For those seeking convenient and accessible healthcare services, the CVS Minute Clinic has emerged as a popular option, offering a range of medical treatments and preventive care services. One common question that arises is whether the CVS Minute Clinic accepts insurance. In this comprehensive article, we will delve into the details of CVS Minute Clinic's insurance policies, explore the types of insurance they accept, and provide insights into the coverage and benefits offered to patients. By understanding the insurance landscape of CVS Minute Clinic, patients can make informed decisions about their healthcare options and navigate the process seamlessly.

Understanding CVS Minute Clinic’s Insurance Acceptance

CVS Health, the parent company of CVS Minute Clinic, understands the importance of insurance coverage in providing accessible healthcare. As such, CVS Minute Clinic accepts a wide range of insurance plans, ensuring that patients can receive the necessary medical care without financial barriers. The acceptance of insurance demonstrates CVS’s commitment to making healthcare services affordable and convenient for a diverse patient population.

It's worth noting that insurance coverage at CVS Minute Clinic may vary depending on the specific location and the type of insurance plan. While CVS Minute Clinic strives to accommodate a broad spectrum of insurance providers, it's essential for patients to verify their insurance coverage before visiting the clinic. This ensures a smooth and stress-free healthcare experience.

Types of Insurance Accepted by CVS Minute Clinic

CVS Minute Clinic is dedicated to serving a diverse patient base, which is reflected in the variety of insurance plans they accept. Here is an overview of the different types of insurance typically covered by CVS Minute Clinic:

- Commercial Health Insurance Plans: CVS Minute Clinic accepts major commercial health insurance plans, including those offered by leading providers such as Aetna, Blue Cross Blue Shield, Cigna, and UnitedHealthcare. These plans often cover a wide range of services, including primary care, urgent care, and preventive health services.

- Medicare: CVS Minute Clinic is a proud participant in the Medicare program, ensuring that seniors and individuals with disabilities can access quality healthcare services without financial strain. Medicare coverage at CVS Minute Clinic includes Part B services, such as preventive care, immunizations, and certain diagnostic tests.

- Medicaid: Understanding the importance of providing healthcare access to vulnerable populations, CVS Minute Clinic accepts Medicaid in many states. Medicaid coverage may vary depending on the state and the specific benefits included in the plan. Patients are advised to check their state's Medicaid program for more details.

- TRICARE: CVS Minute Clinic recognizes the unique healthcare needs of military families and proudly accepts TRICARE insurance. TRICARE covers active-duty military personnel, retirees, and their eligible family members, providing access to essential healthcare services at CVS Minute Clinic locations.

- Workers' Compensation Insurance: For individuals who have sustained work-related injuries or illnesses, CVS Minute Clinic accepts workers' compensation insurance. This ensures that employees can receive the necessary medical treatment and care without out-of-pocket expenses.

Verifying Insurance Coverage at CVS Minute Clinic

To ensure a smooth and efficient healthcare experience, it is crucial for patients to verify their insurance coverage before scheduling an appointment at CVS Minute Clinic. Here are some steps to follow:

- Contact Your Insurance Provider: Reach out to your insurance company or navigate their website to understand the specific coverage details. Inquire about the network of providers covered by your plan and whether CVS Minute Clinic is included.

- Check the CVS Minute Clinic Website: Visit the official CVS Minute Clinic website, where you can find a comprehensive list of accepted insurance plans. This resource provides valuable information about the types of insurance plans and networks they work with.

- Call the CVS Minute Clinic Location: Contact the specific CVS Minute Clinic location you plan to visit and inquire about their insurance acceptance policies. The clinic staff can provide you with detailed information about the insurance plans they accept and guide you through the verification process.

- Review Your Insurance Card: Take a close look at your insurance card to identify the name of your insurance provider and any relevant policy numbers. This information can be useful when verifying coverage with the CVS Minute Clinic team.

Insurance Coverage for Specific Services at CVS Minute Clinic

The range of services offered by CVS Minute Clinic varies, and so does the insurance coverage for these services. Here is an overview of the insurance coverage for some common services provided by CVS Minute Clinic:

| Service | Insurance Coverage |

|---|---|

| Primary Care Services | Commercial health insurance plans, Medicare, and Medicaid often cover primary care services at CVS Minute Clinic. These services may include annual physicals, immunizations, and management of chronic conditions. |

| Urgent Care Services | Urgent care services, such as treatment for minor illnesses and injuries, are typically covered by commercial health insurance plans and Medicare. However, coverage may vary depending on the specific plan and the urgency of the medical condition. |

| Preventive Care Services | Preventive care services, including immunizations, health screenings, and wellness checks, are often covered by commercial health insurance plans, Medicare, and Medicaid. These services are crucial for maintaining good health and catching potential health issues early on. |

| Laboratory and Diagnostic Tests | Insurance coverage for laboratory and diagnostic tests may vary depending on the specific test and the reason for the test. Commercial health insurance plans and Medicare often cover these tests when ordered by a healthcare provider. Medicaid coverage for laboratory tests may vary by state. |

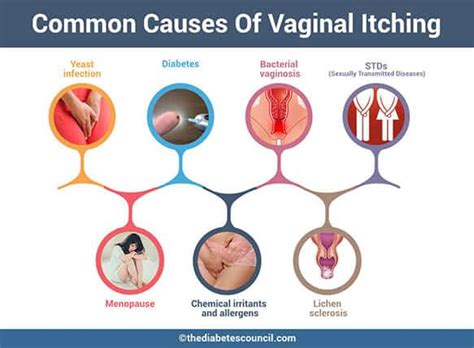

| Specialty Services | CVS Minute Clinic offers a range of specialty services, such as dermatology, optometry, and women's health services. The insurance coverage for these specialty services may depend on the specific plan and the benefits included. It is advisable to verify coverage with your insurance provider before seeking these services. |

Understanding Out-of-Pocket Costs and Copays

While insurance coverage is essential, it’s equally important to understand the potential out-of-pocket costs associated with healthcare services at CVS Minute Clinic. Here are some key considerations:

- Copays: Many insurance plans require patients to pay a copayment for each healthcare service received. The amount of the copay can vary depending on the specific insurance plan and the type of service. CVS Minute Clinic will typically collect the copay at the time of service.

- Deductibles and Out-of-Pocket Maximums: Insurance plans often have deductibles, which are the amounts patients must pay out of pocket before insurance coverage kicks in. Additionally, there may be out-of-pocket maximums, which limit the total amount patients have to pay for covered services in a given year. Understanding these financial aspects is crucial for managing healthcare expenses.

- Balance Billing: In some cases, the amount charged by CVS Minute Clinic for a particular service may exceed the allowed amount under the patient's insurance plan. This is known as balance billing. Patients should be aware of their rights and the potential for balance billing to avoid unexpected charges.

Tips for Maximizing Insurance Coverage at CVS Minute Clinic

To ensure you make the most of your insurance coverage at CVS Minute Clinic, consider the following tips:

- Review Your Insurance Summary of Benefits: Take the time to carefully read your insurance summary of benefits, which outlines the specific coverage details and any limitations or exclusions. Understanding your insurance plan's benefits will help you make informed decisions about your healthcare choices.

- Communicate with Your Insurance Provider: If you have any questions or concerns about your insurance coverage, don't hesitate to reach out to your insurance provider. They can provide valuable insights and guidance to ensure you receive the maximum benefits available under your plan.

- Choose In-Network Providers: Whenever possible, choose healthcare providers, including CVS Minute Clinic, that are in-network with your insurance plan. This can help minimize out-of-pocket costs and ensure seamless coverage for your healthcare services.

- Utilize Preventive Care Services: Take advantage of the preventive care services offered by CVS Minute Clinic, as many insurance plans cover these services at no cost to the patient. Preventive care is crucial for maintaining good health and identifying potential health issues early on.

Frequently Asked Questions

Can I use my insurance for prescription medications at CVS Minute Clinic?

+

Yes, you can use your insurance for prescription medications at CVS Minute Clinic. Simply present your insurance card and the prescription provided by the Minute Clinic healthcare provider. The pharmacy team will verify your coverage and process your prescription accordingly.

What if my insurance plan is not accepted by CVS Minute Clinic?

+

If your insurance plan is not accepted by CVS Minute Clinic, you may still receive healthcare services and pay out-of-pocket. However, it’s advisable to verify your insurance coverage and explore alternative options, such as visiting an in-network provider or exploring self-pay options.

Can I use my Health Savings Account (HSA) or Flexible Spending Account (FSA) at CVS Minute Clinic?

+

Yes, you can use your HSA or FSA to pay for eligible healthcare services and products at CVS Minute Clinic. These accounts provide tax benefits and can be used to cover a wide range of medical expenses, including those incurred at Minute Clinic.

How can I check if a specific service is covered by my insurance at CVS Minute Clinic?

+

To check if a specific service is covered by your insurance at CVS Minute Clinic, contact your insurance provider directly. They can provide you with detailed information about your coverage for the particular service you require. Additionally, you can reach out to the CVS Minute Clinic location for guidance and assistance.

Are there any discounts or promotions available for uninsured patients at CVS Minute Clinic?

+

CVS Minute Clinic may offer discounts or promotional rates for uninsured patients. These offers can vary by location and may be subject to certain eligibility criteria. It’s advisable to contact the specific Minute Clinic location or visit their website for the latest information on uninsured patient discounts.