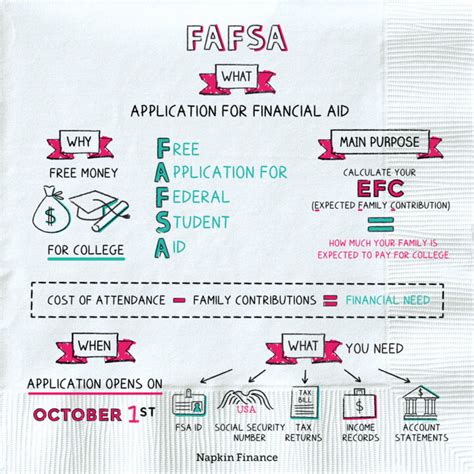

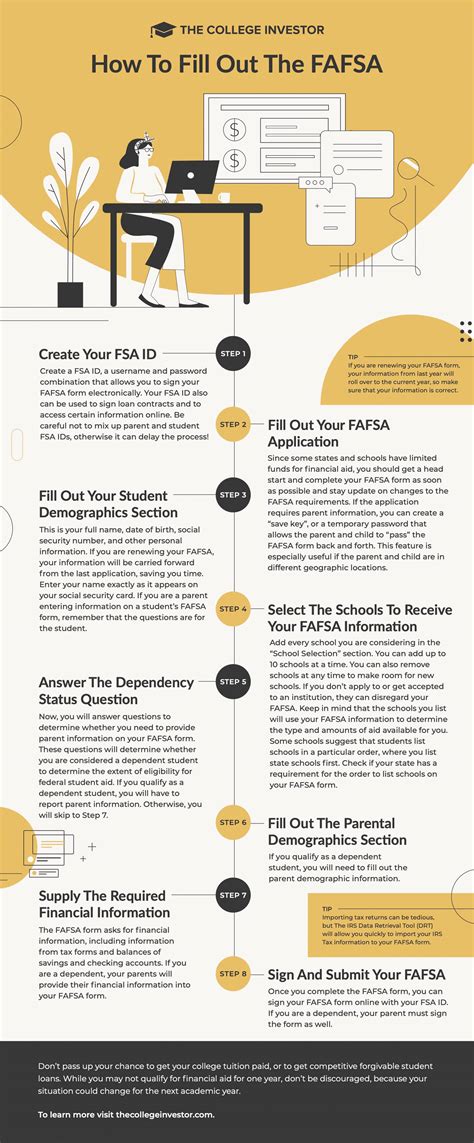

For many students, pursuing a graduate degree is a significant investment in their future. However, the cost of graduate school can be prohibitive, making it essential for students to explore all available financial aid options. One crucial step in securing financial aid for graduate school is completing the Free Application for Federal Student Aid (FAFSA). While often associated with undergraduate education, the FAFSA plays a vital role in helping graduate students fund their education. In this article, we will delve into the ways the FAFSA assists graduate students in financing their advanced degrees.

Key Points

- The FAFSA is a critical step in determining eligibility for federal student loans, which are a common source of funding for graduate students.

- Graduate students may be eligible for the Federal Direct Unsubsidized Loan and the Federal Direct PLUS Loan, with the FAFSA required for both.

- In addition to federal loans, the FAFSA can also help graduate students qualify for other types of financial aid, such as scholarships and assistantships.

- Some graduate programs offer financial aid packages that include a combination of loans, scholarships, and assistantships, and the FAFSA is often required to be considered for these packages.

- Completing the FAFSA can also help graduate students understand their financial aid options and make informed decisions about how to fund their education.

Eligibility for Federal Student Loans

One of the primary ways the FAFSA helps graduate students is by determining their eligibility for federal student loans. Graduate students are eligible for two types of federal loans: the Federal Direct Unsubsidized Loan and the Federal Direct PLUS Loan. The FAFSA is required for both types of loans, and it helps the Department of Education determine how much a student is eligible to borrow. For the 2022-2023 academic year, the maximum amount a graduate student can borrow through the Federal Direct Unsubsidized Loan is $20,500. The Federal Direct PLUS Loan, on the other hand, allows graduate students to borrow up to the cost of attendance minus any other financial aid received.

Federal Direct Unsubsidized Loan

The Federal Direct Unsubsidized Loan is a non-need-based loan, meaning that eligibility is not based on financial need. Instead, the loan is available to all graduate students who complete the FAFSA and meet the basic eligibility requirements, which include being enrolled at least half-time in a graduate program and maintaining satisfactory academic progress. The interest rate for the Federal Direct Unsubsidized Loan for the 2022-2023 academic year is 6.54%, and interest begins accruing as soon as the loan is disbursed.

Federal Direct PLUS Loan

The Federal Direct PLUS Loan, also known as the Grad PLUS Loan, is another type of federal loan available to graduate students. This loan requires a credit check, and borrowers must not have an adverse credit history. The interest rate for the Federal Direct PLUS Loan for the 2022-2023 academic year is 7.54%, and interest begins accruing as soon as the loan is disbursed. The PLUS Loan also has an origination fee, which is currently 4.228% of the loan amount. To be eligible for the Federal Direct PLUS Loan, graduate students must complete the FAFSA and meet the basic eligibility requirements.

| Loan Type | Interest Rate | Origination Fee |

|---|---|---|

| Federal Direct Unsubsidized Loan | 6.54% | 1.057% |

| Federal Direct PLUS Loan | 7.54% | 4.228% |

Other Types of Financial Aid

In addition to federal loans, the FAFSA can also help graduate students qualify for other types of financial aid, such as scholarships and assistantships. Many graduate programs offer financial aid packages that include a combination of loans, scholarships, and assistantships. These packages are often awarded based on academic merit, financial need, or a combination of both. By completing the FAFSA, graduate students can be considered for these packages and potentially receive funding to help offset the cost of their education.

Scholarships

Scholarships are a type of financial aid that does not need to be repaid. They are often awarded based on academic merit, and many organizations, including universities, foundations, and professional associations, offer scholarships to graduate students. To be eligible for scholarships, graduate students often need to complete the FAFSA, as it helps the awarding organization determine financial need and eligibility.

Assistantships

Assistantships are another type of financial aid available to graduate students. These are typically offered by universities and involve working as a research or teaching assistant in exchange for a stipend and/or tuition waiver. To be eligible for an assistantship, graduate students often need to complete the FAFSA, as it helps the university determine financial need and eligibility.

Understanding Financial Aid Options

Completing the FAFSA can also help graduate students understand their financial aid options and make informed decisions about how to fund their education. The FAFSA provides a comprehensive picture of a student’s financial situation, including income, assets, and expenses. This information can be used to determine eligibility for federal loans, scholarships, and assistantships, as well as other types of financial aid. By understanding their financial aid options, graduate students can create a personalized plan to fund their education and minimize debt.

What is the deadline to complete the FAFSA for graduate school?

+The FAFSA deadline varies by school, but it's typically between January and March for the upcoming academic year. Graduate students should check with their school's financial aid office to determine the specific deadline.

Do I need to complete the FAFSA every year to receive financial aid?

+Yes, graduate students need to complete the FAFSA every year to determine their eligibility for federal loans and other types of financial aid. The FAFSA is typically available on October 1st for the upcoming academic year.

Can I still complete the FAFSA if I'm not a U.S. citizen?

+Eligibility for federal student aid is limited to U.S. citizens, permanent residents, and certain eligible non-citizens. However, some private scholarships and assistantships may be available to international students. It's essential to check with the school's financial aid office to determine eligibility.

In conclusion, the FAFSA is a critical step in securing financial aid for graduate school. By completing the FAFSA, graduate students can determine their eligibility for federal loans, scholarships, and assistantships, as well as other types of financial aid. Understanding the different types of financial aid available and how to apply for them can help graduate students make informed decisions about how to fund their education and minimize debt. As a graduate student, it’s essential to explore all available financial aid options and create a personalized plan to fund your education.