Calculating wages is a fundamental aspect of human resources and payroll management. It involves determining the amount of money an employee should receive for their work, taking into account factors such as their hourly rate, number of hours worked, and any deductions or benefits. In this article, we will explore five ways to calculate wages, including the importance of accuracy and compliance with labor laws.

Key Points

- Understanding the different methods of calculating wages, including hourly, salary, piecework, commission, and overtime pay.

- Recognizing the importance of accuracy and compliance with labor laws when calculating wages.

- Implementing a reliable payroll system to ensure timely and accurate payment of wages.

- Considering the impact of deductions and benefits on take-home pay.

- Staying up-to-date with changes in labor laws and regulations affecting wage calculation.

Hourly Wage Calculation

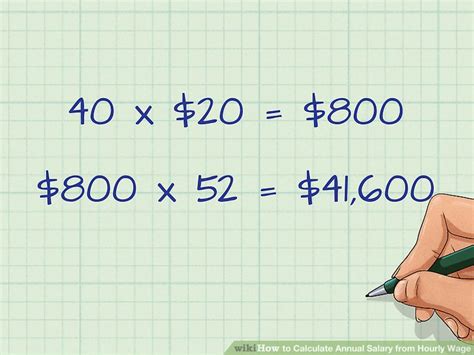

The hourly wage calculation is one of the most common methods used to determine an employee’s wages. It involves multiplying the employee’s hourly rate by the number of hours worked. For example, if an employee earns 15 per hour and works 40 hours per week, their weekly wages would be 600. This method is often used for part-time or temporary workers, as well as for employees who work variable hours.

However, calculating hourly wages can be more complex when considering factors such as overtime pay, sick leave, and vacation time. For instance, if an employee works more than 40 hours per week, they may be eligible for overtime pay, which can be calculated at a rate of 1.5 times their regular hourly rate. Employers must ensure that they comply with labor laws and regulations, such as the Fair Labor Standards Act (FLSA), which governs overtime pay and other wage-related issues.

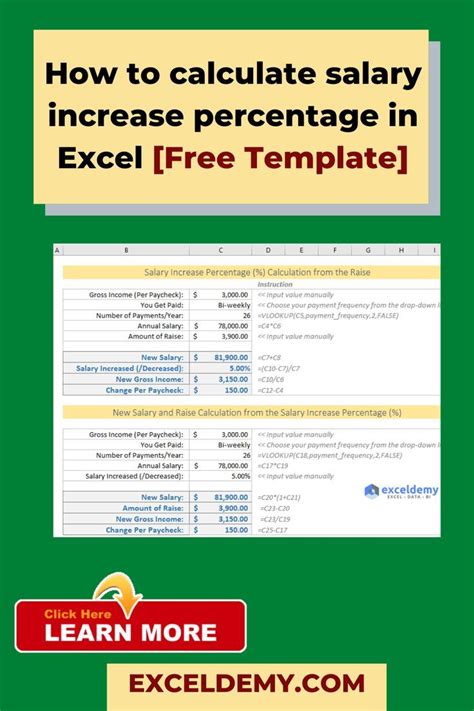

Salary Calculation

A salary calculation is used for employees who are paid a fixed amount of money per year, regardless of the number of hours worked. This method is often used for full-time employees who work a standard 40-hour week. To calculate a salary, employers can divide the annual salary by the number of pay periods per year. For example, if an employee earns an annual salary of 50,000 and is paid biweekly, their biweekly salary would be 1,923.08.

However, salary calculations can be affected by factors such as bonuses, commissions, and deductions. Employers must ensure that they accurately calculate salaries and comply with labor laws and regulations, such as the FLSA, which governs minimum wage and overtime pay.

Piecework Calculation

A piecework calculation is used for employees who are paid based on the amount of work they produce, rather than the number of hours worked. This method is often used in industries such as manufacturing, where employees are paid per unit produced. To calculate piecework wages, employers can multiply the number of units produced by the piece rate. For example, if an employee produces 100 units per day and earns 0.50 per unit, their daily wages would be 50.

However, piecework calculations can be complex when considering factors such as quality control, production standards, and labor laws. Employers must ensure that they comply with labor laws and regulations, such as the FLSA, which governs minimum wage and overtime pay.

Commission Calculation

A commission calculation is used for employees who are paid based on their sales performance, rather than the number of hours worked. This method is often used in industries such as sales, where employees are paid a percentage of their sales. To calculate commission wages, employers can multiply the sales amount by the commission rate. For example, if an employee sells 1,000 worth of products and earns a 10% commission, their commission wages would be 100.

However, commission calculations can be complex when considering factors such as sales targets, bonuses, and deductions. Employers must ensure that they accurately calculate commissions and comply with labor laws and regulations, such as the FLSA, which governs minimum wage and overtime pay.

Overtime Pay Calculation

Overtime pay calculation is used for employees who work more than 40 hours per week. This method involves calculating the employee’s overtime pay rate, which is typically 1.5 times their regular hourly rate. For example, if an employee earns 15 per hour and works 45 hours per week, their overtime pay would be calculated as follows: 5 hours x 22.50 (1.5 x 15) = 112.50.

However, overtime pay calculations can be complex when considering factors such as double-time pay, holidays, and labor laws. Employers must ensure that they comply with labor laws and regulations, such as the FLSA, which governs overtime pay and other wage-related issues.

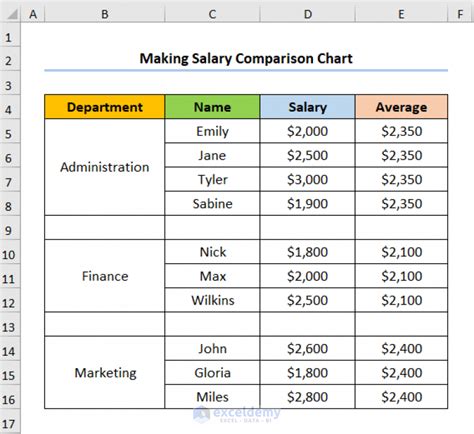

| Calculation Method | Formula | Example |

|---|---|---|

| Hourly Wage | Hourly Rate x Hours Worked | $15/hour x 40 hours = $600 |

| Salary | Annual Salary / Number of Pay Periods | $50,000 / 26 pay periods = $1,923.08 |

| Piecework | Number of Units Produced x Piece Rate | 100 units x $0.50/unit = $50 |

| Commission | Sales Amount x Commission Rate | $1,000 x 10% = $100 |

| Overtime Pay | Overtime Hours x Overtime Pay Rate | 5 hours x $22.50/hour = $112.50 |

What is the difference between hourly and salary calculations?

+Hourly calculations are used for employees who are paid based on the number of hours worked, while salary calculations are used for employees who are paid a fixed amount of money per year, regardless of the number of hours worked.

How do I calculate overtime pay for an employee who works more than 40 hours per week?

+To calculate overtime pay, multiply the employee’s overtime hours by their overtime pay rate, which is typically 1.5 times their regular hourly rate.

What are some common deductions that can affect an employee’s take-home pay?

+Common deductions that can affect an employee’s take-home pay include taxes, health insurance premiums, and 401(k) contributions.

How often should I review and update my payroll system to ensure accuracy and compliance with labor laws?

+It’s essential to regularly review and update your payroll system to ensure accuracy and compliance with labor laws. This can be done quarterly or annually, depending on the size and complexity of your organization.

What are some best practices for communicating wage calculations and deductions to employees?

+Best practices for communicating wage calculations and deductions to employees include providing clear and transparent explanations, using plain language, and making information easily accessible.