A Comprehensive Guide to the Florida Department of Insurance: Navigating the State’s Insurance Landscape

The Florida Department of Insurance is a vital regulatory body that plays a crucial role in safeguarding the interests of both consumers and insurance companies within the state. With its comprehensive oversight and regulatory framework, this department ensures the stability and integrity of the insurance industry, fostering a fair and transparent environment for all stakeholders. This article aims to provide an in-depth exploration of the Florida Department of Insurance, shedding light on its functions, services, and the significant impact it has on the state's insurance landscape.

Understanding the Role and Responsibilities of the Florida Department of Insurance

The Florida Department of Insurance, also known as the Florida Office of Insurance Regulation (OIR), is an independent regulatory agency tasked with overseeing and regulating the insurance industry within the state. Established to protect the rights and interests of policyholders and ensure the solvency and stability of insurance companies, the department operates under the guidance of the Florida Insurance Code and relevant federal regulations.

The department's primary mission is to promote a competitive and solvent insurance market, foster consumer protection, and provide effective regulatory oversight. By doing so, it aims to maintain a balanced and fair environment where insurance companies can thrive, and consumers can access the coverage they need with confidence.

One of the key responsibilities of the Florida Department of Insurance is to approve and monitor insurance rates and forms. This involves reviewing and evaluating insurance products to ensure they meet the state's standards and provide adequate coverage. The department also investigates consumer complaints, mediates disputes, and takes necessary actions to address any unfair or deceptive practices within the industry.

Furthermore, the department plays a vital role in consumer education, offering resources and guidance to help Floridians understand their insurance options and rights. By providing accessible information and tools, the department empowers consumers to make informed decisions and navigate the complex world of insurance with ease.

Key Functions and Services of the Florida Department of Insurance

The Florida Department of Insurance offers a wide range of functions and services that contribute to the efficient regulation and operation of the insurance industry. Here are some of the key areas in which the department excels:

Insurance Rate and Form Approval

One of the primary responsibilities of the Florida Department of Insurance is to review and approve insurance rates and forms. This process involves a meticulous examination of proposed rates and insurance policy language to ensure compliance with state laws and regulations. By scrutinizing these elements, the department safeguards consumers from unfair pricing and ensures that insurance products meet the necessary standards.

To facilitate this process, the department maintains an online system where insurance companies can submit their rate and form filings. This system provides a transparent and efficient platform for the review and approval process, allowing for a streamlined experience for both insurers and consumers.

Consumer Complaint Handling and Dispute Resolution

The Florida Department of Insurance is committed to protecting consumers and ensuring their rights are upheld. When consumers have complaints or disputes with insurance companies, the department steps in to mediate and resolve these issues. Through a dedicated consumer complaint process, the department investigates allegations of unfair practices, fraudulent activities, or violations of insurance laws.

The department's team of experienced professionals thoroughly reviews each complaint, gathers relevant information, and works towards a fair resolution. This process helps maintain the integrity of the insurance industry and ensures that consumers receive the coverage and services they are entitled to.

Market Conduct Examinations

To maintain the stability and integrity of the insurance market, the Florida Department of Insurance conducts regular market conduct examinations. These examinations involve a comprehensive review of insurance companies’ practices, including their compliance with state laws, financial solvency, and overall business operations.

By conducting these examinations, the department identifies potential risks, detects non-compliance issues, and ensures that insurance companies operate within the boundaries of the law. This proactive approach helps mitigate potential threats to consumers and the insurance market as a whole, fostering a healthy and sustainable industry environment.

Consumer Education and Outreach

Empowering consumers with knowledge is a crucial aspect of the Florida Department of Insurance’s mission. The department actively engages in consumer education initiatives, providing resources and tools to help Floridians understand their insurance options and rights. Through its website, the department offers a wealth of information, including articles, guides, and interactive tools, making it easier for consumers to navigate the insurance landscape.

Additionally, the department hosts educational events, workshops, and webinars, bringing experts and consumers together to discuss relevant insurance topics. These initiatives aim to bridge the gap between consumers and the insurance industry, fostering a deeper understanding of insurance concepts and empowering individuals to make informed decisions.

Licensing and Compliance

The Florida Department of Insurance is responsible for licensing insurance professionals and ensuring their compliance with state regulations. This includes the licensing of insurance agents, brokers, adjusters, and other insurance-related professionals. By maintaining a rigorous licensing process, the department ensures that only qualified individuals are authorized to conduct insurance business within the state.

The department's licensing division also plays a crucial role in monitoring the ongoing compliance of insurance professionals. This includes regular audits, inspections, and reviews to ensure that licensees adhere to the required standards and regulations. By upholding these standards, the department protects consumers and maintains the integrity of the insurance profession.

Performance Analysis: The Impact of the Florida Department of Insurance

The Florida Department of Insurance’s efforts have significantly contributed to the stability and growth of the state’s insurance market. Through its rigorous regulatory framework and consumer protection initiatives, the department has fostered an environment where insurance companies thrive, and consumers can access affordable and reliable coverage.

One of the key indicators of the department's success is the state's low rate of insurance fraud and deceptive practices. The department's proactive approach to investigating and resolving consumer complaints, along with its stringent market conduct examinations, has helped maintain a fair and honest insurance market. As a result, Floridians can trust that their insurance policies provide the coverage they need without the fear of being taken advantage of.

Furthermore, the department's consumer education initiatives have empowered Floridians to make informed decisions about their insurance coverage. By providing accessible resources and tools, the department has helped consumers understand their rights and obligations, leading to increased satisfaction and trust in the insurance industry.

The Florida Department of Insurance's impact extends beyond consumer protection. By ensuring a competitive and solvent insurance market, the department has attracted insurance companies and facilitated economic growth within the state. This has resulted in increased investment, job creation, and a thriving insurance ecosystem, benefiting both businesses and individuals alike.

Future Implications and Ongoing Challenges

While the Florida Department of Insurance has made significant strides in regulating the insurance industry, ongoing challenges and emerging trends continue to shape its future direction. Here are some key considerations for the department’s ongoing efforts:

Technology and Digital Transformation

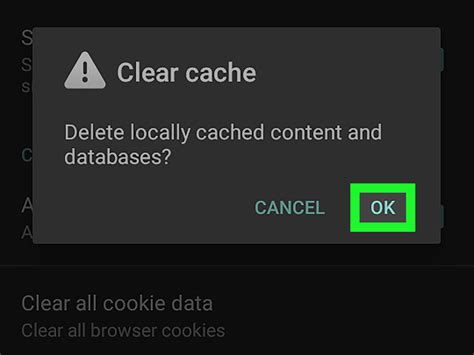

The rapid advancement of technology is transforming the insurance industry, and the Florida Department of Insurance must adapt to these changes. Embracing digital innovation and leveraging technology can enhance the department’s regulatory capabilities, streamline processes, and improve overall efficiency. By integrating digital tools and platforms, the department can better serve both insurers and consumers, offering a more seamless and accessible experience.

Emerging Risks and Regulatory Challenges

The insurance landscape is constantly evolving, and new risks and challenges emerge regularly. The Florida Department of Insurance must stay vigilant and proactive in addressing these emerging issues. This includes keeping abreast of new insurance products, monitoring market trends, and adapting regulations to ensure consumer protection and market stability. By staying ahead of the curve, the department can effectively regulate the industry and mitigate potential risks.

Consumer Education and Awareness

While the department’s consumer education initiatives have made significant progress, there is always room for improvement. Continuing to invest in consumer education and outreach efforts can further empower Floridians to make informed insurance choices. By providing ongoing resources, hosting educational events, and utilizing innovative communication channels, the department can ensure that consumers have the knowledge and tools they need to navigate the insurance market confidently.

Collaborative Partnerships

Building collaborative partnerships with industry stakeholders, consumer groups, and other regulatory bodies can strengthen the Florida Department of Insurance’s regulatory framework. By fostering open communication and sharing best practices, the department can enhance its oversight capabilities and address complex issues more effectively. Collaborative efforts can also lead to innovative solutions and a more cohesive approach to regulating the insurance industry.

How can I contact the Florida Department of Insurance for assistance or to file a complaint?

+You can reach out to the Florida Department of Insurance through their official website or by calling their Consumer Helpline. The website provides detailed contact information, including phone numbers and email addresses, for various departments and divisions. Additionally, you can file a complaint online through their dedicated complaint portal, ensuring a swift and efficient resolution process.

What steps should I take if I suspect insurance fraud or deceptive practices?

+If you suspect insurance fraud or deceptive practices, it is crucial to report your concerns to the Florida Department of Insurance promptly. You can file a complaint through their website or contact their Consumer Helpline to discuss the matter with a representative. Providing detailed information and evidence will assist the department in conducting a thorough investigation.

How can I stay informed about insurance regulations and updates in Florida?

+The Florida Department of Insurance maintains an up-to-date website with the latest insurance regulations, news, and updates. Subscribing to their email notifications or following their social media channels can ensure you receive timely information about any changes or developments in the insurance landscape. Additionally, attending their educational events and webinars can provide valuable insights and keep you informed.