The concept of consumer surplus is a fundamental principle in economics, referring to the difference between the maximum amount a consumer is willing to pay for a product or service and the actual price they pay. Calculating consumer surplus can be a straightforward process, providing valuable insights into the market dynamics and consumer behavior. To understand how to calculate consumer surplus easily, it's essential to grasp the underlying economics principles and the graphical representation of consumer surplus.

Understanding Consumer Surplus

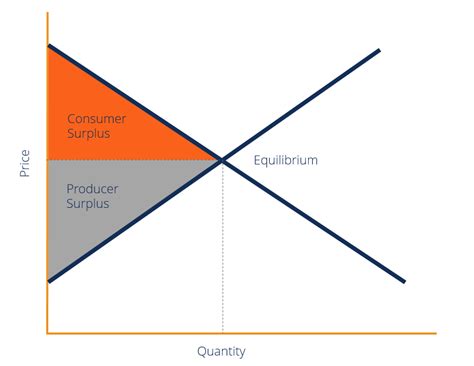

Consumer surplus is essentially the benefit or “savings” that consumers realize when they purchase a product at a price lower than their willingness to pay. This surplus is a measure of consumer satisfaction and can influence market demand. The demand curve, which shows the relationship between the price of a product and the quantity demanded, is crucial in visualizing and calculating consumer surplus.

The Demand Curve and Consumer Surplus

The demand curve slopes downward from left to right, indicating that as the price of a product increases, the quantity demanded decreases, and vice versa. The area under the demand curve and above the market price line represents the total consumer surplus. To calculate this area, one needs to know the equation of the demand curve or have specific data points regarding prices and quantities demanded.

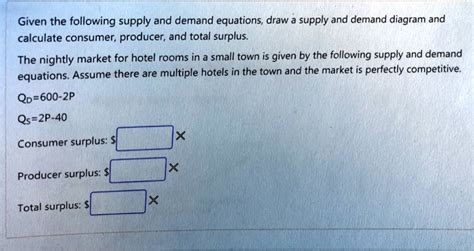

Mathematical Representation: If the demand curve is represented by a linear equation P = a - bQ (where P is the price, Q is the quantity, and a and b are constants), the consumer surplus (CS) can be calculated using the formula CS = (1/2) * b * Q^2, assuming the market price is such that the quantity demanded is Q. However, for a more straightforward calculation, especially in a graphical context, one can use the formula for the area of a triangle: CS = (1/2) * base * height, where the base is the quantity sold, and the height is the difference between the willingness to pay (the price on the demand curve at zero quantity) and the market price.

| Formula Component | Description |

|---|---|

| Base | Quantity of the product purchased |

| Height | Difference between the maximum willingness to pay and the market price |

Step-by-Step Calculation of Consumer Surplus

To calculate consumer surplus practically, follow these steps:

- Determine the Demand Curve: Establish the equation of the demand curve or gather data points that show how quantity demanded changes with price.

- Identify the Market Price and Quantity: Determine the current market price of the product and the quantity sold at this price.

- Find the Maximum Willingness to Pay: This is typically found at the point on the demand curve where quantity demanded is zero, giving the highest price consumers are willing to pay.

- Calculate the Height of the Triangle: Subtract the market price from the maximum willingness to pay to find the height of the triangle representing consumer surplus.

- Apply the Formula: Use the formula for the area of a triangle (CS = (1/2) * base * height) with the base being the quantity sold and the height calculated from the price difference.

Key Points

- Consumer surplus is the difference between the maximum willingness to pay and the actual price paid.

- The demand curve is essential for calculating consumer surplus, as it shows the relationship between price and quantity demanded.

- The formula for consumer surplus can be simplified to the area of a triangle under the demand curve and above the market price line.

- Understanding the demand curve and having specific price and quantity data are crucial for easy calculation.

- Consumer surplus provides valuable insights into consumer satisfaction and market dynamics.

Practical Applications and Limitations

While calculating consumer surplus can provide deep insights into consumer behavior and market efficiency, it’s essential to recognize the limitations and potential challenges. Real-world applications may involve complexities such as non-linear demand curves, changes in consumer preferences, and external factors influencing demand. Moreover, the accuracy of consumer surplus calculations depends heavily on the precision of demand curve estimation and the availability of reliable data.

Despite these challenges, understanding and calculating consumer surplus remains a powerful tool for economists, policymakers, and businesses seeking to comprehend market dynamics and make informed decisions. By applying the principles outlined and considering the practical aspects of consumer behavior, one can easily calculate consumer surplus and leverage this knowledge to drive strategic decisions in various economic contexts.

What is consumer surplus, and why is it important?

+Consumer surplus refers to the difference between the maximum amount a consumer is willing to pay for a product and the actual price they pay. It’s a measure of consumer satisfaction and provides insights into market dynamics, making it crucial for understanding consumer behavior and making informed economic decisions.

How do you calculate consumer surplus in a real-world scenario?

+In a real-world scenario, calculating consumer surplus involves understanding the demand curve, identifying the market price and quantity sold, finding the maximum willingness to pay, and then applying the formula for the area of a triangle. The accuracy of this calculation depends on the precision of the demand curve estimation and the reliability of the data used.

What are some limitations of calculating consumer surplus?

+Limitations include the challenge of accurately estimating the demand curve, especially if it’s non-linear, and the potential for changes in consumer preferences or external factors to influence demand. Additionally, the calculation assumes that the market is in equilibrium, which might not always be the case.