The 1095-C tax form is a crucial document for employers and employees alike, as it provides vital information about the health coverage offered by the employer. As part of the Affordable Care Act (ACA), the 1095-C form is used to report the health insurance coverage provided to employees and their dependents. In this article, we will delve into the world of 1095-C taxes, providing you with expert-level insights and actionable tips to navigate this complex topic.

Key Points

- Understanding the purpose and importance of the 1095-C tax form

- Accurate completion of the 1095-C form to avoid penalties

- Deadlines and filing requirements for the 1095-C form

- Reconciling health insurance premiums with tax credits

- Best practices for employers to maintain compliance with ACA regulations

Understanding the 1095-C Tax Form

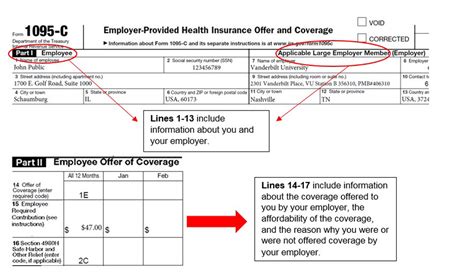

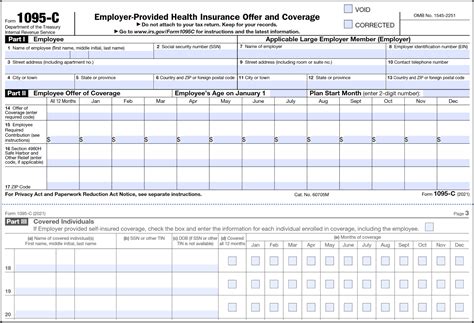

The 1095-C tax form, also known as the Employer-Provided Health Insurance Offer and Coverage, is used by employers to report the health insurance coverage provided to their employees and dependents. This form is essential for employers with 50 or more full-time employees, as it helps the IRS determine whether the employer is complying with the ACA’s employer mandate. The 1095-C form includes information such as the employee’s name and address, the employer’s name and address, the health plan’s name and identifier, and the months during which the employee and their dependents were covered.

Tip 1: Accurate Completion of the 1095-C Form

Accurate completion of the 1095-C form is crucial to avoid penalties and ensure compliance with ACA regulations. Employers must provide a 1095-C form to each employee who was offered health coverage during the tax year, and the form must be filed with the IRS by February 28th (or March 31st if filing electronically) of each year. Employers can use the IRS’s Publication 5196 to guide them through the completion of the 1095-C form, which includes instructions on how to fill out the form, as well as examples and illustrations to help clarify the process.

| Form Section | Description |

|---|---|

| Part I | Employee and Employer Information |

| Part II | Employee and Dependent Information |

| Part III | Coverage Information |

Tip 2: Meeting Deadlines and Filing Requirements

Employers must meet the deadlines and filing requirements for the 1095-C form to avoid penalties. The IRS imposes penalties on employers who fail to file the 1095-C form on time, or who file incomplete or inaccurate forms. The penalties can range from 250 to 3,000 per form, depending on the severity of the error. Employers can file the 1095-C form electronically using the IRS’s AIR (Affordable Care Act Information Returns) system, which allows for faster and more efficient filing.

Reconciling Health Insurance Premiums with Tax Credits

Reconciling health insurance premiums with tax credits is an essential step in the tax filing process for employees who received health insurance coverage through their employer. The 1095-C form provides the necessary information for employees to reconcile their health insurance premiums with any tax credits they may have received. Employees can use the information on the 1095-C form to complete Form 8962, which is used to reconcile the premium tax credit.

Tip 3: Best Practices for Employers

Employers can take several steps to maintain compliance with ACA regulations and avoid penalties. One best practice is to keep accurate and detailed records of health insurance coverage, including the 1095-C form and any other relevant documentation. Employers should also ensure that they are providing the correct information on the 1095-C form, and that they are filing the form on time. Additionally, employers can use the IRS’s ACA Toolkit to guide them through the process of completing and filing the 1095-C form.

| Best Practice | Description |

|---|---|

| Keep Accurate Records | Maintain detailed records of health insurance coverage |

| Provide Correct Information | Ensure accuracy and completeness of 1095-C form information |

| File on Time | Meet deadlines for filing 1095-C form with IRS |

Tip 4: Handling Errors and Corrections

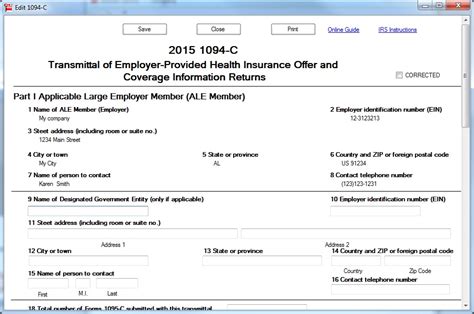

Employers may need to correct errors or make changes to the 1095-C form after it has been filed. In such cases, employers can use the IRS’s Form 1094-C to make corrections and amendments to the 1095-C form. Employers should also keep a record of any corrections or changes made to the 1095-C form, as this information may be needed for future reference.

Tip 5: Seeking Professional Guidance

Finally, employers and employees may need to seek professional guidance when dealing with the 1095-C tax form. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide expert guidance and advice on completing and filing the 1095-C form, as well as reconciling health insurance premiums with tax credits. Employers and employees can also contact the IRS directly for assistance and guidance on the 1095-C form and other ACA-related issues.

What is the purpose of the 1095-C tax form?

+The 1095-C tax form is used by employers to report the health insurance coverage provided to their employees and dependents.

Who is required to file the 1095-C form?

+Employers with 50 or more full-time employees are required to file the 1095-C form.

What is the deadline for filing the 1095-C form?

+The deadline for filing the 1095-C form is February 28th (or March 31st if filing electronically) of each year.

Meta Description: Learn how to navigate the complexities of 1095-C taxes with our expert guide, covering topics such as accurate completion of the 1095-C form, meeting deadlines and filing requirements, and reconciling health insurance premiums with tax credits.