The annual Open Enrollment Period for health insurance in the United States is a critical time for individuals and families to review their healthcare coverage options and make informed decisions. Understanding the timeline and key aspects of this period is essential to ensure you have the right coverage for the upcoming year. In this comprehensive guide, we will delve into the specifics of the Open Enrollment Period, offering valuable insights and practical advice to navigate this crucial healthcare milestone.

Unveiling the Open Enrollment Period

The Open Enrollment Period, often referred to as OEP, is a designated timeframe set by the federal government and individual states, during which individuals can enroll in or change their health insurance plans for the upcoming year. This period provides a crucial opportunity for individuals to assess their current coverage, consider their healthcare needs, and make adjustments to ensure they have the most suitable plan.

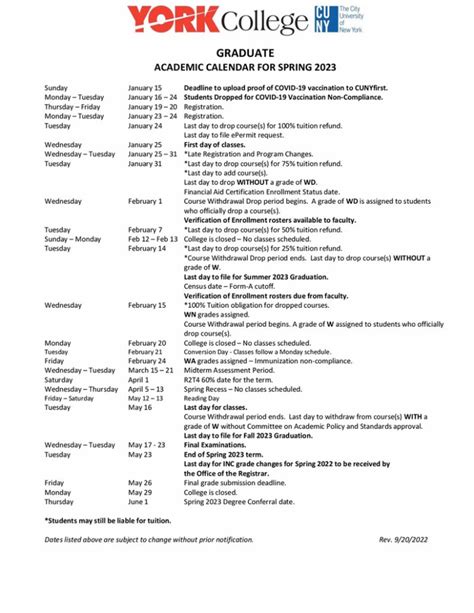

The exact dates of the Open Enrollment Period can vary depending on the state and the type of insurance plan. However, as a general guideline, the 2023 Open Enrollment Period for most states falls within the timeframe of November 1, 2023, to January 15, 2024. This period allows individuals ample time to research, compare, and select the right health insurance plan.

It's important to note that missing the Open Enrollment Period can result in limited options for acquiring health insurance outside of this timeframe. Exceptions to this rule include qualifying life events, such as marriage, birth, or job loss, which can trigger a Special Enrollment Period, allowing individuals to enroll outside of the regular OEP.

Understanding the Importance of Open Enrollment

The Open Enrollment Period holds significant importance for several reasons. Firstly, it ensures that individuals have access to affordable healthcare options, as insurance companies are prohibited from discriminating against applicants based on pre-existing conditions during this period. This means that regardless of your health status, you have the opportunity to secure comprehensive coverage.

Secondly, Open Enrollment provides a chance to review and update your coverage based on changing personal circumstances. Whether you've experienced a change in income, family size, or healthcare needs, this period allows you to make adjustments that align with your current situation.

Lastly, the OEP is a time when insurance companies compete for your business, often resulting in a variety of plan options with different coverage levels, premium costs, and networks of healthcare providers. This competition can lead to more affordable and tailored healthcare plans, giving you the power to choose the best option for your needs.

Key Considerations During Open Enrollment

When navigating the Open Enrollment Period, several key considerations can help you make informed decisions about your health insurance coverage.

Assess Your Healthcare Needs

Begin by evaluating your current and anticipated healthcare needs. Consider factors such as your age, family size, chronic conditions, and prescription medications. Understanding your unique healthcare requirements is crucial in selecting a plan that provides adequate coverage without unnecessary costs.

Compare Plan Options

Research and compare different health insurance plans offered during the Open Enrollment Period. Consider factors such as the plan’s network of healthcare providers, coverage limits, deductibles, co-pays, and out-of-pocket maximums. Online tools and resources provided by healthcare exchanges can assist in comparing plans side by side.

Understand Cost-Sharing

Cost-sharing, including deductibles, co-pays, and co-insurance, can significantly impact your out-of-pocket expenses. Understand how these cost-sharing mechanisms work in different plans and how they align with your budget and healthcare needs. Remember that lower premiums often come with higher cost-sharing, so strike a balance that suits your financial situation.

Explore Premium Subsidies

If you meet certain income criteria, you may be eligible for premium subsidies, which can lower the cost of your health insurance premiums. Research and understand the income thresholds and subsidy levels to determine if you qualify for this financial assistance.

Review Prescription Drug Coverage

If you rely on prescription medications, ensure that your plan covers the drugs you need. Some plans have preferred drug lists or require prior authorization for certain medications, so thoroughly review the plan’s coverage to avoid unexpected costs or limited access.

Consider Dental and Vision Coverage

Dental and vision coverage is often offered separately from medical insurance plans. Assess whether you need these additional coverages and compare the options available during the Open Enrollment Period.

Navigating the Open Enrollment Process

To ensure a smooth Open Enrollment experience, follow these practical steps:

Gather Necessary Documents

Collect all relevant documents, including your income verification, Social Security numbers for your family members, and details of any current health insurance coverage.

Create an Account

If you’re enrolling through a healthcare exchange, create an account and ensure you have all the necessary login details.

Research and Compare Plans

Use online tools and resources to research and compare plans based on your healthcare needs and budget. Consider factors such as coverage limits, networks, and cost-sharing.

Enroll or Make Changes

Once you’ve made your decision, enroll in your chosen plan or make necessary changes to your existing coverage. Ensure you understand the effective date of your new plan and any potential grace periods.

Review and Confirm

After enrollment, carefully review your plan details, including coverage limits, network providers, and cost-sharing structures. Confirm that your personal information and dependents are accurately reflected in the plan.

Future Implications and Planning

The Open Enrollment Period is not just about the upcoming year’s coverage; it’s also an opportunity to plan for the long term. Consider the following implications and strategies for future healthcare coverage:

Stay Informed About Plan Changes

Keep yourself updated on any changes to your chosen plan, including network provider updates, coverage modifications, or premium adjustments. Stay vigilant to ensure your coverage remains suitable for your needs.

Review Coverage Annually

Make it a habit to review your health insurance coverage annually, even outside of the Open Enrollment Period. This practice allows you to address any changes in your healthcare needs or circumstances and make adjustments accordingly.

Explore Alternative Options

If you find that your current plan no longer meets your needs or becomes too costly, explore alternative options, such as switching to a different plan or considering alternative insurance providers.

Consider Short-Term Plans

In certain situations, short-term health insurance plans can bridge the gap between coverage periods. These plans offer temporary coverage and may be suitable for individuals transitioning between jobs or experiencing a gap in coverage.

| Key Dates | Description |

|---|---|

| November 1, 2023 | Open Enrollment Period begins for most states. |

| January 15, 2024 | Open Enrollment Period ends for most states. |

| February 1, 2024 | New health insurance coverage begins for plans enrolled during OEP. |

Can I enroll in health insurance outside of the Open Enrollment Period?

+

Yes, you can enroll outside of the Open Enrollment Period if you experience a qualifying life event, such as marriage, birth, or job loss. These events trigger a Special Enrollment Period, allowing you to enroll in or change your health insurance plan.

What happens if I miss the Open Enrollment Period without a qualifying life event?

+

Missing the Open Enrollment Period without a qualifying life event may limit your options for acquiring health insurance. You may have to wait until the next Open Enrollment Period or explore alternative options, such as short-term plans or state-specific programs.

Are there any penalties for not having health insurance during the year?

+

The individual mandate penalty for not having health insurance was eliminated in 2019. However, some states may have their own mandates and penalties. It’s essential to check your state’s regulations to understand any potential consequences.

Can I switch health insurance plans during the year if my needs change?

+

While it’s generally recommended to review and adjust your health insurance coverage during the Open Enrollment Period, some states allow for mid-year changes if you experience a qualifying life event or if your income changes significantly. Check with your state’s insurance department for specific guidelines.