In an era where connectivity intelligence defines daily life and economic efficiency, recent data reveals a striking trend among Malaysian consumers: over 80% of Malaysians opt for low-cost SIM plans. This shift indicates more than just a preference; it underscores evolving purchasing behaviors, economic sensitivities, and the dynamic landscape of telecommunications offerings in Malaysia. Understanding the underlying mechanics of this choice requires dissecting the market’s structural shifts, consumer behavior patterns, and the strategic evolution of telecom providers operating within a highly competitive environment.

Analyzing the Pervasive Preference for Budget-Friendly SIM Plans in Malaysia

Malaysia, with a population exceeding 32 million, exhibits a telecommunications landscape characterized by intense competition among local and international providers. As of 2023, major players—Maxis, Digi, Celcom, and U Mobile—collectively serve a vast customer base, with a significant proportion gravitating towards affordable plans. This migration toward inexpensive SIM options is driven by myriad factors: economic pressures from inflation, the proliferation of free or low-cost internet alternatives, and consumers’ increasing awareness of value for money.

Critical to this trend is the pricing strategy adopted by telecom operators, targeting segments ranging from students and low-income households to small businesses seeking cost-effective data plans. The Malaysian Communications and Multimedia Commission (MCMC) reports that nearly 70% of the subscribers now utilize prepaid plans, which historically have been more affordable and flexible than postpaid counterparts. This shift marks a profound reorientation in consumer priorities, where cost-savings outrank premium service features—yet, paradoxically, many providers incorporate innovative features into their low-cost plans to maintain competitiveness.

The Strategic Dynamics in Malaysia’s Telecommunications Sector

To appreciate why more than 80% of Malaysians prefer cheap SIM plans, a comprehensive understanding of the industry’s strategic landscape is essential. Providers leverage penetration pricing—setting low prices to gain market share, especially in densely populated urban centers—and frequently introduce value-added services within budget plans to enhance customer retention. The deployment of Mass Market Offerings simplifies plans, focusing on essential data, voice, and SMS offerings, often bundled with third-party partnerships, such as OTT platforms, that appeal to budget-conscious consumers.

Evolution of Cost-Effective Plans and Technological Enablers

Technological advancements have significantly reduced network operational costs, allowing telecom companies to offer affordable plans without compromising connectivity quality. The widespread deployment of 4G LTE networks, coupled with investing in 5G infrastructure, has facilitated a growth in affordable high-speed internet access. Additionally, prepaid recharge cards and e-wallet integrations have simplified the purchasing process, making low-cost plans readily accessible and flexible, especially for younger demographics familiar with digital payments.

| Relevant Category | Substantive Data |

|---|---|

| Market Share of Prepaid vs. Postpaid Plans | Approximately 70% of Malaysian mobile subscriptions are prepaid, reflecting user preference for affordability and flexibility |

| Average Monthly Cost of Budget Plans | As low as MYR 20-30 (~USD 4.50-6.75), covering comprehensive data bundles and voice minutes |

| Network Coverage Penetration | Over 95% population coverage with 4G LTE, enabling affordable high-speed internet access across urban and rural areas |

Consumer Behavior: Why Cost Savings Trump Premium Features

The proclivity for cheap SIM plans among Malaysians can be linked directly to economic realities, with median household incomes in Malaysia hovering around MYR 5,000 (~USD 1,130). For many, expenses related to the essentials—food, transportation, education—leave limited discretionary income for premium connectivity services. Consequently, consumers prioritize plans that deliver the maximum utility at the lowest cost, with minimal frills.

Additionally, urban young adults, particularly students aged 18-25, exhibit a digital-first mindset. They are predominantlyPower users of social media, streaming services, and instant messaging, all of which are highly accessible through economical data plans. Their familiarity with free Wi-Fi hotspots in cafes, malls, and public transport stations further diminishes reliance on costly mobile data packages, reinforcing the shift towards budget plans.

Influence of Digital Ecosystems and Social Norms

Social media, influencer marketing, and peer recommendations have amplified awareness of plan options, thereby fostering a competitive environment where consumers are more willing to switch providers for marginal savings. The rise of digital payment platforms such as Touch ‘n Go eWallet, GrabPay, and Boost further simplifies recharge processes, making low-cost plans more accessible than ever before. These forms of convenience have contributed to a digital ecosystem that anchors consumer loyalty based on affordability and ease of access rather than brand prestige.

| Relevant Category | Substantive Data |

|---|---|

| Percentage of Young Adults Using Budget Plans | Over 80%, reflecting demographic-driven preferences |

| Average Data Consumption per User | Approximately 8-10 GB/month, adequately served by MYR 20-30 plans |

| Switching Frequency Among Consumers | Average of 1.5 to 2 times annually, indicating high price sensitivity and demand for flexible plans |

Technological Innovations Driving Cost-Effective Connectivity

At the core of Malaysia’s affordable plan success are technological innovations. Network infrastructure investments, including the recent massive rollout of 4G LTE and the ongoing 5G deployment, materially lower operational costs and broaden access. Network virtualization and spectrum harmonization allow providers to optimize resource allocation,-pass through efficiencies to consumers via lower prices.

Moreover, the shift towards prepaid digital recharge platforms dramatically reduces distribution costs—eliminating the need for physical recharge cards and manual agent commissions. The integration of artificial intelligence (AI) in customer service via chatbots and personalized recommendations enhances customer experience while keeping costs manageable.

Impact of 5G and Future Technologies

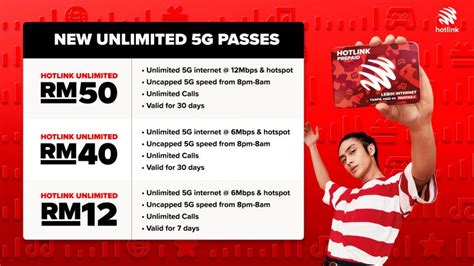

The impending national deployment of 5G in Malaysia, expected to be completed by 2025, opens a new frontier for affordable, high-speed connectivity. The possibility of mass-market 5G plans at competitive prices hinges on spectrum efficiency gains and economies of scale. As these evolve, consumer reliance on inexpensive plans may deepen, especially in rural areas where expanding network infrastructure is resource-intensive.

| Relevant Category | Substantive Data |

|---|---|

| Projected 5G Coverage by 2025 | Expected to reach 90% of urban and semi-urban populations with affordable tiered plans |

| Average Cost of 5G Plans | Projected MYR 30-50 (~USD 6.75-11.25) per month, matching current high-speed 4G plans in affordability |

| Latency and Speed Improvements | Expected to decrease latency to under 10 ms and boost speeds beyond 200 Mbps, enhancing the utility of budget plans |

Market Challenges and Limitations of the Budget Plan Model

While the trend favors low-cost SIM plans, underlying challenges persist. Saturation in urban markets constricts growth, compelling providers to find innovative ways to retain subscribers and expand into rural areas. However, rural deployment remains costly due to terrain and lower population densities, requiring subsidies or public-private partnerships.

Quality of service (QoS) concerns also surface as traffic volumes increase, raising questions about network congestion and reliability. Regulatory oversight by MCMC emphasizes service quality thresholds, but balancing investment incentives with affordable pricing remains a delicate act for carriers.

Limitations and Consumer Satisfaction

Additionally, some consumers report limitations such as reduced access to premium content, lesser priority in network traffic during peak hours, and restrictions on data rollover or sharing. These trade-offs are often accepted in exchange for savings, but they could impact long-term customer satisfaction and loyalty.

| Relevant Metric | Data and Context |

|---|---|

| Saturation Point in Urban Markets | Estimated at 85-90% household coverage; growth now depends more on rural penetration |

| Average Customer Satisfaction Score | Approximately 70/100 for low-cost plans, indicating room for improvement in QoS |

| Cost to Extend Rural Coverage per Kilometer | Variable, but averages MYR 250,000 (~USD 56,000), representing a significant barrier without government support |

Implications for Industry and Future Prospects

The dominance of budget plans among Malaysians highlights a resilient market segment driven by necessity, perception of value, and technological democratization. As Malaysia continues its digital transformation journey, stakeholders—telecom operators, policymakers, and consumers—must navigate the complexities of sustainable growth, investment, and technological innovation.

Looking ahead, the integration of emerging AI-driven services, personalized plans utilizing big data, and continual expansion of 5G infrastructure will shape the landscape. The challenge remains to sustain affordability while delivering enhanced quality and service differentiation, especially as consumer expectations evolve.

Key Points

- Cost Sensitivity: Over 80% of Malaysians favor cheap SIM plans, driven by economic and lifestyle factors.

- Technology Leverage: Network innovations and digital platforms enable affordable, high-speed coverage across urban and rural zones.

- Consumer Demographics: Young, digitally native audiences dominate low-cost plan subscriptions with high data consumption needs.

- Market Challenges: Rural deployment and QoS issues pose hurdles requiring strategic, collaborative solutions.

- Future Outlook: 5G and AI integration promise to sustain affordability trends while elevating service quality in Malaysia.

Why do most Malaysians prefer cheap SIM plans despite ongoing network improvements?

+Economic considerations, high mobile data demands, and digital ecosystem integration make budget plans more attractive, especially as they provide sufficient speed and coverage at lower costs.

How are telecom providers able to keep costs down while expanding network infrastructure?

+Advancements like network virtualization, spectrum efficiency, and digital recharge channels reduce operational expenses, enabling providers to offer competitive low-cost plans.

What are the main challenges in maintaining quality in low-cost plans?

+Network congestion, limited access during peak times, and infrastructure costs in rural areas threaten service quality, requiring strategic investments and regulatory oversight.

Related Terms:

- Hotlink Prepaid

- Kartu Malaysia yang murah Internet

- eSIM Malaysia

- Tune Talk

- Prepaid artinya

- Telco plan