In times of unforeseen financial distress, the need for emergency cash immediately can be overwhelming. Whether it's a sudden medical expense, an unexpected car repair, or an urgent home maintenance issue, having access to quick funds is crucial. The ability to cover these expenses without delay can significantly reduce stress and prevent further complications. For individuals facing such situations, understanding the available options for obtaining emergency cash is essential.

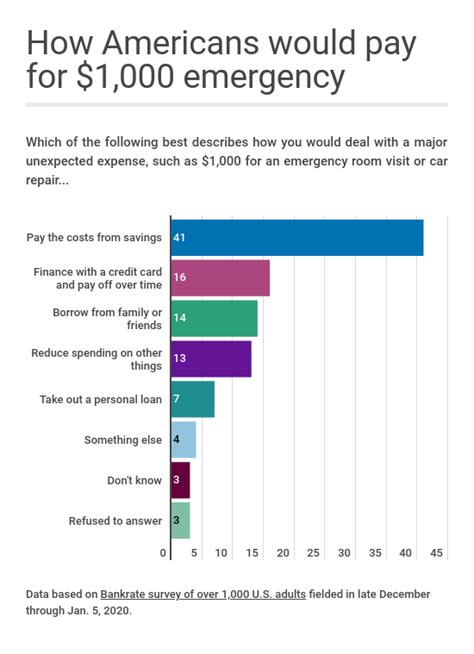

The traditional banking system often requires a considerable amount of time to process loans, which may not be feasible in emergency situations. Moreover, not everyone has the luxury of an easily accessible savings account or a supportive network to fall back on. In such cases, exploring alternative financial solutions becomes necessary. These can range from short-term loans offered by financial institutions to more innovative, technology-driven lending platforms that promise rapid access to cash.

Key Points

- Emergency cash needs can arise from unexpected expenses such as medical bills, car repairs, or home emergencies.

- Traditional banking loans may not provide the immediate funds required in emergency situations.

- Alternative financial solutions, including short-term loans and payday loans, can offer rapid access to cash but often come with higher interest rates and fees.

- Credit card cash advances are another option, though they typically carry high interest rates and fees.

- Non-profit credit counseling agencies can provide advice and help manage debt, offering a more sustainable long-term solution.

Understanding Emergency Loan Options

When seeking emergency cash immediately, it’s crucial to understand the different types of loans available. Short-term loans, for instance, are designed to provide quick access to funds but usually come with higher interest rates compared to traditional loans. Payday loans are a specific type of short-term loan that requires repayment by the borrower’s next payday, often along with a fee. While these loans can offer rapid financial relief, their high costs can lead to a cycle of debt if not managed carefully.

Payday Loans and Their Implications

Payday loans are frequently criticized for their exorbitant interest rates and fees, which can significantly increase the amount borrowed. For example, a 500 loan might incur a 75 fee, resulting in a total repayment of $575. While payday loans can provide emergency cash immediately, their long-term implications must be carefully considered. Borrowers should be aware of the total cost of the loan, including all fees and interest, and have a clear plan for repayment to avoid falling into debt.

| Loan Type | Interest Rate | Fees |

|---|---|---|

| Short-term Loan | 15% - 30% APR | Varying origination fees |

| Payday Loan | 300% - 400% APR | Fixed fee per $100 borrowed |

| Credit Card Cash Advance | 20% - 30% APR | Fixed fee or percentage of advance |

Alternative Solutions and Long-term Strategies

Beyond emergency loans, there are alternative solutions and long-term strategies that individuals can explore to manage financial emergencies. Building an emergency fund, for example, can provide a cushion against unexpected expenses. Contributing a small amount regularly to a savings account can help accumulate funds over time, reducing the reliance on emergency loans.

Non-profit credit counseling agencies offer another valuable resource. These organizations provide free or low-cost advice on managing debt and can help individuals develop a personalized plan to achieve financial stability. They can also negotiate with creditors on behalf of the borrower to reduce payments or interest rates, making it easier to manage debt.

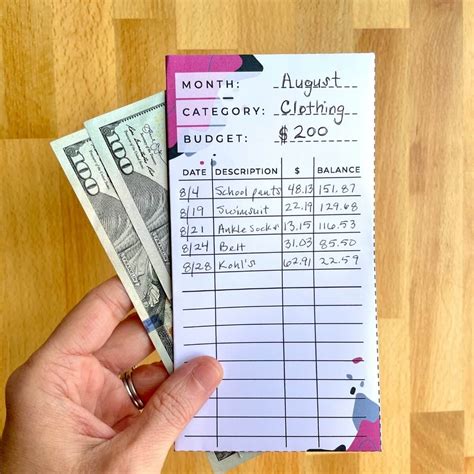

Building Financial Resilience

Building financial resilience involves adopting habits and strategies that enhance one’s ability to withstand financial shocks. This includes creating a budget that accounts for all expenses and prioritizes saving, reducing debt, and investing in financial education. Understanding personal finance, recognizing the importance of emergency savings, and being aware of the options available for emergency funding are crucial steps in achieving financial stability.

What are the key factors to consider when choosing an emergency loan?

+When choosing an emergency loan, it's crucial to consider the interest rate, fees associated with the loan, repayment terms, and the total cost of the loan. Borrowers should also evaluate their ability to repay the loan without falling into further debt.

How can I build an emergency fund to reduce my reliance on emergency loans?

+Building an emergency fund involves setting aside a portion of your income regularly. Start by allocating a small, manageable amount each month into a dedicated savings account. Over time, aim to save 3-6 months' worth of living expenses to provide a sufficient cushion against financial emergencies.

What role can non-profit credit counseling agencies play in managing debt?

+Non-profit credit counseling agencies can provide valuable advice and assistance in managing debt. They offer free or low-cost counseling, help develop personalized debt management plans, and can negotiate with creditors to reduce payments or interest rates, making it easier to become debt-free.

In conclusion, the need for emergency cash immediately can arise from various unforeseen circumstances. While there are several options available for obtaining emergency funds, each comes with its own set of implications and costs. By understanding these options, adopting strategies to build financial resilience, and seeking professional advice when needed, individuals can better navigate financial emergencies and work towards achieving long-term financial stability.