For small business owners, understanding and managing risks is crucial to long-term success. One of the most effective ways to mitigate financial risks is by investing in the right insurance coverage. General liability insurance is a fundamental aspect of this risk management strategy, offering protection against a wide range of potential liabilities. However, determining the optimal coverage amount can be a complex decision, as it must consider the unique characteristics and exposures of each business.

Understanding General Liability Insurance

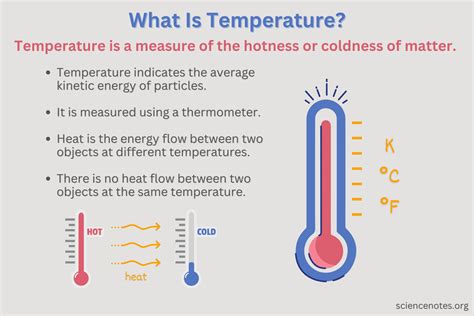

General liability insurance is a type of business insurance that protects companies from various third-party claims, including bodily injury, property damage, and advertising injuries. It covers a broad spectrum of common risks that businesses face, making it an essential component of any comprehensive insurance portfolio.

This type of insurance is designed to provide coverage for a variety of incidents, such as:

- Slip and fall accidents on business premises.

- Damage to a client's property caused by business operations.

- Defamation or copyright infringement claims.

- Product liability claims for defective products.

- Medical expenses for injuries sustained by customers on business property.

While general liability insurance is a critical safeguard for small businesses, it is important to note that it does not cover every type of risk. Exclusions can vary based on the specific policy and insurance provider, but common exclusions include professional liability, vehicle accidents, workers' compensation, and pollution-related incidents.

Factors Influencing General Liability Coverage Amounts

Determining the right amount of general liability insurance for a small business involves a careful analysis of several key factors. Here are some of the most influential considerations:

Industry and Business Activities

Different industries face varying levels of risk. For instance, a construction company would typically require higher general liability limits due to the inherent physical risks of the work, whereas a consulting firm might need lower limits as their risk exposure is generally less physical and more focused on professional services.

Revenue and Assets

The size and value of a business’s assets and revenue streams can significantly influence the amount of general liability insurance required. Larger businesses with substantial assets and high revenue potential may need higher limits to adequately protect their interests in the event of a claim.

Claim History and Risk Profile

A business’s claim history is an important factor in determining general liability insurance needs. Companies with a history of frequent or large claims may need to consider higher limits to ensure adequate coverage. Additionally, the business’s overall risk profile, including its safety record and risk management practices, can also influence the necessary coverage amount.

State Requirements and Legal Considerations

State laws often dictate minimum liability insurance requirements for businesses. While these minimums provide a baseline, it’s important for businesses to carefully assess their specific needs and exposures to ensure they are adequately protected.

Calculating General Liability Insurance Needs

While there is no one-size-fits-all approach to determining general liability insurance limits, several methods can help small business owners make an informed decision. These include:

Risk Assessment and Exposure Analysis

Conducting a thorough risk assessment involves identifying all potential risks and exposures the business faces. This process can help business owners understand the types of claims they might encounter and the potential financial impact of those claims. An exposure analysis considers the likelihood and potential severity of different types of claims, allowing for a more precise estimation of insurance needs.

Industry Benchmarks and Peer Comparisons

Reviewing industry benchmarks and comparing coverage levels with similar businesses can provide valuable insights into appropriate general liability limits. While every business is unique, understanding how peers in the industry manage their insurance coverage can offer a solid starting point for determining coverage needs.

Expert Consultation and Insurance Broker Advice

Insurance brokers and risk management experts can provide invaluable guidance in determining general liability insurance limits. They can offer insights based on their experience with similar businesses, help navigate the complexities of insurance policies, and ensure that the chosen coverage aligns with the business’s specific needs and risk profile.

| Industry | Recommended General Liability Limits |

|---|---|

| Construction | $2 million or higher |

| Retail | $1 million |

| Professional Services | $500,000 to $1 million |

| Manufacturing | $1 million to $2 million |

The above table provides a rough guide to general liability limits based on industry. However, it's important to remember that these are just recommendations, and each business should conduct a thorough assessment to determine its unique needs.

Benefits of Adequate General Liability Insurance

Ensuring that a small business has sufficient general liability insurance coverage offers several critical advantages, including:

- Financial Protection: General liability insurance safeguards a business's financial stability by covering the costs associated with third-party claims, including legal fees, settlements, and judgments.

- Peace of Mind: Knowing that the business is adequately insured can provide business owners and employees with a sense of security, allowing them to focus on their core operations without constant worry about potential liabilities.

- Enhanced Reputation: Having robust insurance coverage can enhance a business's reputation, demonstrating a commitment to safety and responsibility. This can be particularly beneficial when working with clients or partners who require proof of insurance.

- Contractual Requirements: Many contracts and client agreements may stipulate that a business maintains a certain level of general liability insurance. Adequate coverage ensures that the business can meet these requirements and continue its operations without contractual interruptions.

Common Misconceptions About General Liability Insurance

There are several common misconceptions about general liability insurance that can lead to inadequate coverage or unnecessary overspending. These include:

- Myth: Higher Limits Always Provide Better Protection. While it's true that higher general liability limits can provide more comprehensive coverage, this doesn't necessarily mean that every business needs the highest limits available. The key is to find the right balance between adequate coverage and unnecessary overspending.

- Myth: General Liability Insurance Covers All Risks. General liability insurance is designed to cover a broad range of common risks, but it does not provide blanket coverage for all potential liabilities. It's important to carefully review the policy's exclusions and understand what risks are not covered.

- Myth: Once You Have Insurance, You're Fully Protected. Having general liability insurance is a critical step in risk management, but it's not a guarantee against all potential liabilities. Business owners must also implement robust risk management practices to minimize the likelihood of claims.

Case Study: Determining General Liability Insurance for a Small Retail Business

Let’s consider a hypothetical scenario involving a small retail store specializing in electronics. The store has a modest physical footprint with limited customer traffic and primarily sells products online. It has a solid safety record with no history of accidents or claims. However, the nature of its business means it still faces risks such as customer slips and falls, property damage, and potential product liability claims.

After conducting a thorough risk assessment, the store owner decides to purchase general liability insurance with the following coverage limits:

- Bodily Injury and Property Damage: $1 million per occurrence, $2 million aggregate

- Personal and Advertising Injury: $1 million per occurrence

These limits were chosen based on the store's low-risk profile, its relatively small physical space, and its primarily online sales model. While the store could have opted for higher limits, the owner determined that the chosen coverage provided adequate protection without excessive costs.

Conclusion

Determining the right amount of general liability insurance for a small business is a complex but crucial task. By carefully considering factors such as industry, business size, risk profile, and legal requirements, business owners can make informed decisions about their insurance coverage. Remember, while general liability insurance is an essential component of risk management, it’s just one part of a comprehensive strategy. Combining adequate insurance coverage with robust risk management practices is the key to ensuring long-term business success and stability.

What are the typical general liability insurance limits for small businesses?

+Typical general liability insurance limits for small businesses can vary widely depending on the industry and specific business activities. However, common limits often range from 500,000 to 2 million per occurrence and aggregate. It’s important to note that these are just guidelines, and each business should conduct a thorough assessment to determine its unique needs.

How often should I review my general liability insurance coverage?

+It’s recommended to review your general liability insurance coverage annually, or whenever significant changes occur in your business operations, size, or risk profile. Regular reviews ensure that your coverage remains aligned with your business’s evolving needs and exposures.

Can I customize my general liability insurance policy to fit my business’s specific needs?

+Yes, general liability insurance policies can often be customized to fit the unique needs of your business. This may include adjusting coverage limits, adding endorsements or riders for specific risks, or opting for additional coverage types like commercial auto or professional liability insurance.