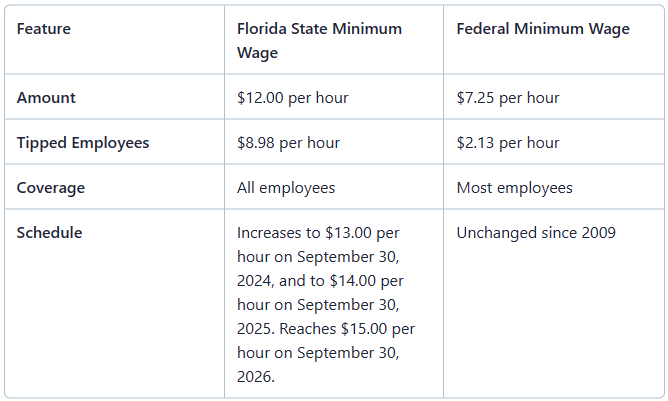

The state of Florida has undergone significant changes in its minimum wage laws in recent years, with a notable increase scheduled for 2024. As of January 1, 2024, the Florida minimum wage is set to rise to $12.00 per hour, marking a substantial increase from the $10.00 per hour rate that was effective from September 30, 2022. This change is part of a gradual increase aimed at reaching a $15.00 per hour minimum wage by September 30, 2026, as mandated by the Florida Constitution.

This increase is a result of Amendment 2, which was approved by Florida voters in the 2020 general election. The amendment stipulates that the state's minimum wage will increase by $1.00 per hour each year until it reaches $15.00 per hour. The incremental increases are designed to help mitigate the impact on businesses, particularly small businesses and those in the service industry, which may face challenges in absorbing the higher labor costs.

Key Points

- The Florida minimum wage will increase to $12.00 per hour as of January 1, 2024.

- This increase is part of a scheduled rise to $15.00 per hour by September 30, 2026, as per Amendment 2.

- The incremental increases are intended to ease the transition for businesses and employees.

- The minimum wage for tipped employees will also see an increase, though it will remain lower than the standard minimum wage.

- Employers must ensure compliance with the new minimum wage rates to avoid potential penalties and legal issues.

Understanding the Minimum Wage Increase

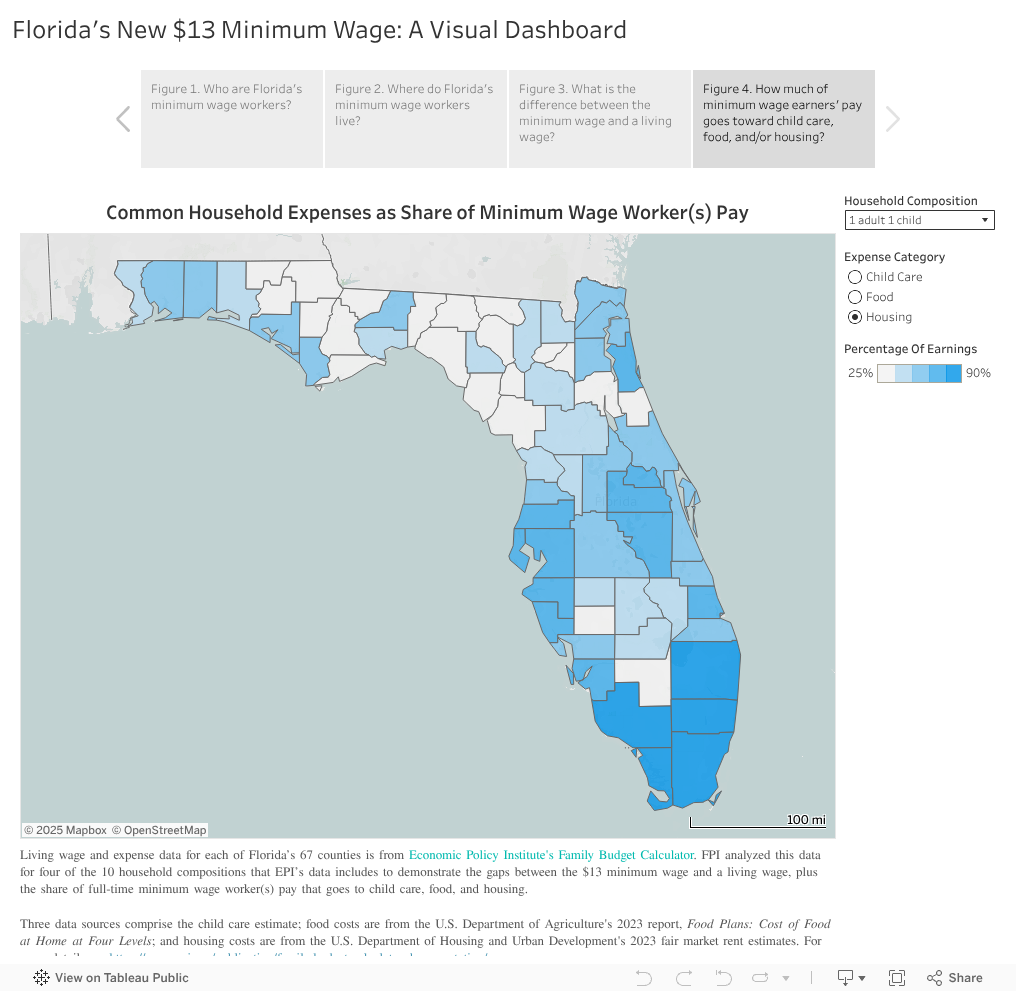

The scheduled increase in the minimum wage is expected to have a significant impact on both employees and employers in Florida. For employees, the higher minimum wage represents an increase in earning potential, which can improve their standard of living and purchasing power. However, for employers, especially small businesses and those in industries with tight profit margins, the increase in labor costs may pose challenges, potentially leading to increased prices for consumers or adjustments in hiring practices.

Impact on Tipped Employees

Tipped employees, such as those in the food and beverage service industry, will also see an increase in their minimum wage, although it will remain lower than the standard minimum wage. As of January 1, 2024, the minimum wage for tipped employees in Florida is set to increase, with the understanding that tips will supplement the lower base wage to reach the standard minimum wage. This provision aims to balance the needs of employers with the requirement to ensure that all employees earn a fair wage for their work.

| Year | Standard Minimum Wage | Tipped Employee Minimum Wage |

|---|---|---|

| 2024 | $12.00 | $6.98 (assuming a $5.02 tip credit) |

| 2025 | $13.00 | $7.98 (assuming a $5.02 tip credit) |

| 2026 | $15.00 | $9.98 (assuming a $5.02 tip credit) |

Preparing for the Change

Given the scheduled increases, employers in Florida should start preparing for the changes by reviewing their budget, assessing the potential impact on their operations, and considering strategies to absorb the increased labor costs. This might involve planning for potential price adjustments, exploring efficiency improvements, or reevaluating staffing levels and employee roles.

Moreover, employers must ensure that they are in compliance with all aspects of the minimum wage law, including record-keeping requirements and the prohibition against retaliating against employees who assert their rights under the law. Failure to comply can result in significant penalties, including back pay, damages, and legal fees.

Strategic Planning for Businesses

Businesses can take several strategic steps to prepare for the minimum wage increase. Firstly, conducting a thorough review of their current payroll and operational costs can help identify areas where efficiencies can be improved. Secondly, exploring options for price adjustments or new revenue streams can help offset the increased labor costs. Finally, investing in employee training and development can enhance productivity and help retain skilled workers in a competitive labor market.

In conclusion, the increase in Florida's minimum wage to $12.00 per hour as of January 1, 2024, marks a significant step towards achieving a $15.00 per hour minimum wage by 2026. While this change presents challenges for businesses, it also offers an opportunity for employers to reassess their operational strategies and invest in their workforce. By understanding the implications of the minimum wage increase and planning accordingly, businesses can navigate this change effectively and contribute to the overall economic well-being of their employees and the state of Florida.

What is the new minimum wage in Florida as of January 1, 2024?

+The new minimum wage in Florida as of January 1, 2024, is $12.00 per hour.

How will the minimum wage increase affect tipped employees?

+Tipped employees will see an increase in their minimum wage, but it will remain lower than the standard minimum wage, with the understanding that tips will supplement their earnings to reach the standard minimum wage.

What steps can businesses take to prepare for the minimum wage increase?

+Businesses can prepare by reviewing their budget, assessing the potential impact, considering strategies to absorb increased labor costs, and ensuring compliance with all aspects of the minimum wage law.