Welcome to this comprehensive guide on the Department of Banking and Insurance, an essential regulatory body in the financial sector. This article aims to delve deep into the world of banking and insurance regulation, exploring its critical functions, impact, and future prospects. With a focus on accuracy and depth, we will navigate through the intricate web of regulations, providing valuable insights for professionals and enthusiasts alike.

Unveiling the Department of Banking and Insurance

The Department of Banking and Insurance is a regulatory authority responsible for overseeing and governing the activities of financial institutions within a specific jurisdiction. It plays a pivotal role in maintaining stability, fairness, and transparency in the banking and insurance industries, ensuring that consumers’ interests are protected and that financial markets operate efficiently.

The department's primary mandate is to safeguard the public's financial interests by implementing and enforcing a comprehensive set of regulations and standards. This includes licensing and supervising banks, credit unions, insurance companies, and other financial entities to ensure they adhere to legal and ethical practices.

One of the key functions of the Department of Banking and Insurance is to prevent fraud, money laundering, and other financial crimes. Through rigorous scrutiny and ongoing monitoring, the department aims to identify and mitigate potential risks, thereby fostering a secure and trustworthy financial environment.

Regulatory Framework and Oversight

The regulatory framework employed by the Department of Banking and Insurance is extensive and multifaceted. It encompasses a wide range of laws, guidelines, and best practices that financial institutions must adhere to. These regulations cover aspects such as capital requirements, lending practices, consumer protection, and fair competition.

For instance, the department enforces regulations on loan origination, ensuring that banks provide accurate information to borrowers and comply with fair lending practices. It also sets standards for insurance companies, ensuring that policyholders receive the benefits they are entitled to and that companies maintain adequate reserves to cover potential claims.

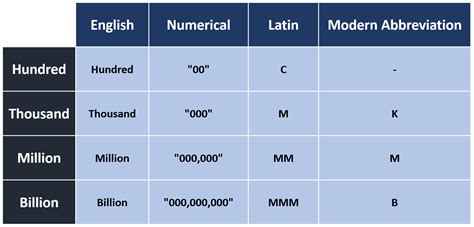

| Regulatory Category | Key Focus Areas |

|---|---|

| Banking Regulations | Capital Adequacy, Lending Practices, Consumer Protection |

| Insurance Regulations | Policy Standards, Reserve Requirements, Claims Handling |

| Anti-Money Laundering | Customer Due Diligence, Transaction Monitoring, Risk Assessment |

The Department of Banking and Insurance also conducts regular examinations and audits of financial institutions to assess their compliance with regulations. These inspections help identify areas of improvement, ensure financial health, and maintain the integrity of the financial system.

Consumer Protection and Education

A significant aspect of the Department of Banking and Insurance’s work revolves around consumer protection and financial literacy. The department strives to empower individuals and businesses by providing resources, tools, and education to make informed financial decisions.

Through its consumer protection initiatives, the department aims to prevent unfair practices, such as predatory lending, deceptive advertising, and fraudulent schemes. It offers guidance and support to consumers, helping them understand their rights and responsibilities in the financial marketplace.

Key Consumer Protection Measures

- Fair Lending Practices: Ensuring banks provide equal access to credit and do not discriminate based on race, gender, or other protected characteristics.

- Truth in Lending: Requiring clear and accurate disclosure of loan terms and conditions, including interest rates, fees, and repayment schedules.

- Protection Against Fraud: Implementing measures to identify and combat financial scams, identity theft, and other forms of consumer fraud.

- Complaint Resolution: Providing a streamlined process for consumers to report and resolve issues with financial institutions.

Additionally, the department conducts outreach programs and offers educational resources to promote financial literacy. These initiatives help individuals understand basic financial concepts, manage their finances effectively, and make wise investment choices.

Financial Literacy Programs

- Workshops and Seminars: Hosting events to educate the public on topics such as budgeting, saving, investing, and managing debt.

- Online Resources: Developing comprehensive websites and digital tools that provide easy access to financial education materials and resources.

- School Programs: Collaborating with educational institutions to integrate financial literacy into school curricula, targeting students at various levels.

- Community Outreach: Partnering with community organizations to reach underserved populations and provide financial education tailored to their needs.

By prioritizing consumer protection and financial literacy, the Department of Banking and Insurance contributes to a more informed and empowered society, reducing financial vulnerabilities and fostering economic stability.

Supervision and Examination Process

The supervision and examination process conducted by the Department of Banking and Insurance is a critical aspect of its regulatory framework. This process ensures that financial institutions maintain sound practices, adhere to regulations, and remain financially solvent.

During examinations, the department's experts thoroughly assess various aspects of a financial institution's operations, including its financial health, internal controls, risk management practices, and compliance with regulatory requirements.

Key Components of the Examination Process

- On-Site Visits: Examiners physically visit the financial institution to review records, interview staff, and assess operational procedures.

- Financial Analysis: Thorough examination of financial statements, accounting practices, and liquidity and solvency metrics.

- Compliance Review: Assessment of the institution’s adherence to regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Risk Assessment: Evaluation of the institution’s risk management framework, including credit, market, and operational risks.

Based on the findings of these examinations, the department may issue recommendations, require corrective actions, or take enforcement measures if serious violations are identified. This proactive approach helps maintain the integrity of the financial system and protects consumers from potential risks.

Regulatory Challenges and Future Prospects

The Department of Banking and Insurance operates in a dynamic and ever-evolving financial landscape, presenting both opportunities and challenges. As technology advances and financial products become more complex, the department must adapt its regulatory approaches to keep pace with these changes.

One of the key challenges is the rapid growth of digital banking and fintech innovations. With the rise of online lending platforms, mobile banking, and cryptocurrency, the department must strike a balance between encouraging innovation and maintaining consumer protection and financial stability.

Emerging Regulatory Trends

- Regulatory Sandboxes: Implementing controlled environments for fintech startups to test innovative products and services while under close supervision.

- Artificial Intelligence and Machine Learning: Leveraging advanced technologies to enhance regulatory compliance, fraud detection, and consumer protection.

- Cross-Border Collaboration: Strengthening international cooperation to address complex regulatory issues arising from global financial transactions.

- Consumer-Centric Approach: Shifting focus towards a more consumer-centric regulatory framework, ensuring that consumers’ interests remain at the forefront.

Looking ahead, the Department of Banking and Insurance will continue to play a crucial role in shaping the future of the financial sector. By embracing technological advancements, fostering collaboration, and prioritizing consumer protection, the department can contribute to a robust, inclusive, and resilient financial ecosystem.

Conclusion

In conclusion, the Department of Banking and Insurance is an indispensable guardian of the financial system, working tirelessly to protect consumers, maintain stability, and promote ethical practices. Through its comprehensive regulatory framework, supervision processes, and consumer education initiatives, the department ensures that the financial sector remains a pillar of trust and security.

As we navigate the complexities of the modern financial landscape, the Department of Banking and Insurance stands ready to adapt, innovate, and lead the way towards a brighter and more sustainable future for the financial industry and its stakeholders.

FAQ

What is the primary role of the Department of Banking and Insurance?

+

The primary role of the Department of Banking and Insurance is to regulate and supervise financial institutions, ensuring they operate in a fair, stable, and transparent manner, while protecting the interests of consumers and promoting a robust financial system.

How does the department enforce regulations?

+

The department enforces regulations through a combination of licensing, supervision, examinations, and enforcement actions. It conducts regular audits and inspections to ensure compliance and may impose penalties or sanctions for violations.

What are some key consumer protection measures implemented by the department?

+

Key consumer protection measures include fair lending practices, truth in lending disclosures, protection against fraud and scams, and streamlined complaint resolution processes. The department also promotes financial literacy through educational programs and resources.