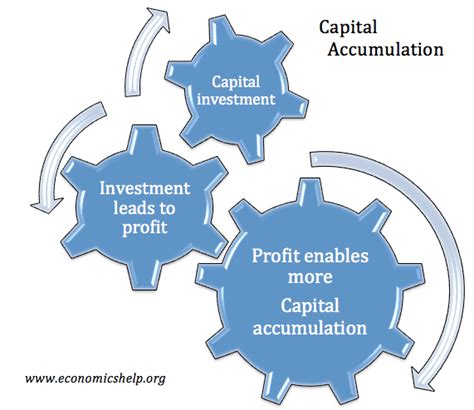

The concept of capital accumulation and its impact on income distribution has been a longstanding topic of discussion among economists and sociologists. At its core, capital accumulation refers to the process of acquiring and investing wealth, which in turn, can lead to increased economic growth and development. However, the distribution of this wealth and its effects on income inequality have sparked intense debates. In this article, we will delve into the relationship between capital accumulation and income distribution, exploring the theoretical frameworks, empirical evidence, and policy implications.

Key Points

- Capital accumulation can lead to increased economic growth, but also exacerbate income inequality

- The distribution of wealth and income is influenced by factors such as institutional structures, economic policies, and technological advancements

- Understanding the relationship between capital accumulation and income distribution is crucial for designing effective policies to address income inequality

- Empirical evidence suggests that countries with higher levels of capital accumulation tend to have higher levels of income inequality

- Policymakers must balance the need for economic growth with the need to address income inequality, through measures such as progressive taxation and social welfare programs

Theoretical Frameworks

Theoretical frameworks such as the neoclassical and Marxist schools of thought have been used to explain the relationship between capital accumulation and income distribution. The neoclassical perspective posits that capital accumulation is driven by individual entrepreneurship and innovation, leading to increased economic growth and prosperity. In contrast, the Marxist perspective argues that capital accumulation is driven by the exploitation of labor, leading to increased income inequality and social unrest. A more nuanced understanding of the relationship between capital accumulation and income distribution can be gained by considering the role of institutional structures, economic policies, and technological advancements.

Institutional Structures and Economic Policies

Institutional structures, such as the legal and financial systems, play a crucial role in shaping the distribution of wealth and income. For example, a country with a strong legal system and well-developed financial markets may be more likely to attract foreign investment, leading to increased capital accumulation and economic growth. However, the distribution of this wealth may be skewed towards the wealthy, exacerbating income inequality. Economic policies, such as taxation and social welfare programs, can also influence the distribution of wealth and income. A progressive taxation system, for instance, can help reduce income inequality by redistributing wealth from the rich to the poor.

| Country | Capital Accumulation (as a percentage of GDP) | Income Inequality (Gini Coefficient) |

|---|---|---|

| United States | 45.6% | 0.41 |

| China | 51.2% | 0.47 |

| Sweden | 38.4% | 0.27 |

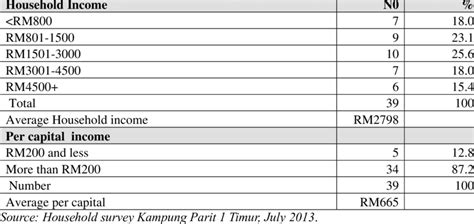

Empirical Evidence

Empirical evidence from various countries and time periods has shed light on the relationship between capital accumulation and income distribution. Studies have shown that countries with higher levels of capital accumulation tend to have higher levels of income inequality. For example, a study by the Organization for Economic Co-operation and Development (OECD) found that the top 10% of earners in the United States hold over 70% of the country’s wealth, while the bottom 50% hold less than 1%. In contrast, countries with stronger social welfare systems and progressive taxation, such as Sweden, tend to have lower levels of income inequality.

Technological Advancements

Technological advancements have also played a significant role in shaping the relationship between capital accumulation and income distribution. The rise of automation and artificial intelligence, for instance, has led to increased productivity and economic growth, but has also displaced certain jobs and exacerbated income inequality. The gig economy, characterized by short-term and flexible work arrangements, has also contributed to increased income inequality, as workers lack access to traditional benefits and job security.

What is the relationship between capital accumulation and income distribution?

+The relationship between capital accumulation and income distribution is complex and influenced by various factors, including institutional structures, economic policies, and technological advancements. While capital accumulation can lead to increased economic growth, it can also exacerbate income inequality.

How can policymakers address income inequality?

+Policymakers can address income inequality through measures such as progressive taxation, social welfare programs, and investments in education and training. A balanced approach that considers the need for economic growth and the need to address income inequality is crucial.

What is the role of technological advancements in shaping the relationship between capital accumulation and income distribution?

+Technological advancements, such as automation and artificial intelligence, have led to increased productivity and economic growth, but have also displaced certain jobs and exacerbated income inequality. Policymakers must consider the impact of technological advancements on the labor market and implement policies to mitigate their negative effects.

In conclusion, the relationship between capital accumulation and income distribution is complex and influenced by various factors. While capital accumulation can lead to increased economic growth, it can also exacerbate income inequality. A nuanced understanding of this relationship is crucial for designing effective policies to address income inequality. By considering the role of institutional structures, economic policies, and technological advancements, policymakers can implement measures to promote economic growth while reducing income inequality.

Meta description suggestion: “Explore the complex relationship between capital accumulation and income distribution, and discover how policymakers can address income inequality through a balanced approach.”