Annuities are a type of financial instrument that provides a steady income stream for a set period of time or for life. The annuity formula is a mathematical concept used to calculate the present value of an annuity, which is the current value of a series of future cash flows. In this article, we will explore five ways to use the annuity formula to make informed financial decisions.

Key Points

- The annuity formula can be used to calculate the present value of an annuity, which is essential for making informed investment decisions.

- There are different types of annuities, including fixed annuities, variable annuities, and indexed annuities, each with its own unique characteristics and benefits.

- The annuity formula takes into account factors such as the interest rate, payment amount, and payment frequency to determine the present value of an annuity.

- Using the annuity formula can help individuals and businesses make informed decisions about investments, retirement planning, and risk management.

- It's essential to understand the assumptions and limitations of the annuity formula to ensure accurate calculations and informed decision-making.

Understanding the Annuity Formula

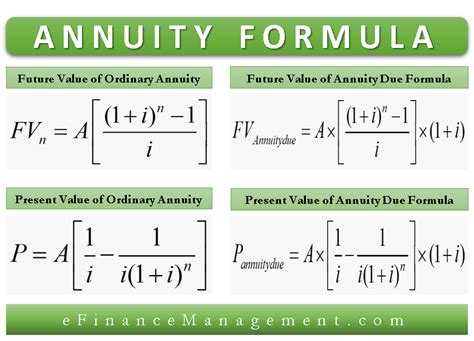

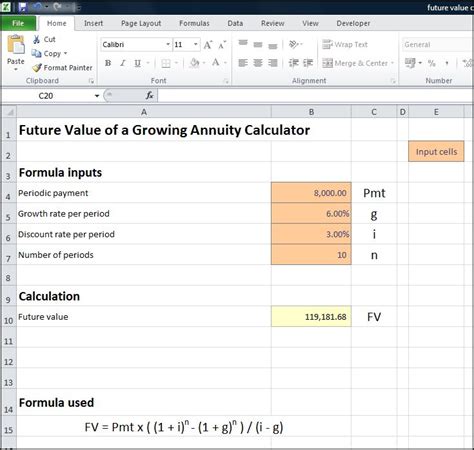

The annuity formula is a mathematical concept that calculates the present value of an annuity based on the interest rate, payment amount, and payment frequency. The formula is as follows:

PV = PMT x [(1 - (1 + r)^(-n)) / r]

Where:

- PV = present value of the annuity

- PMT = payment amount

- r = interest rate

- n = number of payments

Calculating the Present Value of an Annuity

To calculate the present value of an annuity, we need to plug in the values of the payment amount, interest rate, and number of payments into the annuity formula. For example, let's say we want to calculate the present value of an annuity that pays $1,000 per year for 10 years, with an interest rate of 5%.

| Variable | Value |

|---|---|

| PMT | $1,000 |

| r | 5% |

| n | 10 |

Using the annuity formula, we can calculate the present value of the annuity as follows:

PV = $1,000 x [(1 - (1 + 0.05)^(-10)) / 0.05] = $7,721.73

Types of Annuities

There are different types of annuities, each with its own unique characteristics and benefits. The most common types of annuities include:

- Fixed annuities: provide a fixed payment amount for a set period of time or for life

- Variable annuities: provide a payment amount that varies based on the performance of an underlying investment portfolio

- Indexed annuities: provide a payment amount that varies based on the performance of a specific stock market index, such as the S&P 500

Fixed Annuities

Fixed annuities provide a fixed payment amount for a set period of time or for life. They are often used as a retirement income strategy, as they provide a predictable income stream. For example, let’s say we want to calculate the present value of a fixed annuity that pays $5,000 per year for 20 years, with an interest rate of 4%.

| Variable | Value |

|---|---|

| PMT | $5,000 |

| r | 4% |

| n | 20 |

Using the annuity formula, we can calculate the present value of the annuity as follows:

PV = $5,000 x [(1 - (1 + 0.04)^(-20)) / 0.04] = $64,919.19

What is the main benefit of using the annuity formula?

+The main benefit of using the annuity formula is that it allows individuals and businesses to calculate the present value of an annuity, which is essential for making informed investment decisions and retirement planning.

What are the different types of annuities?

+There are several types of annuities, including fixed annuities, variable annuities, and indexed annuities. Each type of annuity has its own unique characteristics and benefits, and the choice of which one to use depends on individual circumstances and goals.

How does the annuity formula take into account the interest rate?

+The annuity formula takes into account the interest rate by using it to calculate the present value of the annuity. The interest rate is used to discount the future cash flows, which allows individuals and businesses to determine the current value of the annuity.

In conclusion, the annuity formula is a powerful tool for calculating the present value of an annuity, which is essential for making informed financial decisions. By understanding the different types of annuities and how to use the annuity formula, individuals and businesses can make informed decisions about investments, retirement planning, and risk management. It’s essential to consider the assumptions and limitations of the formula and to seek professional advice when necessary.