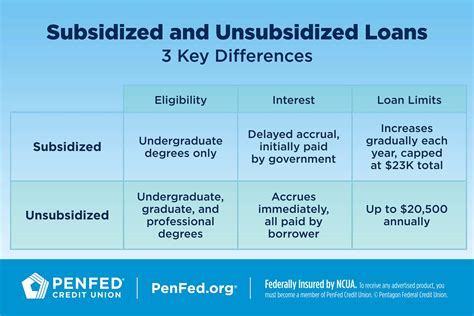

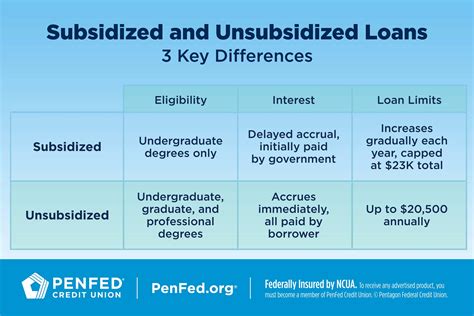

The world of student loans can be complex and overwhelming, especially for those who are new to the process. One type of loan that often sparks interest and inquiry is the subsidized loan. Subsidized loans are a type of federal student loan that offers borrowers a more favorable set of terms compared to unsubsidized loans. The primary benefit of subsidized loans is that the borrower is not responsible for paying the interest on the loan while they are in school, during the grace period, or during periods of deferment. This feature alone can significantly reduce the overall cost of the loan over its lifespan. In this article, we will delve into five key facts about subsidized loans, exploring their benefits, eligibility criteria, and how they compare to other types of student loans.

Key Points

- Subsidized loans are a type of federal student loan that does not accrue interest while the borrower is in school or during deferment periods.

- Eligibility for subsidized loans is based on financial need, and the amount borrowed cannot exceed the borrower's financial need or the annual loan limit.

- The interest rate on subsidized loans is fixed and is determined by the federal government, making them more predictable than private loans.

- Repayment of subsidized loans begins after a six-month grace period following graduation, withdrawal from school, or a drop below half-time enrollment.

- Borrowers of subsidized loans are eligible for income-driven repayment plans and loan forgiveness programs under certain conditions.

Understanding Subsidized Loans

Subsidized loans, formally known as Direct Subsidized Loans, are part of the federal student aid program provided by the U.S. Department of Education. These loans are designed to help undergraduate students who demonstrate financial need pay for their education expenses. The “subsidized” aspect refers to the fact that the U.S. Department of Education pays the interest on the loan while the student is enrolled in school at least half-time, during the grace period, and during any periods of deferment. This subsidy can lead to significant savings over the life of the loan, as the borrower is only responsible for paying the principal amount borrowed, plus any interest that accrues after the grace period or during repayment.

Eligibility and Application Process

To be eligible for a subsidized loan, students must meet certain criteria, including being enrolled at least half-time in an eligible program, not having exceeded the aggregate loan limit, and demonstrating financial need as determined by the Free Application for Federal Student Aid (FAFSA). The application process for subsidized loans begins with completing the FAFSA, which collects financial information about the student and their family to determine their Expected Family Contribution (EFC). Based on the EFC and the cost of attendance at the student’s chosen school, the financial aid office determines the student’s eligibility for subsidized loans and informs them of the maximum amount they can borrow.

| Loan Type | Interest Subsidy | Eligibility | Interest Rate |

|---|---|---|---|

| Direct Subsidized Loan | Yes | Undergraduate students with demonstrated financial need | Fixed rate determined annually by Congress |

| Direct Unsubsidized Loan | No | Undergraduate and graduate students; no requirement to demonstrate financial need | Fixed rate determined annually by Congress |

Repayment and Forgiveness Options

Repayment of subsidized loans begins after a six-month grace period following the borrower’s graduation, withdrawal from school, or drop below half-time enrollment. Borrowers have several repayment options, including the Standard Repayment Plan, Graduated Repayment Plan, and Income-Driven Repayment (IDR) plans. IDR plans, such as Income-Based Repayment (IBR) and Pay As You Earn (PAYE), cap monthly payments based on income and family size, potentially leading to lower monthly payments. Additionally, borrowers who work in public service jobs may be eligible for Public Service Loan Forgiveness (PSLF) after making 120 qualifying payments, which can result in the forgiveness of the remaining balance on their loan.

Comparing Subsidized Loans to Other Options

While subsidized loans offer several benefits, they are not the only option for financing education. Unsubsidized loans, for example, are available to both undergraduate and graduate students and do not require demonstration of financial need. However, borrowers are responsible for paying the interest on unsubsidized loans from the time the loan is disbursed. Private student loans, offered by banks and other lenders, may have variable interest rates and less favorable terms than federal loans. It’s essential for students and their families to carefully consider their options and choose the loans that best fit their financial situation and goals.

What is the main advantage of subsidized loans over unsubsidized loans?

+The main advantage is that the interest is paid by the U.S. Department of Education while the borrower is in school, during the grace period, and during deferment, reducing the overall cost of the loan.

How do I apply for a subsidized loan?

+To apply, you must complete the Free Application for Federal Student Aid (FAFSA), which determines your eligibility based on financial need and other factors.

Can I have both subsidized and unsubsidized loans at the same time?

+Yes, it is possible to have both types of loans simultaneously, depending on your financial need and the cost of attendance at your school.

In conclusion, subsidized loans offer a valuable financial aid option for undergraduate students who demonstrate financial need. By understanding the eligibility criteria, application process, repayment options, and forgiveness possibilities, borrowers can make informed decisions about their financial aid and set themselves up for success in managing their student loan debt. As the landscape of higher education and student financing continues to evolve, staying informed about the details and benefits of subsidized loans will remain essential for those navigating the complex world of student loans.