Florida, known for its beautiful beaches, vibrant cities, and thriving economy, is a state that attracts businesses and individuals alike. One crucial aspect of doing business in Florida is understanding its sales tax laws. With a state sales tax rate of 6% and the possibility of additional local taxes, navigating the complexities of sales tax can be challenging. However, with the right guidance, businesses can ensure compliance, avoid penalties, and even find opportunities to save. Here are five Florida sales tax tips to help you navigate the system effectively.

Key Points

- Understanding the state and local sales tax rates to ensure accurate tax collection and remittance.

- Identifying which products and services are subject to sales tax to avoid compliance issues.

- Knowing how to obtain a sales tax permit and the importance of timely renewal.

- Learning about exemptions and how they can apply to your business operations.

- Staying informed about changes in sales tax laws and regulations to maintain compliance.

Understanding Sales Tax Rates in Florida

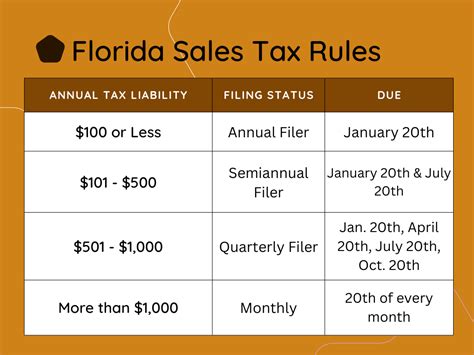

Florida’s base state sales tax rate is 6%. However, this rate can be higher in certain locations due to discretionary sales surtaxes, also known as local option sales taxes, imposed by counties. These surtaxes can range from 0.5% to 1.5%, depending on the county. For instance, in Miami-Dade County, the total sales tax rate is 7% (6% state rate + 1% local surtax), while in Orange County, it’s 6.5% (6% state rate + 0.5% local surtax). Understanding these rates is crucial for businesses to correctly charge and remit sales tax.

sales Tax Permit Requirements

To collect and remit sales tax, businesses in Florida must obtain a sales tax permit from the Florida Department of Revenue. This permit is required for any business selling tangible personal property or certain services. The application process involves providing detailed business information, including the business name, address, and type of products or services sold. It’s also important to note that sales tax permits must be renewed periodically to avoid penalties and ensure ongoing compliance.

| County | State Sales Tax Rate | Local Surtax | Total Sales Tax Rate |

|---|---|---|---|

| Miami-Dade | 6% | 1% | 7% |

| Orange | 6% | 0.5% | 6.5% |

| Hillsborough | 6% | 1% | 7% |

Navigating Sales Tax Exemptions

Certain products and services in Florida are exempt from sales tax, which can provide significant savings for businesses and consumers. For example, groceries, medical supplies, and certain agricultural products are typically exempt. Additionally, Florida offers sales tax holidays for specific items like school supplies and hurricane preparedness equipment during designated periods. Understanding these exemptions can help businesses reduce their tax liability and pass the savings on to their customers.

Importance of Compliance and Record Keeping

Maintaining accurate records of sales, exemptions, and tax remittances is crucial for businesses in Florida. The Florida Department of Revenue conducts audits to ensure compliance with sales tax laws. Businesses found non-compliant may face penalties, including fines and interest on unremitted taxes. Therefore, investing in a robust accounting system and possibly consulting with a tax professional can help ensure that all sales tax obligations are met accurately and on time.

What is the current state sales tax rate in Florida?

+The current state sales tax rate in Florida is 6%. However, this rate can be higher in certain locations due to local sales surtaxes.

How do I obtain a sales tax permit in Florida?

+You can obtain a sales tax permit by applying through the Florida Department of Revenue. The application process involves providing detailed business information and can be completed online or by mail.

Are there any sales tax exemptions in Florida that my business can benefit from?

+Yes, Florida offers several sales tax exemptions on certain products and services, including groceries, medical supplies, and specific agricultural products. Understanding these exemptions can help reduce your business's tax liability.

In conclusion, navigating Florida’s sales tax landscape requires a deep understanding of the state’s sales tax laws, including rates, permits, exemptions, and compliance requirements. By staying informed and seeking professional advice when necessary, businesses can not only avoid penalties but also find opportunities to save and thrive in the Sunshine State. Whether you’re a seasoned entrepreneur or just starting out, grasping these fundamentals is key to success in Florida’s vibrant business environment.