Emergency loans for individuals with bad credit can be a challenging and stressful experience, especially when time is of the essence. The urgency to secure funds to cover unexpected expenses, such as medical bills, car repairs, or other unforeseen costs, can be overwhelming. For those with a less-than-perfect credit history, the fear of rejection from traditional lenders can be daunting. However, there are alternative options available that cater specifically to individuals with bad credit, offering guaranteed approval or more lenient eligibility criteria.

Understanding Bad Credit and Emergency Loans

Bad credit is often the result of past financial difficulties, such as missed payments, defaults, or high credit utilization ratios. This history is reflected in an individual’s credit score, which lenders use to assess the risk of lending. Traditional lenders, such as banks, typically have strict credit score requirements, making it difficult for individuals with bad credit to secure a loan. Emergency loans for bad credit, on the other hand, are designed to provide quick access to funds for those in urgent need, despite their credit history.

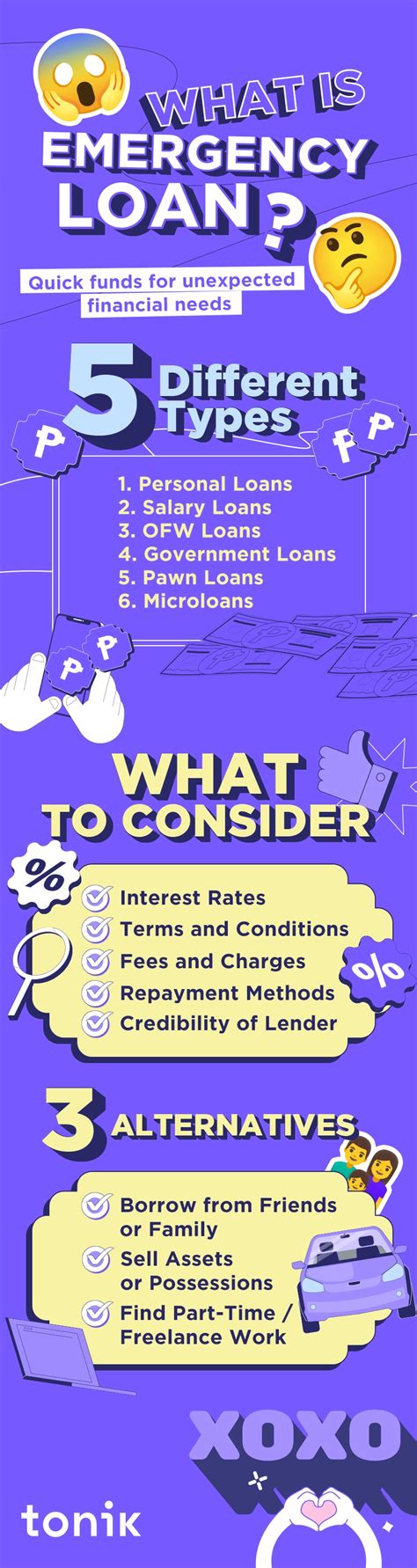

Types of Emergency Loans for Bad Credit

Several types of emergency loans are available for individuals with bad credit, each with its own set of features and requirements. These include:

- Payday Loans: Short-term, high-interest loans that are typically due on the borrower’s next payday. While they can provide quick cash, they often come with extremely high interest rates and fees.

- Personal Installment Loans: Longer-term loans that are repaid in installments over several months or years. These loans may offer more favorable interest rates and terms than payday loans but still carry risks for borrowers with bad credit.

- Secured Loans: Loans that require collateral, such as a vehicle or property, to secure the loan. These loans may offer better interest rates but pose a significant risk to the borrower if they fail to repay, as they could lose their collateral.

- Guaranteed Approval Loans: Loans that promise guaranteed approval, regardless of credit score. While these loans may seem appealing, they often come with very high interest rates and unfavorable terms.

| Loan Type | Interest Rate Range | Repayment Terms |

|---|---|---|

| Payday Loan | 300% - 1,000% APR | Due on next payday |

| Personal Installment Loan | 6% - 36% APR | Several months to years |

| Secured Loan | 4% - 36% APR | Depends on collateral and lender |

| Guaranteed Approval Loan | 100% - 300% APR | Varying terms, often unfavorable |

Guaranteed Approval: Understanding the Risks

Loans with guaranteed approval may seem like an attractive option for those with bad credit, as they promise approval regardless of credit history. However, these loans often come with significantly higher interest rates and less favorable terms than traditional loans. Borrowers must carefully consider the total cost of the loan, including all fees and interest, to avoid falling into a debt trap.

Alternatives to Emergency Loans for Bad Credit

Before opting for an emergency loan, individuals with bad credit should explore alternative options to address their financial needs. These may include:

- Non-profit Credit Counseling: Organizations that provide free or low-cost advice on managing debt and improving credit scores.

- Local Assistance Programs: Government or community programs that offer financial assistance for specific needs, such as food, housing, or medical care.

- Side Hustles or Temporary Work: Increasing income through part-time jobs or freelance work to cover unexpected expenses.

Key Points

- Emergency loans for bad credit are available but often come with high interest rates and unfavorable terms.

- Understanding the different types of emergency loans, including payday loans, personal installment loans, secured loans, and guaranteed approval loans, is crucial for making informed decisions.

- Borrowers should carefully review loan agreements and consider alternative options before committing to a loan.

- Improving credit scores through responsible financial practices can increase access to better loan terms and lower interest rates in the future.

- Seeking advice from financial advisors or credit counselors can provide valuable insights and strategies for managing debt and improving financial stability.

In conclusion, while emergency loans for bad credit can provide a necessary lifeline in times of financial crisis, they must be approached with caution. Borrowers should be aware of the potential risks and consider all available options before making a decision. By understanding the terms, exploring alternatives, and prioritizing financial stability, individuals can navigate the challenges of bad credit and work towards a more secure financial future.

What are the main risks associated with emergency loans for bad credit?

+The main risks include high interest rates, unfavorable repayment terms, and the potential for debt traps. Borrowers must carefully review the loan agreement and ensure they can afford the repayments.

How can I improve my credit score to access better loan terms?

+Improving your credit score involves responsible financial practices such as making on-time payments, keeping credit utilization low, and monitoring your credit report for errors. Over time, these habits can lead to better credit scores and access to more favorable loan terms.

What alternatives are available to emergency loans for bad credit?

+Alternatives include non-profit credit counseling, local assistance programs, and increasing income through side hustles or temporary work. These options can help address financial needs without the risks associated with high-interest loans.