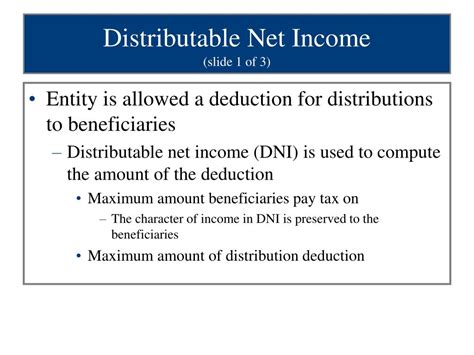

Distributable Net Income (DNI) is a crucial concept in the realm of finance and accounting, particularly in the context of partnerships, limited liability companies (LLCs), and other pass-through entities. At its core, DNI represents the amount of income that can be distributed to owners or partners without depleting the entity's capital. Understanding DNI is essential for financial reporting, tax planning, and ensuring the long-term sustainability of a business. In this article, we will delve into the intricacies of DNI, exploring its definition, calculation, and implications for businesses and their owners.

Definition and Purpose of Distributable Net Income

DNI is essentially the net income of a business that is available for distribution to its owners, after accounting for various deductions and adjustments. The purpose of DNI is to provide a clear picture of the income that can be safely distributed without compromising the entity’s financial stability. This is particularly important in pass-through entities, where income is passed through to the owners and taxed at the individual level, rather than at the entity level. By calculating DNI, businesses can ensure that they are not distributing more income than they can afford, thereby avoiding potential financial difficulties.

Calculating Distributable Net Income

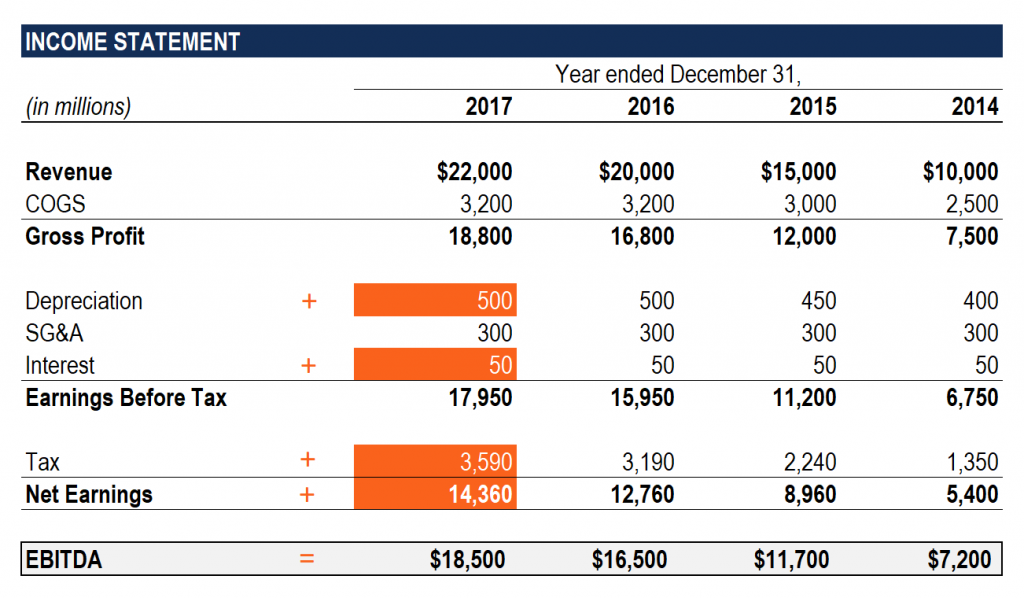

The calculation of DNI involves several steps, starting with the determination of the entity’s net income. This is typically done by preparing a financial statement, such as an income statement, which outlines the revenues and expenses of the business. From the net income, various deductions are made, including taxes, depreciation, and amortization, as well as any other non-cash items that do not affect the entity’s cash flow. The resulting figure represents the DNI, which can be distributed to the owners. It is essential to note that the calculation of DNI may vary depending on the specific circumstances of the business and the applicable accounting standards.

| Component | Amount |

|---|---|

| Net Income | $100,000 |

| Taxes | $20,000 |

| Depreciation | $15,000 |

| Amortization | $10,000 |

| Distributable Net Income | $55,000 |

Implications of Distributable Net Income for Businesses and Owners

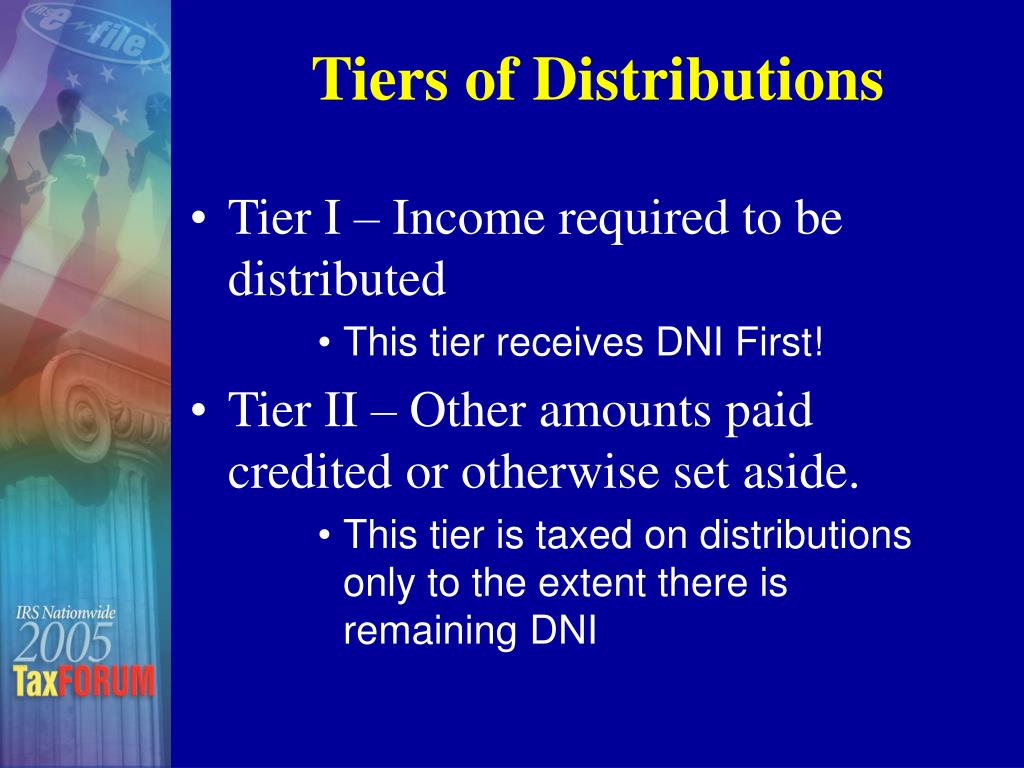

The concept of DNI has significant implications for businesses and their owners. By understanding the amount of income that can be safely distributed, owners can make informed decisions about the allocation of profits, whether to reinvest in the business or distribute to themselves. Additionally, DNI plays a critical role in tax planning, as it affects the amount of income that is subject to taxation at the individual level. It is essential for businesses to maintain accurate records and consult with tax professionals to ensure compliance with tax laws and regulations.

Strategic Considerations for Distributable Net Income

From a strategic perspective, DNI can be used as a tool for managing the financial performance of a business. By monitoring DNI, owners can identify areas for improvement and make adjustments to optimize profitability. Furthermore, DNI can be used to evaluate the financial health of a business, providing insights into its ability to generate cash flow and meet its financial obligations. As such, DNI is an essential metric for businesses seeking to achieve long-term sustainability and success.

Key Points

- DNI represents the amount of income that can be distributed to owners without depleting the entity's capital.

- The calculation of DNI involves deducting taxes, depreciation, and amortization from net income.

- DNI is essential for tax planning and ensuring compliance with tax laws and regulations.

- Understanding DNI is critical for making informed decisions about the allocation of profits.

- DNI can be used as a tool for managing financial performance and evaluating the financial health of a business.

Conclusion and Future Outlook

In conclusion, Distributable Net Income is a vital concept in finance and accounting, providing insights into the amount of income that can be safely distributed to owners without compromising the financial stability of a business. As the business landscape continues to evolve, it is essential for owners and financial professionals to stay informed about the latest developments in DNI and its implications for tax planning and financial management. By doing so, businesses can ensure long-term sustainability and success, while also optimizing profitability and achieving their financial goals.

What is the primary purpose of calculating Distributable Net Income?

+The primary purpose of calculating DNI is to determine the amount of income that can be safely distributed to owners without depleting the entity’s capital.

How is Distributable Net Income calculated?

+DNI is calculated by deducting taxes, depreciation, and amortization from net income, as well as any other non-cash items that do not affect the entity’s cash flow.

Why is Distributable Net Income important for tax planning?

+DNI is essential for tax planning because it affects the amount of income that is subject to taxation at the individual level, and can help owners make informed decisions about the allocation of profits.