When it comes to investing in the stock market, selecting the right online brokerage firm is crucial for both novice and seasoned investors. With numerous options available, it's essential to evaluate factors such as trading fees, investment products, research tools, and customer support to make an informed decision. In this article, we'll delve into the world of online brokerage firms, exploring the key features and benefits of the top players in the industry.

Key Points

- Online brokerage firms offer a range of investment products, including stocks, options, ETFs, and mutual funds

- Trading fees and commissions can significantly impact investment returns, with some firms offering zero-commission trades

- Research tools and educational resources are essential for making informed investment decisions

- Customer support and mobile accessibility are critical factors in choosing an online brokerage firm

- Regulatory compliance and account security are paramount in protecting investors' assets

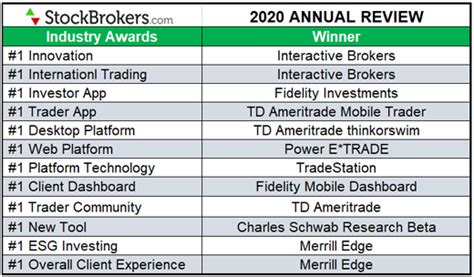

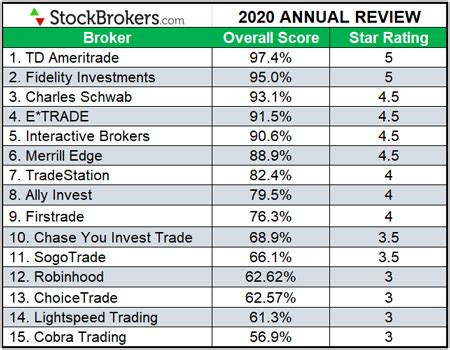

Top Online Brokerage Firms

The online brokerage landscape is highly competitive, with several firms standing out for their exceptional services and features. Some of the top online brokerage firms include:

- Fidelity Investments: Known for its extensive research tools, competitive pricing, and wide range of investment products

- Charles Schwab: Offers a user-friendly platform, comprehensive educational resources, and a vast network of branch offices

- Robinhood: A pioneer in commission-free trading, with a simple and intuitive mobile app

- TD Ameritrade: Provides a robust trading platform, thinkorswim, and a wide range of investment products, including futures and forex

- Ally Invest: Formerly known as TradeKing, offers a low-cost trading platform with a user-friendly interface and excellent customer support

Comparison of Online Brokerage Firms

When evaluating online brokerage firms, it’s essential to consider factors such as trading fees, investment products, and research tools. The following table provides a comparison of the top online brokerage firms:

| Brokerage Firm | Trading Fees | Investment Products | Research Tools |

|---|---|---|---|

| Fidelity Investments | $0 for online stock and ETF trades | Stocks, options, ETFs, mutual funds, bonds | Extensive research reports, analyst recommendations |

| Charles Schwab | $0 for online stock and ETF trades | Stocks, options, ETFs, mutual funds, bonds | Comprehensive research reports, StreetSmart Edge platform |

| Robinhood | $0 for online stock and ETF trades | Stocks, options, ETFs, cryptocurrencies | Basic research tools, limited analyst recommendations |

| TD Ameritrade | $0 for online stock and ETF trades | Stocks, options, ETFs, mutual funds, bonds, futures, forex | thinkorswim platform, extensive research reports |

| Ally Invest | $3.95 for online stock and ETF trades | Stocks, options, ETFs, mutual funds, bonds | Basic research tools, limited analyst recommendations |

Regulatory Compliance and Account Security

Regulatory compliance and account security are paramount in protecting investors’ assets. Reputable online brokerage firms are registered with the Securities and Exchange Commission (SEC) and are members of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). These organizations provide oversight and protection for investors, ensuring that firms operate in a fair and transparent manner.

Mobile Accessibility and Customer Support

In today’s digital age, mobile accessibility and customer support are critical factors in choosing an online brokerage firm. Look for firms that offer user-friendly mobile apps, allowing you to trade and manage your investments on-the-go. Additionally, evaluate the firm’s customer support, including phone, email, and live chat options, to ensure that you can receive assistance when needed.

What is the best online brokerage firm for beginners?

+Fidelity Investments and Charles Schwab are excellent options for beginners, offering comprehensive educational resources, user-friendly platforms, and competitive pricing.

What is the difference between a brokerage firm and a robo-advisor?

+A brokerage firm provides a range of investment products and services, allowing you to manage your investments yourself. A robo-advisor, on the other hand, offers automated investment management, using algorithms to create and manage a diversified portfolio.

How do I choose the best online brokerage firm for my needs?

+Consider factors such as trading fees, investment products, research tools, customer support, and mobile accessibility. Evaluate your individual investment needs and goals, and choose a firm that aligns with your requirements.

In conclusion, selecting the right online brokerage firm is a critical decision that can significantly impact your investment returns. By evaluating factors such as trading fees, investment products, research tools, and customer support, you can make an informed decision that aligns with your individual investment needs and goals. Remember to prioritize regulatory compliance, account security, and mobile accessibility to ensure a secure and seamless investing experience.