Medical debt has become a significant concern for many individuals and families, with the potential to impact not only their financial stability but also their credit score. The relationship between medical debt and credit scores is complex, and it's essential to understand how medical debt can affect an individual's creditworthiness. In this article, we will delve into the world of medical debt and its implications on credit scores, providing a comprehensive analysis of the topic.

Understanding Medical Debt

Medical debt refers to the amount owed to healthcare providers for medical services received. This type of debt can arise from various sources, including hospital bills, doctor visits, surgical procedures, and prescription medications. According to a study by the Kaiser Family Foundation, approximately 27% of adults in the United States have struggled to pay medical bills, and about 16% have had to make significant sacrifices to pay for healthcare.

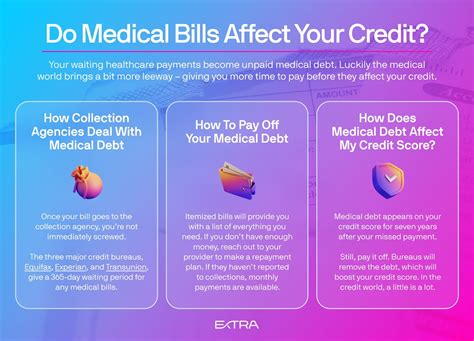

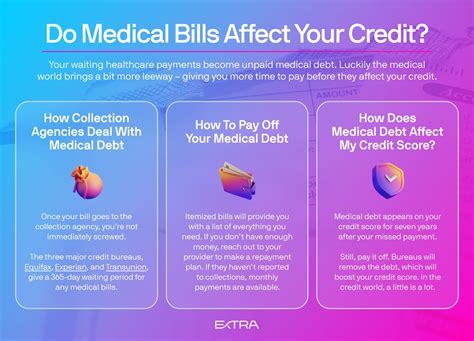

How Medical Debt is Reported to Credit Bureaus

When an individual incurs medical debt, the healthcare provider may report the debt to one or more of the three major credit bureaus: Equifax, Experian, and TransUnion. The credit bureaus then use this information to calculate the individual’s credit score. However, the way medical debt is reported and factored into credit scores has undergone significant changes in recent years. For instance, the Fair Credit Reporting Act (FCRA) requires credit bureaus to wait at least 180 days before reporting medical debt, allowing consumers time to resolve the debt with their healthcare provider or insurer.

| Year | Number of Adults with Medical Debt | Percentage of Adults with Medical Debt |

|---|---|---|

| 2019 | 64 million | 27% |

| 2018 | 62 million | 26% |

| 2017 | 59 million | 25% |

Impact of Medical Debt on Credit Scores

The impact of medical debt on credit scores depends on various factors, including the amount of debt, the individual’s credit history, and the credit scoring model used. Generally, medical debt can have a negative effect on credit scores, particularly if it is sent to collections or results in a lawsuit. However, the FICO 9 credit scoring model, which is widely used by lenders, treats medical debt differently than other types of debt. Specifically, FICO 9 is more lenient when it comes to medical debt, and it may not penalize consumers as severely for medical debt as it would for other types of debt.

Credit Scoring Models and Medical Debt

The VantageScore 4.0 credit scoring model also takes a more nuanced approach to medical debt, considering the individual’s overall credit history and the circumstances surrounding the medical debt. This model may be more forgiving of medical debt than other credit scoring models, especially if the individual has a strong credit history and makes timely payments on other debts.

Key Points

- Medical debt can have a negative impact on credit scores, particularly if it is sent to collections or results in a lawsuit.

- The FICO 9 credit scoring model treats medical debt differently than other types of debt, and it may not penalize consumers as severely.

- The VantageScore 4.0 credit scoring model takes a more nuanced approach to medical debt, considering the individual's overall credit history and the circumstances surrounding the medical debt.

- Consumers can take steps to minimize the impact of medical debt on their credit scores, such as negotiating with healthcare providers, seeking financial assistance, and making timely payments on other debts.

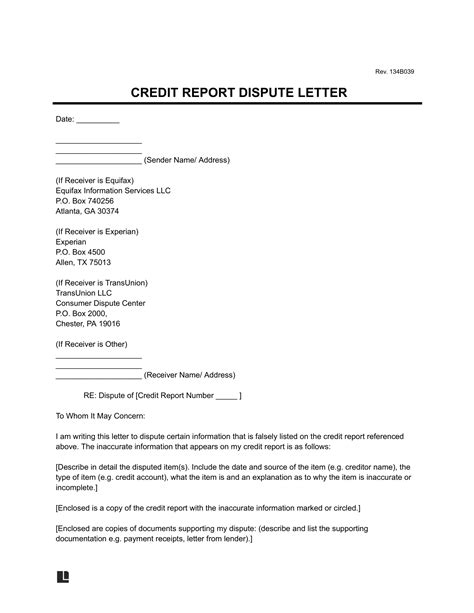

- Regularly reviewing credit reports and disputing any errors or inaccuracies is crucial to maintaining a healthy credit score.

Minimizing the Impact of Medical Debt on Credit Scores

While medical debt can have a negative impact on credit scores, there are steps consumers can take to minimize this impact. For instance, negotiating with healthcare providers or seeking financial assistance can help reduce the amount of debt owed. Additionally, making timely payments on other debts and maintaining a strong credit history can help offset the negative effects of medical debt.

Seeking Financial Assistance

Many healthcare providers offer financial assistance programs or charity care to help patients with medical debt. These programs can help reduce or eliminate medical debt, and they may not report the debt to credit bureaus. Consumers can also seek assistance from non-profit organizations or government agencies that provide financial assistance for medical expenses.

Medical debt can be a significant challenge for many individuals and families, but it's essential to understand the implications of medical debt on credit scores. By taking steps to minimize the impact of medical debt, such as negotiating with healthcare providers, seeking financial assistance, and maintaining a strong credit history, consumers can protect their credit scores and maintain financial stability.

Will medical debt always hurt my credit score?

+No, medical debt will not always hurt your credit score. The impact of medical debt on credit scores depends on various factors, including the amount of debt, the individual’s credit history, and the credit scoring model used.

Can I negotiate with healthcare providers to reduce medical debt?

+Yes, you can negotiate with healthcare providers to reduce medical debt. Many healthcare providers offer financial assistance programs or charity care to help patients with medical debt.

How can I minimize the impact of medical debt on my credit score?

+You can minimize the impact of medical debt on your credit score by negotiating with healthcare providers, seeking financial assistance, making timely payments on other debts, and maintaining a strong credit history.