Calculating retained earnings is a crucial aspect of understanding a company's financial health and its ability to generate profits over time. Retained earnings represent the portion of a company's net income that is not distributed to shareholders as dividends, but rather reinvested in the business to finance future growth and operations. In this article, we will delve into the concept of retained earnings, its importance, and provide a step-by-step guide on how to calculate it easily.

Key Points

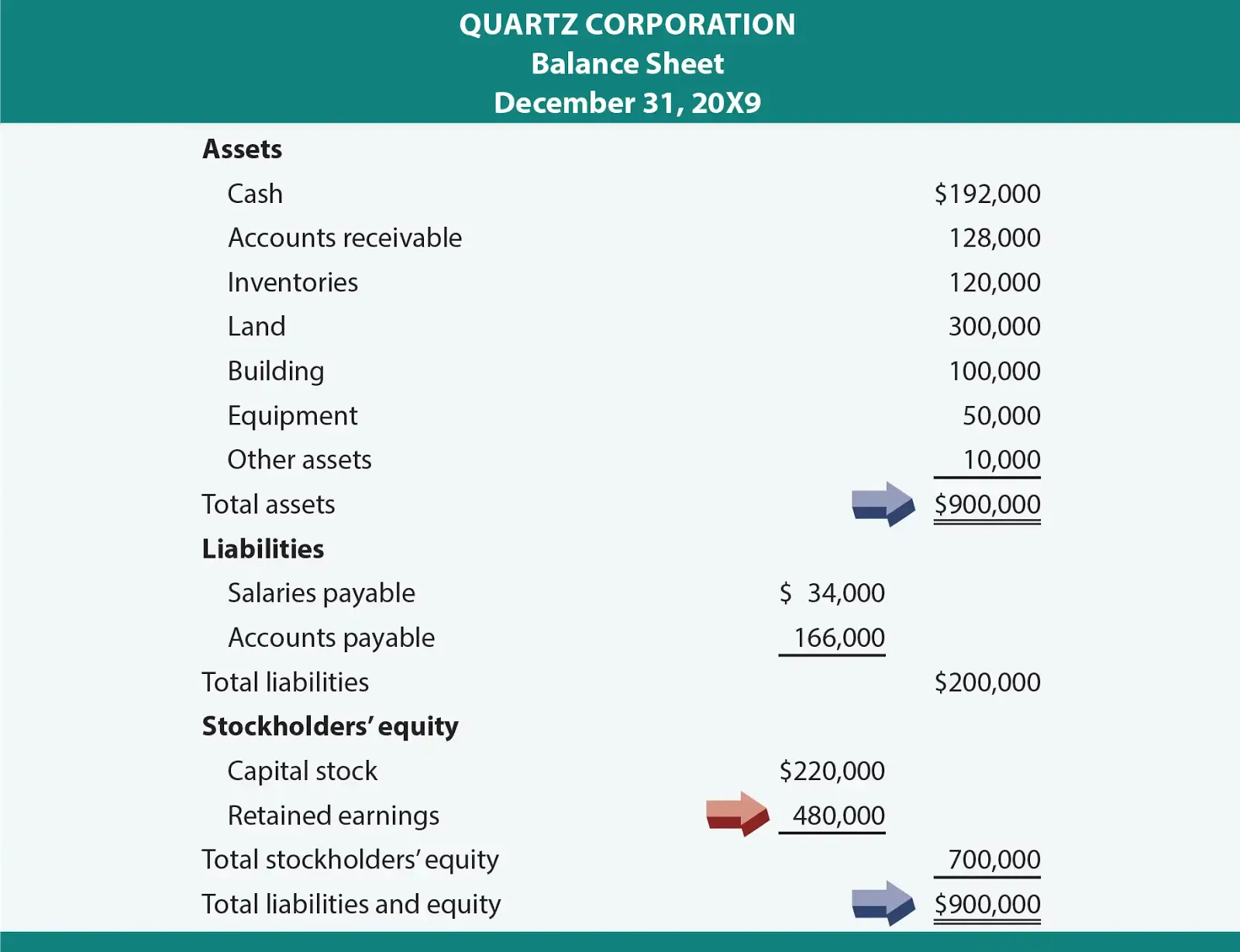

- Retained earnings are a critical component of a company's balance sheet and financial statement.

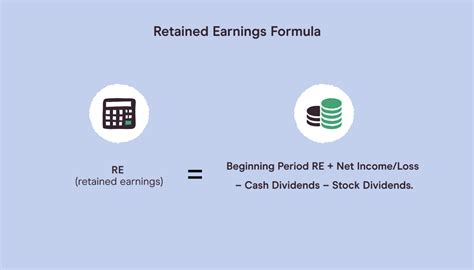

- The formula to calculate retained earnings is: Retained Earnings = Beginning Retained Earnings + Net Income - Dividends.

- Understanding retained earnings helps investors and analysts assess a company's financial performance and potential for future growth.

- Retained earnings can be used to finance new projects, pay off debt, or invest in new technologies and assets.

- A high retained earnings figure can indicate a company's ability to generate consistent profits and invest in its future.

Understanding Retained Earnings

Retained earnings are an essential part of a company’s financial statement, as they reflect the company’s ability to generate profits and reinvest them in the business. The retained earnings account is typically found on the balance sheet under the shareholders’ equity section. It is calculated by taking the beginning retained earnings, adding the net income for the period, and subtracting any dividends paid out to shareholders during that period.

Importance of Retained Earnings

Retained earnings are vital for several reasons. Firstly, they provide a source of internal financing for the company, allowing it to invest in new projects, pay off debt, or acquire new assets without having to rely on external funding sources. Secondly, retained earnings can help a company to weather economic downturns or periods of financial stress, as they provide a cushion of funds that can be used to cover expenses and maintain operations. Finally, retained earnings can be used to reward shareholders through dividend payments, which can help to attract and retain investors.

Calculating Retained Earnings

The formula to calculate retained earnings is straightforward: Retained Earnings = Beginning Retained Earnings + Net Income - Dividends. To illustrate this, let’s consider an example. Suppose a company has a beginning retained earnings balance of 100,000, generates a net income of 50,000 during the period, and pays out 20,000 in dividends. Using the formula, the retained earnings would be: Retained Earnings = 100,000 + 50,000 - 20,000 = $130,000.

| Component | Value |

|---|---|

| Beginning Retained Earnings | $100,000 |

| Net Income | $50,000 |

| Dividends | $20,000 |

| Retained Earnings | $130,000 |

Interpreting Retained Earnings

When analyzing retained earnings, it’s crucial to consider the company’s overall financial performance and industry trends. A high retained earnings figure can indicate a company’s ability to generate consistent profits and invest in its future. However, it’s also important to consider the company’s dividend payout ratio, as a high ratio may indicate that the company is prioritizing dividend payments over reinvesting in the business.

Conclusion

In conclusion, calculating retained earnings is a straightforward process that involves adding the net income to the beginning retained earnings and subtracting any dividends paid out. Understanding retained earnings is crucial for investors, analysts, and business owners, as it provides valuable insights into a company’s financial performance, growth potential, and ability to generate profits over time. By following the steps outlined in this article, you can easily calculate retained earnings and gain a deeper understanding of this critical component of a company’s financial statement.

What is the purpose of retained earnings?

+Retained earnings provide a source of internal financing for the company, allowing it to invest in new projects, pay off debt, or acquire new assets without having to rely on external funding sources.

How do I calculate retained earnings?

+Retained Earnings = Beginning Retained Earnings + Net Income - Dividends.

What does a high retained earnings figure indicate?

+A high retained earnings figure can indicate a company’s ability to generate consistent profits and invest in its future.