Medical bills, despite being a necessity for many, can have an unforeseen impact on an individual's financial stability. The relationship between medical bills and credit ratings is complex and often misunderstood. As healthcare costs continue to rise, more people are finding themselves in situations where they are unable to pay their medical bills in full, leading to potential credit score implications. In this context, understanding how medical bills can affect credit ratings is crucial for maintaining financial health.

Understanding Credit Ratings and Medical Debt

Credit ratings, or credit scores, are numerical representations of an individual’s creditworthiness, based on their credit history. They are calculated from information in the consumer’s credit reports, which include data on payment history, current debt, and other factors. Historically, medical debt was treated similarly to other forms of debt when it came to credit scoring. However, due to the unique nature of medical bills, which are often unexpected and can be extremely high, the approach to how medical debt affects credit scores has evolved.

Changes in How Medical Debt Impacts Credit Scores

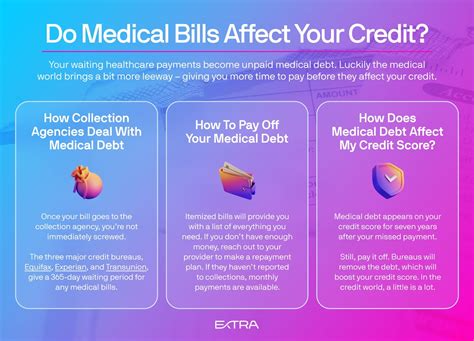

In recent years, there has been a significant shift in how credit reporting agencies treat medical debt. Recognizing that medical bills are not always a reflection of a person’s creditworthiness, the three major credit reporting agencies (Equifax, Experian, and TransUnion) have adjusted their practices. For instance, medical debts that have been paid or are being paid by insurance are given less weight in credit score calculations. Additionally, the Credit Reporting Resource Guide, which outlines the policies for reporting and handling credit information, has been updated to reflect these changes, providing more nuanced treatment of medical debt.

| Debt Type | Impact on Credit Score |

|---|---|

| Unpaid Medical Debt | Can significantly lower credit score if sent to collections |

| Paid Medical Debt | Less impact, especially if paid promptly or through insurance |

| Medical Debt in Collections | Most severe impact, can lead to substantial credit score reduction |

Managing Medical Debt to Protect Credit Ratings

Given the potential impact of medical bills on credit ratings, managing medical debt effectively is crucial. This can involve negotiating with healthcare providers, setting up payment plans, and ensuring that insurance claims are processed correctly. Consumers should also regularly check their credit reports to ensure accuracy, especially concerning medical debt entries. The FCRA allows consumers to dispute errors on their credit reports, which can help prevent unnecessary damage to their credit scores.

Strategies for Handling Medical Bills

For individuals facing challenges with medical debt, several strategies can help mitigate the impact on credit ratings. These include communicating with healthcare providers and creditors, considering financial assistance programs offered by hospitals or non-profit organizations, and seeking professional advice from credit counselors. It’s also important to prioritize medical bills, focusing on resolving debts that are likely to be sent to collections, which can have the most detrimental effect on credit scores.

Key Points

- Medical debt can affect credit ratings, especially if bills are sent to collections.

- Changes in credit reporting practices give less weight to paid medical debts and those being paid by insurance.

- Consumers have protections under the Fair Credit Reporting Act, including a 180-day waiting period before medical debt can be reported.

- Effective management of medical debt, including negotiation and setting up payment plans, can help protect credit ratings.

- Regularly checking credit reports for accuracy and disputing errors is crucial for maintaining a healthy credit score.

In conclusion, while medical bills can have an impact on credit ratings, understanding the nuances of how medical debt is treated by credit reporting agencies and taking proactive steps to manage such debt can minimize this effect. By being informed and taking advantage of the protections and strategies available, individuals can better navigate the complex relationship between medical bills and credit scores, ultimately protecting their financial well-being.

How long does it take for medical debt to affect my credit score?

+Medical debt typically cannot be reported to the credit bureaus until after a 180-day waiting period. This allows time for insurance claims to be processed and for consumers to resolve bills with their healthcare providers.

Can I negotiate my medical bills to avoid affecting my credit score?

+Yes, negotiating with healthcare providers is a common practice. Many hospitals and medical offices are willing to work with patients to set up payment plans or reduce the amount owed, especially if you communicate with them early on.

How can I check if there are any medical debt errors on my credit report?

+You can request a free copy of your credit report from each of the three major credit reporting agencies once a year. Review the reports carefully for any errors related to medical debt, and dispute these errors directly with the credit bureau.