When it comes to managing finances, understanding the intricacies of payroll is essential, especially for employers and employees in Florida. The Florida paycheck calculator tool is a vital resource designed to help individuals and businesses navigate the complexities of calculating net pay, taxes, and other deductions. This tool takes into account the specific tax laws and regulations applicable in Florida, ensuring that calculations are accurate and compliant with state requirements.

The importance of a paycheck calculator cannot be overstated, as it provides a clear and concise way to determine the actual take-home pay of an employee after all necessary deductions have been made. This includes federal, state, and local taxes, as well as other deductions such as health insurance premiums, retirement contributions, and garnishments. For Florida residents, the calculator must also account for the state's unique tax environment, which includes no state income tax but may involve other local taxes and fees.

Key Points

- The Florida paycheck calculator is designed to simplify the process of calculating net pay and taxes for employees in Florida.

- It takes into account federal, state, and local taxes, as well as other deductions such as health insurance and retirement contributions.

- The calculator is particularly useful for employers looking to ensure compliance with tax laws and for employees wanting to understand their take-home pay.

- Florida's tax environment, including the absence of state income tax, is a critical factor in the calculations provided by the tool.

- Accuracy and compliance with tax regulations are paramount, making the Florida paycheck calculator an indispensable resource for financial planning and management.

Understanding the Florida Paycheck Calculator Tool

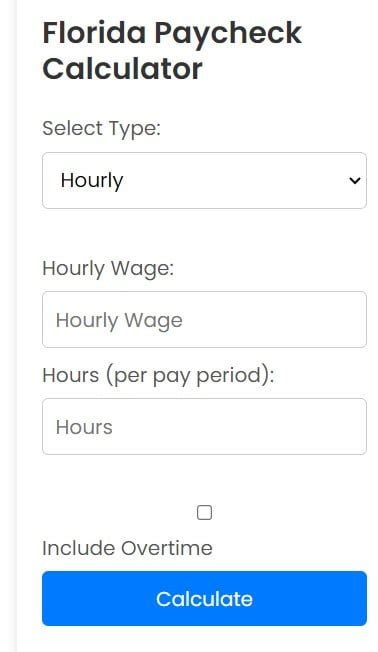

The Florida paycheck calculator tool is designed with user simplicity in mind, allowing for easy input of relevant data such as gross pay, pay frequency, and specific deductions. By utilizing this tool, employers can ensure that they are accurately calculating employee paychecks, which is crucial for maintaining legal compliance and employee satisfaction. Employees, on the other hand, can use the calculator to anticipate their net pay, helping them with personal financial planning and budgeting.

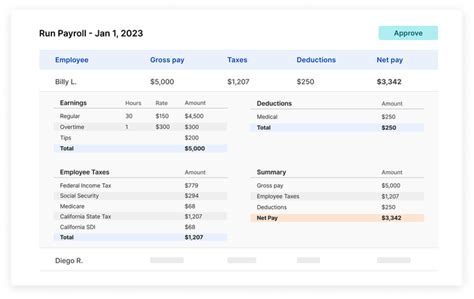

Components of the Florida Paycheck Calculator

A comprehensive Florida paycheck calculator will typically include several key components. These may encompass gross pay calculations, federal income tax withholding based on the latest tax tables, deductions for social security and Medicare taxes, and any applicable state or local taxes. Given Florida’s lack of state income tax, the calculator will focus more on federal and any local taxes that may apply. Additionally, it will account for other common deductions such as health insurance premiums, 401(k) contributions, and any voluntary deductions like life insurance or flexible spending accounts.

| Pay Component | Description |

|---|---|

| Gross Pay | The total amount of money earned by an employee before any deductions. |

| Federal Income Tax | Withholding based on current tax tables and the employee's filing status and number of allowances. |

| Social Security Tax | A fixed percentage of gross earnings dedicated to social security, up to a certain income threshold. |

| Medicare Tax | A percentage of gross earnings that goes towards funding Medicare, with no income threshold. |

| State and Local Taxes | Any applicable taxes in Florida, which may include local taxes but does not include state income tax. |

| Other Deductions | Voluntary deductions such as health insurance, retirement plan contributions, and life insurance premiums. |

Utilizing the Florida Paycheck Calculator for Financial Planning

Beyond its role in calculating paychecks, the Florida paycheck calculator tool can be a powerful resource for financial planning. By inputting different scenarios, such as changes in pay rate, deductions, or filing status, individuals can anticipate how these changes will affect their net pay. This can be invaluable in making informed decisions about budgeting, saving, and long-term financial goals. Moreover, for employers, being able to accurately predict payroll costs can help in planning business expenses, hiring, and expansion strategies.

Benefits for Employers and Employees

The benefits of using a Florida paycheck calculator are multifaceted. For employers, it ensures compliance with tax laws and regulations, reducing the risk of penalties or legal issues. It also simplifies the payroll process, saving time and resources. Employees benefit from a clear understanding of their take-home pay, which can reduce uncertainty and stress related to financial planning. Additionally, by being able to anticipate net pay accurately, employees can make better financial decisions, such as planning for savings, debt repayment, or major purchases.

In conclusion, the Florida paycheck calculator tool is an indispensable resource for both employers and employees in the state. Its ability to accurately calculate net pay, taking into account the unique aspects of Florida's tax environment, makes it a vital tool for financial management and planning. Whether used for ensuring compliance, simplifying payroll, or personal financial planning, the Florida paycheck calculator demonstrates its value through its accuracy, ease of use, and comprehensive approach to payroll calculation.

What is the primary purpose of a Florida paycheck calculator?

+The primary purpose of a Florida paycheck calculator is to calculate an employee’s net pay after all deductions, including taxes, benefits, and other voluntary deductions, have been subtracted from their gross pay.

Does Florida have state income tax that the paycheck calculator needs to account for?

+No, Florida does not have a state income tax. However, the paycheck calculator will still account for federal income taxes, social security taxes, Medicare taxes, and any applicable local taxes or deductions.

How can employers benefit from using a Florida paycheck calculator?

+Employers can benefit from using a Florida paycheck calculator by ensuring compliance with tax laws, simplifying the payroll process, and accurately predicting payroll costs for better business planning.

Can the Florida paycheck calculator be used for personal financial planning?

+Yes, the Florida paycheck calculator can be a valuable tool for personal financial planning. By accurately anticipating net pay, individuals can make informed decisions about budgeting, saving, and achieving long-term financial goals.

What types of deductions can the Florida paycheck calculator account for?

+The Florida paycheck calculator can account for a variety of deductions, including federal and local taxes, social security and Medicare taxes, health insurance premiums, retirement plan contributions, and other voluntary deductions such as life insurance or flexible spending accounts.