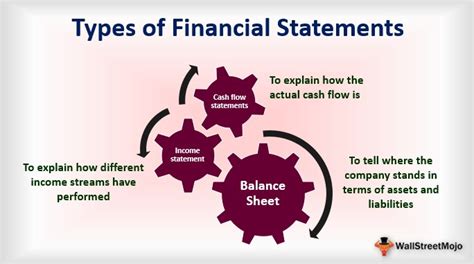

Financial reports are a crucial component of any business, providing stakeholders with a comprehensive overview of a company's financial health and performance. Accurate and transparent financial reporting is essential for making informed decisions, identifying areas for improvement, and ensuring compliance with regulatory requirements. In this article, we will explore five key tips for creating effective financial reports, highlighting the importance of clarity, accuracy, and relevance in financial reporting.

Key Points

- Clearly define the report's purpose and audience to ensure targeted and relevant content

- Utilize a standardized reporting framework to promote consistency and comparability

- Ensure accuracy and reliability through rigorous data verification and validation processes

- Present complex financial data in a clear and concise manner using visual aids and summaries

- Provide actionable insights and recommendations to support informed decision-making

Tip 1: Define the Report’s Purpose and Audience

Before creating a financial report, it is essential to clearly define its purpose and intended audience. This will help determine the type of information to include, the level of detail required, and the format of the report. For example, a report for external stakeholders, such as investors or creditors, may focus on high-level financial performance metrics, while a report for internal management may delve deeper into operational metrics and key performance indicators (KPIs). By understanding the report’s purpose and audience, you can create a targeted and relevant report that meets the needs of its users.

Identifying Key Stakeholders

Identifying key stakeholders is critical in determining the report’s purpose and audience. This may include investors, creditors, management, employees, customers, and regulatory bodies. Each stakeholder group may have different information needs, and the report should be tailored to address these needs. For instance, investors may be interested in financial performance metrics, such as revenue growth and return on investment (ROI), while employees may be more interested in operational metrics, such as productivity and employee engagement.

| Stakeholder Group | Information Needs |

|---|---|

| Investors | Financial performance metrics, such as revenue growth and ROI |

| Creditors | Cash flow and liquidity metrics, such as debt-to-equity ratio and interest coverage ratio |

| Management | Operational metrics, such as productivity and employee engagement |

Tip 2: Utilize a Standardized Reporting Framework

A standardized reporting framework is essential for promoting consistency and comparability in financial reporting. This can be achieved by using established reporting standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). A standardized framework ensures that financial reports are presented in a consistent and transparent manner, making it easier for stakeholders to compare and analyze financial performance over time.

Benefits of Standardization

Standardization offers several benefits, including improved comparability, increased transparency, and enhanced credibility. By using a standardized reporting framework, companies can ensure that their financial reports are presented in a consistent and reliable manner, which can help to build trust with stakeholders. Additionally, standardization can facilitate the comparison of financial performance across different companies and industries, enabling stakeholders to make more informed decisions.

Tip 3: Ensure Accuracy and Reliability

Accuracy and reliability are critical components of financial reporting. Financial reports must be free from material errors and biases, and must accurately reflect the company’s financial position and performance. This can be achieved by implementing rigorous data verification and validation processes, such as internal controls and audits. By ensuring the accuracy and reliability of financial reports, companies can build trust with stakeholders and provide a foundation for informed decision-making.

Data Verification and Validation

Data verification and validation are essential steps in ensuring the accuracy and reliability of financial reports. This involves reviewing and testing financial data to ensure that it is complete, accurate, and consistent with established accounting standards. By implementing robust data verification and validation processes, companies can minimize the risk of errors and biases, and provide stakeholders with confidence in the accuracy and reliability of financial reports.

Tip 4: Present Complex Data in a Clear and Concise Manner

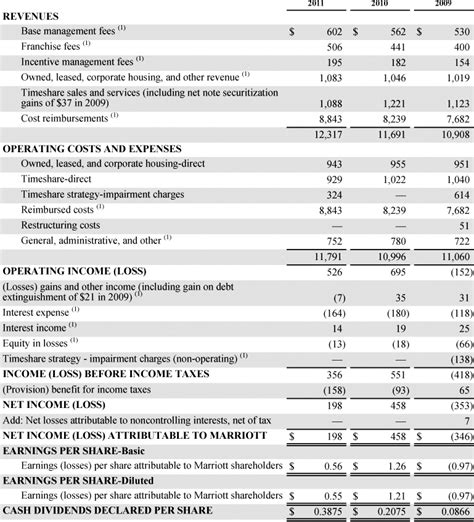

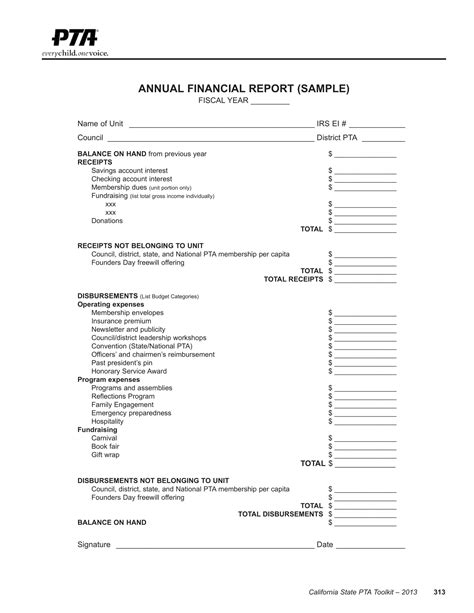

Financial reports often contain complex and technical information, which can be challenging for non-financial stakeholders to understand. To address this challenge, it is essential to present complex financial data in a clear and concise manner, using visual aids and summaries to facilitate understanding. This can include using charts, graphs, and tables to illustrate key financial metrics, as well as providing narrative summaries and analysis to provide context and insights.

Visual Aids and Summaries

Visual aids and summaries are essential tools for presenting complex financial data in a clear and concise manner. By using charts, graphs, and tables, companies can illustrate key financial metrics and trends, making it easier for stakeholders to understand and analyze financial performance. Additionally, narrative summaries and analysis can provide context and insights, helping stakeholders to understand the underlying drivers of financial performance and make informed decisions.

| Visual Aid | Purpose |

|---|---|

| Charts | To illustrate trends and patterns in financial data |

| Graphs | To compare and contrast different financial metrics |

| Tables | To present detailed financial data in a clear and organized manner |

Tip 5: Provide Actionable Insights and Recommendations

Financial reports should provide stakeholders with actionable insights and recommendations, rather than simply presenting historical financial data. This can be achieved by including analysis and commentary on financial performance, as well as recommendations for future actions and improvements. By providing actionable insights and recommendations, companies can help stakeholders to make informed decisions and drive business growth and improvement.

Analysis and Commentary

Analysis and commentary are essential components of financial reporting, providing stakeholders with insights and perspectives on financial performance. This can include discussing key financial metrics, such as revenue growth and profitability, as well as analyzing trends and patterns in financial data. By providing analysis and commentary, companies can help stakeholders to understand the underlying drivers of financial performance and make informed decisions.

What is the purpose of a financial report?

+The purpose of a financial report is to provide stakeholders with a comprehensive overview of a company's financial health and performance, enabling them to make informed decisions and drive business growth and improvement.

How can I ensure the accuracy and reliability of financial reports?

+To ensure the accuracy and reliability of financial reports, it is essential to implement rigorous data verification and validation processes, such as internal controls and audits. Additionally, companies should use a standardized reporting framework and provide clear and concise presentation of complex financial data.

What are the benefits of using a standardized reporting framework?

+The benefits of using a standardized reporting framework include improved comparability, increased transparency, and enhanced credibility. By using a standardized framework, companies can ensure that their financial reports are presented in a consistent and reliable manner, making it easier for stakeholders to compare and analyze financial performance over time.

In conclusion, creating effective financial reports requires a combination of technical accuracy, clarity, and relevance. By following the five tips outlined in this article, companies can ensure that their financial reports provide stakeholders with a comprehensive overview of financial health and performance, enabling them to make informed decisions and drive business growth and improvement. Whether you are a financial professional or a non-financial stakeholder, understanding the principles of effective financial reporting is essential for navigating the complex world of business and finance.