opportunities for finance graduates, including roles in microfinance, financial literacy, and digital financial services.

What are the most in-demand finance careers?

+The most in-demand finance careers include financial analyst, investment banker, financial planner, portfolio manager, and risk management specialist.

What skills are required for a career in finance?

+Finance careers require strong analytical skills, excellent communication skills, and a deep understanding of financial markets. Additionally, skills such as data analysis, financial modeling, and programming are highly valued in the finance industry.

What are the emerging trends and opportunities in finance?

+The emerging trends and opportunities in finance include fintech, sustainable finance, and financial inclusion. These trends are creating new career opportunities for finance graduates, including roles in digital payments, sustainable investing, and microfinance.

Meta description: Discover the various career paths available to individuals with a Bachelor’s degree in Finance, including financial analyst, investment banker, and financial planner. Learn about the required skills, median annual salaries, and emerging trends and opportunities in the finance industry. (149 characters)