Navigating the complex world of health insurance can be daunting, but with the right knowledge and approach, finding the perfect coverage for your needs becomes an achievable task. This comprehensive guide aims to demystify the process of shopping for health insurance, providing you with expert insights and practical steps to make informed choices.

Understanding Your Health Insurance Needs

Before embarking on your health insurance journey, it’s crucial to assess your specific requirements. Consider the following factors to tailor your search:

Health Status and History

Your current health status and past medical history significantly influence the type of coverage you should seek. If you have pre-existing conditions or require regular medical attention, comprehensive plans with broader coverage might be more suitable. On the other hand, individuals with generally good health may opt for catastrophic coverage or high-deductible health plans (HDHPs) to balance cost and coverage.

Prescription Medication Needs

If you rely on prescription medications, ensure that your insurance plan includes prescription drug coverage. Look for plans that cover a wide range of medications and offer competitive copayments or coinsurance rates to manage your medication costs effectively.

Network Preferences

Health insurance plans often operate within specific provider networks. These networks include doctors, hospitals, and other healthcare providers. When choosing a plan, consider whether you want the flexibility to choose any provider (out-of-network coverage) or prefer to stick to a particular network (in-network coverage). Remember that out-of-network coverage typically comes with higher costs.

Cost Considerations

Health insurance plans vary widely in terms of cost. Factors such as premium amounts, deductibles, coinsurance, and out-of-pocket maximums all impact the overall cost of your coverage. Assess your financial situation and determine the level of coverage you can afford without straining your budget.

Specialized Services and Treatments

If you anticipate needing specialized medical services, such as mental health counseling, maternity care, or specific types of therapy, ensure that your chosen plan covers these services adequately. Some plans may offer add-on coverage or riders to cater to such specialized needs.

Researching and Comparing Plans

With a clear understanding of your needs, it’s time to delve into the research phase. Here’s a systematic approach to comparing health insurance plans:

Utilize Online Tools and Resources

Numerous online platforms and government websites provide comprehensive information about health insurance plans. Explore resources like Healthcare.gov or state-specific insurance marketplaces to access detailed plan summaries and comparison tools.

Assess Plan Summaries

Plan summaries offer a concise overview of the coverage, costs, and benefits associated with each plan. Pay close attention to the summary of benefits and coverage (SBC) document, which provides a standardized breakdown of key plan features.

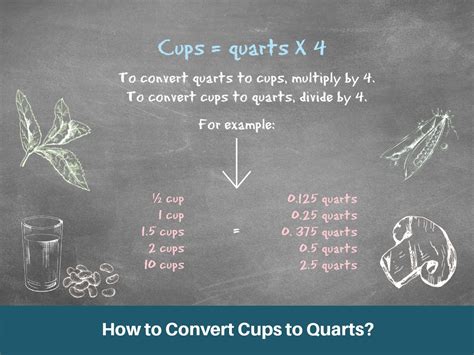

| Plan Feature | Description |

|---|---|

| Premium | The amount you pay monthly to maintain coverage. |

| Deductible | The amount you must pay out of pocket before your insurance coverage kicks in. |

| Copayment | A fixed amount you pay for a covered service, like a doctor's visit or prescription. |

| Coinsurance | The percentage of costs you share with the insurance company after meeting your deductible. |

| Out-of-Pocket Maximum | The maximum amount you'll pay out of pocket in a year for covered services. |

Evaluate Provider Networks

Review the provider directories for each plan to ensure that your preferred doctors and hospitals are included. Consider the convenience of accessing healthcare services within your chosen plan’s network.

Compare Prescription Drug Coverage

If you require prescription medications, carefully examine the plan’s formulary, which lists covered drugs and their associated costs. Look for plans that offer competitive pricing for your specific medication needs.

Analyze Coverage for Specialized Services

Ensure that the plans you’re considering provide adequate coverage for any specialized services you may require. Review the details of each plan’s benefits package to understand what’s included and what may require additional coverage.

Consider Cost-Sharing Reduction Subsidies

If you’re eligible for cost-sharing reduction subsidies, these can significantly lower your out-of-pocket costs. Check if the plans you’re interested in offer these subsidies and understand the potential savings.

Choosing the Right Plan

Once you’ve thoroughly researched and compared your options, it’s time to make an informed decision. Here are some key considerations for choosing the right health insurance plan:

Assess Your Priorities

Prioritize the features that matter most to you. Whether it’s comprehensive coverage, affordability, or flexibility with provider choices, align your plan selection with your top priorities.

Consider Your Financial Situation

Health insurance plans can vary significantly in cost. Assess your budget and choose a plan that balances your financial constraints with your coverage needs. Remember that choosing a plan with a higher premium might provide better coverage in the long run.

Evaluate Provider Networks Again

Before finalizing your choice, reconfirm that your preferred healthcare providers are still in-network with the plan you’ve selected. This step ensures that you won’t face unexpected out-of-network charges.

Review Enrollment Periods

Understand the enrollment periods for the plan you’re considering. Open enrollment periods typically occur annually, while special enrollment periods may be available if you experience a qualifying life event.

Consider Short-Term Plans

If you’re between jobs or have a temporary gap in coverage, short-term health insurance plans can provide a cost-effective solution. These plans offer more limited coverage but can bridge the gap until you find a more comprehensive plan.

Enrolling and Understanding Your Coverage

After selecting your preferred health insurance plan, the next step is enrollment. Here’s what you need to know:

Enrollment Process

The enrollment process typically involves completing an application, providing personal and health-related information, and making your initial premium payment. Ensure that you meet all the necessary deadlines to avoid delays in coverage.

Understanding Your Coverage

Once enrolled, take the time to thoroughly understand your coverage. Review the policy documents, summary of benefits, and any other materials provided by your insurance company. Familiarize yourself with your deductibles, copayments, and the process for filing claims.

Seek Clarification

If you have questions or concerns about your coverage, don’t hesitate to reach out to your insurance provider’s customer service team. They can provide clarification on specific plan details and guide you through any potential complexities.

Review and Update Regularly

Health insurance needs can change over time. Regularly review your coverage to ensure it still aligns with your needs. Update your policy or consider switching plans during open enrollment periods if your circumstances change significantly.

Conclusion: Empowering Your Health Insurance Journey

Shopping for health insurance is a critical decision that impacts your financial and physical well-being. By understanding your needs, researching thoroughly, and making informed choices, you can find the right coverage to protect your health and your wallet. Remember, health insurance is an investment in your future, and with the right approach, you can navigate the process with confidence.

What is the Affordable Care Act (ACA) and how does it impact my health insurance options?

+

The Affordable Care Act (ACA) is a federal law that aims to make health insurance more accessible and affordable. It introduces important protections and benefits, such as prohibiting insurance companies from denying coverage based on pre-existing conditions and requiring certain essential health benefits to be covered by plans. The ACA also establishes healthcare marketplaces where individuals can shop for and enroll in qualified health plans. Understanding the ACA’s provisions is crucial for making informed choices when selecting a health insurance plan.

How do I know if I qualify for Medicaid or CHIP (Children’s Health Insurance Program)?

+

Medicaid and CHIP are government-sponsored health insurance programs that provide coverage for eligible low-income individuals and families. Eligibility criteria vary by state, but generally, factors like income, household size, and certain special circumstances are considered. You can apply for Medicaid or CHIP through your state’s healthcare marketplace or by contacting your state’s Medicaid office. It’s important to understand the specific requirements in your state to determine your eligibility.

What happens if I miss the open enrollment period for health insurance plans?

+

Missing the open enrollment period for health insurance plans can limit your options for coverage. However, certain qualifying life events, such as losing your job, getting married, or having a baby, may trigger a special enrollment period, allowing you to enroll outside of the regular open enrollment window. It’s important to be aware of these qualifying events and act promptly to ensure you don’t miss out on crucial coverage opportunities.

Can I switch health insurance plans during the year, or am I locked into my choice?

+

In most cases, you are locked into your health insurance plan choice for the entire plan year, unless you experience a qualifying life event that triggers a special enrollment period. However, some plans, such as short-term health insurance plans or certain employer-sponsored plans, may offer more flexibility in terms of switching during the year. It’s important to understand the specific rules and guidelines for your particular plan to know your options for making changes to your coverage.