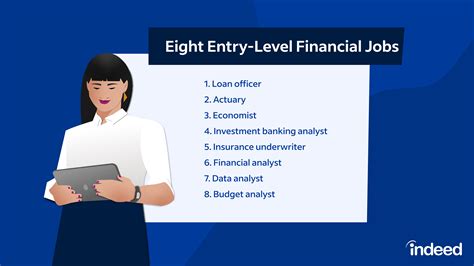

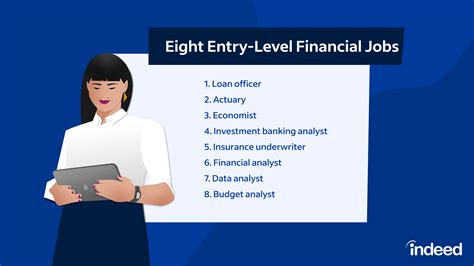

Breaking into the finance industry can be a daunting task, especially for those with little to no experience. However, there are several entry-level positions that can serve as a stepping stone to a successful career in finance. In this article, we will explore five finance entry jobs that can help individuals gain the skills and experience needed to succeed in this field.

Key Points

- Financial analyst: Assists in preparing financial reports and forecasting future financial trends

- Investment banking analyst: Supports clients in raising capital, advising on mergers and acquisitions, and managing financial transactions

- Financial planner: Helps individuals and businesses create personalized financial plans to achieve their goals

- Accountant: Prepares and examines financial records, ensuring accuracy and compliance with laws and regulations

- Portfolio manager: Oversees investment portfolios, making decisions on asset allocation and risk management

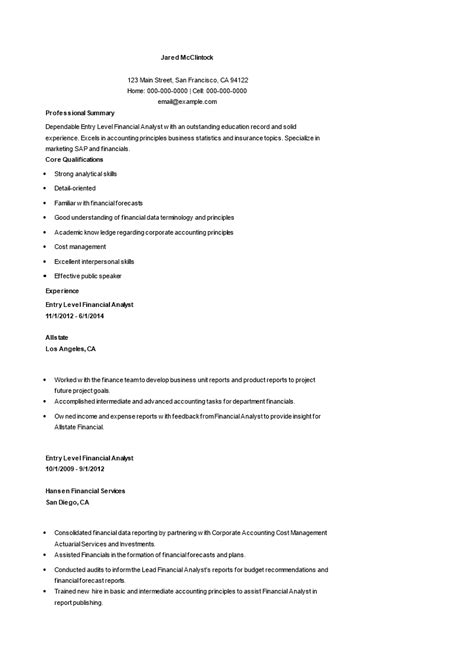

Financial Analyst

A financial analyst is responsible for preparing financial reports, forecasting future financial trends, and analyzing market data to help businesses and organizations make informed decisions. This entry-level position requires strong analytical and problem-solving skills, as well as the ability to communicate complex financial information in a clear and concise manner. According to the Bureau of Labor Statistics, the median annual salary for financial analysts is $85,660.

Skills and Qualifications

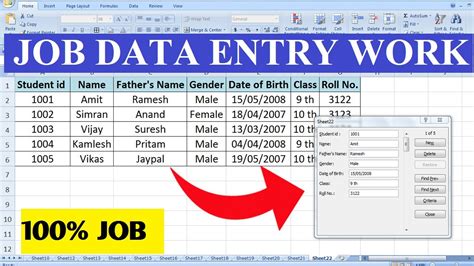

To become a financial analyst, one typically needs a bachelor’s degree in finance, accounting, or a related field. Strong knowledge of financial modeling, data analysis, and financial markets is also essential. Proficiency in Microsoft Office, particularly Excel, is a must, as well as experience with financial software such as Bloomberg or Reuters.

Investment Banking Analyst

An investment banking analyst supports clients in raising capital, advising on mergers and acquisitions, and managing financial transactions. This entry-level position requires strong analytical and problem-solving skills, as well as the ability to work well under pressure and meet tight deadlines. According to Glassdoor, the average salary for an investment banking analyst is $100,000 per year.

Skills and Qualifications

To become an investment banking analyst, one typically needs a bachelor’s degree in finance, economics, or a related field. Strong knowledge of financial modeling, data analysis, and financial markets is also essential. Experience with financial software such as Excel, PowerPoint, and financial modeling tools is highly valued.

Financial Planner

A financial planner helps individuals and businesses create personalized financial plans to achieve their goals. This entry-level position requires strong communication and interpersonal skills, as well as the ability to analyze financial data and provide sound financial advice. According to the Bureau of Labor Statistics, the median annual salary for financial planners is $94,170.

Skills and Qualifications

To become a financial planner, one typically needs a bachelor’s degree in finance, accounting, or a related field. Strong knowledge of financial planning principles, investment strategies, and retirement planning is also essential. Professional certifications such as the Certified Financial Planner (CFP) designation are highly valued.

Accountant

An accountant prepares and examines financial records, ensuring accuracy and compliance with laws and regulations. This entry-level position requires strong attention to detail, organizational skills, and the ability to communicate complex financial information in a clear and concise manner. According to the Bureau of Labor Statistics, the median annual salary for accountants is $74,170.

Skills and Qualifications

To become an accountant, one typically needs a bachelor’s degree in accounting or a related field. Strong knowledge of accounting principles, financial statements, and tax laws is also essential. Professional certifications such as the Certified Public Accountant (CPA) designation are highly valued.

Portfolio Manager

A portfolio manager oversees investment portfolios, making decisions on asset allocation and risk management. This entry-level position requires strong analytical and problem-solving skills, as well as the ability to communicate complex financial information in a clear and concise manner. According to Indeed, the average salary for a portfolio manager is $115,000 per year.

Skills and Qualifications

To become a portfolio manager, one typically needs a bachelor’s degree in finance, economics, or a related field. Strong knowledge of investment principles, asset allocation, and risk management is also essential. Professional certifications such as the Chartered Financial Analyst (CFA) designation are highly valued.

| Finance Entry Job | Median Annual Salary |

|---|---|

| Financial Analyst | $85,660 |

| Investment Banking Analyst | $100,000 |

| Financial Planner | $94,170 |

| Accountant | $74,170 |

| Portfolio Manager | $115,000 |

What skills are required for a career in finance?

+Strong analytical and problem-solving skills, as well as the ability to communicate complex financial information in a clear and concise manner, are essential for a career in finance.

What is the average salary for a finance entry job?

+The average salary for a finance entry job varies depending on the position and industry, but can range from $60,000 to over $100,000 per year.

What certifications are valued in the finance industry?

+Professional certifications such as the Certified Financial Planner (CFP), Certified Public Accountant (CPA), and Chartered Financial Analyst (CFA) designations are highly valued in the finance industry.

Meta Description: Discover the top 5 finance entry jobs, including financial analyst, investment banking analyst, financial planner, accountant, and portfolio manager, and learn about the skills and qualifications required for each role.