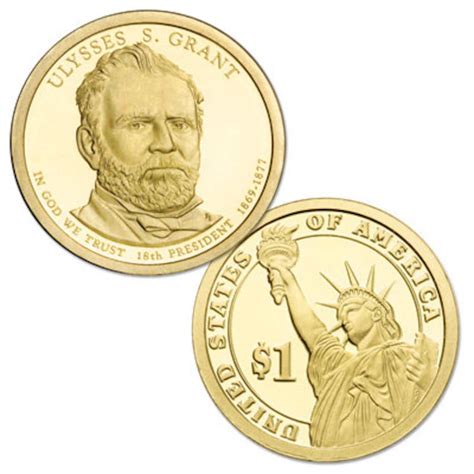

The gold dollar coin, a denomination that was once a staple in American currency, has become a highly sought-after collectible among numismatists and investors alike. With a rich history spanning from 1849 to 1889, these coins offer a unique blend of historical significance, aesthetic appeal, and potential for financial appreciation. For those looking to navigate the complex world of gold dollar coins, understanding their value is crucial. This comprehensive guide aims to provide a detailed overview of the gold dollar coin, including its history, design variations, grading, and most importantly, its value.

Introduction to Gold Dollar Coins

The gold dollar coin was first introduced in 1849, as part of the U.S. government’s effort to mint coins from the gold discovered during the California Gold Rush. The coin’s existence was relatively short-lived, with the last gold dollar coins being minted in 1889. During its 40-year production run, the gold dollar underwent several design changes, creating a variety of types that collectors and investors find particularly appealing.

Design Variations of the Gold Dollar Coin

There are three main design types of the gold dollar coin: the Type I (1849-1854), Type II (1854-1856), and Type III (1856-1889). Each type has distinct characteristics, from the size and thickness of the coin to the portrait of Lady Liberty on the obverse side. Understanding these design variations is essential for determining the value of a gold dollar coin, as certain types and dates are more rare and valuable than others.

| Type | Description | Years Minted |

|---|---|---|

| Type I | 13 mm diameter, Lady Liberty with a coronet | 1849-1854 |

| Type II | 15 mm diameter, Lady Liberty with an Indian headdress | 1854-1856 |

| Type III | 15 mm diameter, Lady Liberty with a laurel wreath | 1856-1889 |

Determining the Value of Gold Dollar Coins

The value of a gold dollar coin is determined by several factors, including its rarity, condition, and demand. Coins that are in better condition, with minimal wear and tear, are more valuable. Additionally, certain dates and mint marks can increase the value of a coin due to their rarity. For example, coins minted in Philadelphia (which bear no mint mark) are generally more common than those minted in other locations like Charlotte (C mint mark) or Dahlonega (D mint mark).

Grading Gold Dollar Coins

Grading is a critical aspect of determining the value of gold dollar coins. The condition of a coin is evaluated on a scale from Poor (the lowest grade) to Mint State 70 (the highest grade), with several grades in between. The process of grading involves examining the coin’s surface for signs of wear, checking for any damage or tampering, and assessing its overall appeal. Professional grading services, such as the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Corporation (NGC), provide an independent assessment of a coin’s condition, which can significantly impact its value.

Key Points

- The gold dollar coin was minted from 1849 to 1889, with three distinct design types.

- Rarity, condition, and demand are key factors in determining the value of a gold dollar coin.

- Professional grading can significantly impact the value of a coin.

- Certain dates and mint marks can increase the value of a coin due to their rarity.

- Understanding the history and design variations of gold dollar coins is essential for collectors and investors.

Investing in Gold Dollar Coins

For those considering investing in gold dollar coins, it’s essential to approach the market with a clear understanding of the coins’ values and the factors that influence them. Investing in rare and high-grade coins can provide a unique opportunity for financial appreciation, but it requires careful research and possibly the advice of a professional numismatist. The gold content of these coins, while a factor, is not the sole determinant of their value; historical significance, aesthetic appeal, and rarity play equally important roles.

Potential for Appreciation

The potential for financial appreciation is one of the reasons why gold dollar coins are attractive to investors. As with any collectible, the value of gold dollar coins can fluctuate based on market demand. However, given their historical significance and the limited number of coins minted, especially in high grades, there is potential for long-term appreciation in value. It’s also worth noting that the value of gold itself can impact the coin’s worth, although the bullion value is often overshadowed by the coin’s numismatic value.

What is the most valuable gold dollar coin?

+The 1849 Gold Dollar, especially in high grades, is among the most valuable due to its rarity and historical significance. However, values can vary based on condition, grading, and provenance.

How do I determine the authenticity of a gold dollar coin?

+Authenticity can be verified through professional grading services like PCGS and NGC, or by consulting with a reputable numismatist. Look for signs of wear, check the metal composition, and examine the coin's edges and surfaces for any signs of tampering.

Can I buy gold dollar coins as an investment?

+Yes, gold dollar coins can be a viable investment option, especially for those interested in rare coins or numismatic collectibles. However, it's crucial to do thorough research, consider consulting with a professional, and understand the risks and potential for appreciation.

In conclusion, the gold dollar coin offers a fascinating blend of history, artistry, and potential for financial growth, making it an attractive choice for both collectors and investors. By understanding the complexities of these coins, including their design variations, grading, and the factors that influence their value, individuals can make informed decisions about their numismatic pursuits. Whether you’re drawn to the historical significance, the aesthetic appeal, or the investment potential, the gold dollar coin is a captivating piece of American numismatic history that continues to intrigue and reward those who delve into its world.