Securing cheap auto insurance in New York is a common goal for many drivers, especially given the state's reputation for having relatively high insurance rates. With a comprehensive understanding of the insurance landscape and some strategic approaches, it's possible to find affordable coverage without compromising on quality.

Understanding the Cost of Auto Insurance in New York

The cost of auto insurance in New York is influenced by a multitude of factors, including the driver’s age, gender, driving history, and the type of vehicle insured. Additionally, the state’s dense population and high incidence of traffic congestion contribute to higher insurance premiums.

New York's mandatory insurance laws also play a significant role. The state requires drivers to carry a minimum level of liability coverage to protect against bodily injury and property damage caused in accidents. This mandatory coverage is often a starting point for many drivers seeking insurance, but it may not provide sufficient protection in the event of an accident.

Factors Influencing Insurance Rates

- Demographics: Personal factors like age, gender, and marital status can impact insurance rates. Young drivers, particularly males, tend to pay higher premiums due to their perceived riskiness on the road.

- Driving Record: A clean driving record is crucial. Tickets, accidents, and DUI convictions can lead to substantial increases in insurance costs. Some insurance companies offer accident forgiveness programs, but these may come at a cost.

- Vehicle Type: The make, model, and year of your vehicle matter. Sports cars and luxury vehicles often have higher insurance rates due to their expense and the increased likelihood of theft.

- Coverage Limits: Opting for higher coverage limits provides more financial protection but also increases premiums. Balancing coverage needs with budget constraints is essential.

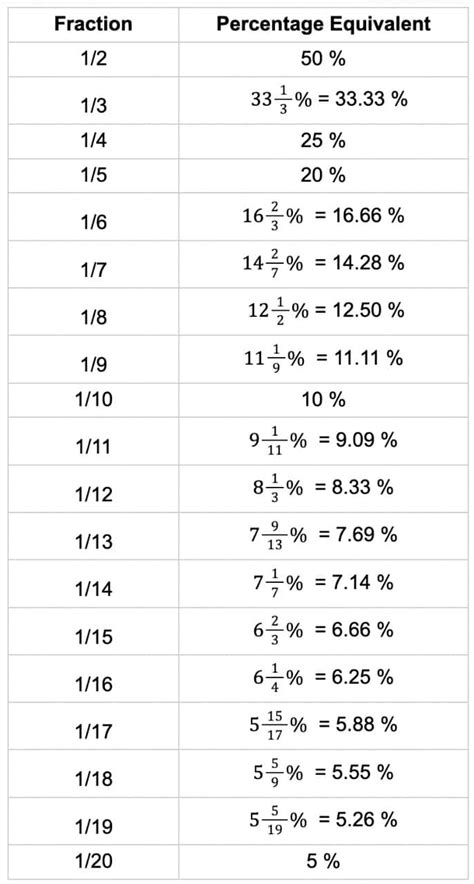

| Coverage Type | Average Premium (NY) |

|---|---|

| Liability Only | $700 - $1,200 annually |

| Full Coverage (Comprehensive & Collision) | $1,500 - $3,000 annually |

Strategies for Finding Cheap Auto Insurance in New York

Securing affordable auto insurance in New York requires a strategic approach. Here are some key strategies to consider:

Compare Multiple Quotes

Obtaining quotes from various insurance providers is essential. Different companies offer varying rates based on their risk assessment models. By comparing quotes, you can identify the most competitive options for your specific circumstances.

Utilize Online Insurance Comparison Tools

Online insurance comparison platforms can streamline the quote-gathering process. These tools allow you to input your details once and receive multiple quotes from different insurers. This not only saves time but also ensures a comprehensive overview of available options.

Take Advantage of Discounts

Insurance companies offer a range of discounts that can significantly reduce your premiums. Common discounts include those for safe driving, multiple policies (bundling home and auto insurance), and loyalty. Additionally, some insurers provide discounts for specific occupations or memberships, so it’s worth exploring these options.

Improve Your Driving Record

A clean driving record is a powerful tool for lowering insurance costs. If you have a less-than-perfect record, consider taking a defensive driving course. These courses can help you become a safer driver and may result in premium discounts. Additionally, most violations are removed from your record after a certain period, typically three to five years.

Choose a Suitable Coverage Level

Assess your coverage needs carefully. While it’s tempting to opt for the lowest possible coverage to save money, this may not provide adequate protection. Consider your assets and financial situation to determine the right level of coverage. Remember, liability insurance only covers the other party’s damages; it doesn’t protect your vehicle or medical expenses.

Consider Usage-Based Insurance

Usage-based insurance programs, often referred to as telematics, use devices or smartphone apps to monitor your driving behavior. Insurers then use this data to calculate your premium. These programs can be beneficial for safe drivers, as they offer the potential for significant premium reductions. However, they may not be suitable for drivers with high-risk driving habits.

Shop Around Regularly

Insurance rates can fluctuate, and what was a competitive rate a year ago might not be the best deal today. Regularly shopping around, at least annually, ensures you stay informed about the latest insurance offerings and can take advantage of any new discounts or promotions.

Conclusion: Navigating the New York Insurance Landscape

Finding cheap auto insurance in New York requires a combination of understanding the factors that influence rates and employing strategic approaches. By comparing quotes, taking advantage of discounts, and maintaining a safe driving record, you can significantly reduce your insurance premiums. Remember, while saving money is important, ensuring you have adequate coverage to protect your assets and provide financial security is paramount.

What is the average cost of auto insurance in New York?

+The average cost of auto insurance in New York varies based on numerous factors. As of recent data, the average premium for liability-only coverage is around 900 annually, while full coverage (comprehensive and collision) averages about 2,000 annually. However, these figures can deviate significantly based on individual circumstances.

Are there any specific discounts available for New York drivers?

+Yes, New York drivers can often take advantage of various discounts. These may include safe driver discounts, multi-policy discounts (for bundling home and auto insurance), loyalty discounts, and discounts for specific occupations or memberships. It’s worth inquiring with insurers about these opportunities.

How can I improve my chances of getting cheap auto insurance in New York?

+To improve your chances of securing cheap auto insurance in New York, focus on maintaining a clean driving record, comparing quotes from multiple insurers, and taking advantage of available discounts. Additionally, consider adjusting your coverage levels to find the right balance between affordability and adequate protection.