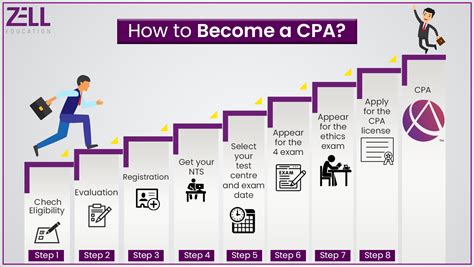

Becoming a Certified Public Accountant (CPA) is a prestigious and rewarding career goal for individuals interested in the field of accounting. The CPA designation is a mark of excellence in the profession, indicating that an individual has met the rigorous standards of education, experience, and ethics required to provide high-quality accounting services. To become a CPA, one must navigate a complex process that involves meeting specific educational requirements, gaining relevant work experience, and passing a comprehensive examination.

Meeting the Educational Requirements

The first step towards becoming a CPA is to meet the educational requirements set by the American Institute of Certified Public Accountants (AICPA) and the state’s accountancy board. Typically, this involves completing a minimum of 120-150 semester hours of college credit, which includes a bachelor’s degree in accounting or a related field. The curriculum should cover a wide range of topics, including financial accounting, auditing, taxation, and financial management. Specifically, the AICPA requires CPAs to complete coursework in subjects such as financial accounting, managerial accounting, auditing, taxation, and business law. Some states may have additional educational requirements, so it’s essential to check with the state’s accountancy board for specific requirements.

Coursework and Degree Requirements

In addition to meeting the general educational requirements, CPAs must also complete specific coursework and degree requirements. This may include completing a master’s degree in accounting or a related field, or completing a certain number of credit hours in specific subjects such as taxation or auditing. For example, the University of Texas at Austin offers a Master of Science in Accounting degree that is designed to meet the educational requirements for the CPA exam. It’s crucial to research the specific requirements for the state and the AICPA to ensure that the educational program meets the necessary standards.

| State | Educational Requirements |

|---|---|

| California | 120 semester hours, including 24 semester hours in accounting and 24 semester hours in business |

| New York | 150 semester hours, including 33 semester hours in accounting and 36 semester hours in business |

| Texas | 120 semester hours, including 24 semester hours in accounting and 24 semester hours in business |

Gaining Relevant Work Experience

![Best Cpa Exam Study Guide [100% Pass Guarantee] Best Cpa Exam Study Guide [100% Pass Guarantee]](https://search.sks.com/assets/img/best-cpa-exam-study-guide-100-pass-guarantee.jpeg)

After meeting the educational requirements, the next step is to gain relevant work experience in the field of accounting. This can be achieved by working for a public accounting firm, a private company, or a government agency. The work experience should be in a role that is relevant to the CPA profession, such as auditing, taxation, or financial accounting. The AICPA requires CPAs to have at least one year of work experience in a role that is supervised by a licensed CPA. This experience provides valuable hands-on training and helps to develop the skills and knowledge required to become a successful CPA.

Types of Work Experience

There are several types of work experience that can be relevant to the CPA profession. This may include working as an auditor, a tax preparer, or a financial accountant. For example, working as an auditor for a public accounting firm can provide valuable experience in auditing and financial accounting. It’s essential to research the specific requirements for the state and the AICPA to ensure that the work experience meets the necessary standards.

Key Points

- Meet the educational requirements set by the AICPA and the state's accountancy board

- Gain relevant work experience in a role that is supervised by a licensed CPA

- Pass the Uniform CPA Examination

- Obtain a CPA license from the state's accountancy board

- Complete continuing professional education (CPE) courses to stay up-to-date with the latest developments in the field

Passing the Uniform CPA Examination

The Uniform CPA Examination is a comprehensive exam that tests a candidate’s knowledge and skills in a wide range of topics, including financial accounting, auditing, taxation, and financial management. The exam is administered by the AICPA and is designed to assess a candidate’s ability to apply accounting principles and concepts to real-world scenarios. The exam consists of four sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC). Each section is designed to test a candidate’s knowledge and skills in a specific area of accounting.

Preparing for the Exam

Preparing for the Uniform CPA Examination requires a significant amount of time and effort. Candidates should start by reviewing the exam content and format, and then develop a study plan that includes a combination of self-study and formal education. For example, the AICPA offers a range of study materials and courses that can help candidates prepare for the exam. It’s also essential to practice with sample questions and simulations to get a feel for the exam format and timing.

| Section | Content | Format |

|---|---|---|

| Auditing and Attestation (AUD) | Auditing procedures, audit reports, and attest engagements | Multiple-choice questions and simulations |

| Financial Accounting and Reporting (FAR) | Financial statements, accounting principles, and financial reporting | Multiple-choice questions and simulations |

| Regulation (REG) | Taxation, business law, and professional ethics | Multiple-choice questions and simulations |

| Business Environment and Concepts (BEC) | Financial management, business strategy, and information technology | Multiple-choice questions and simulations |

Obtaining a CPA License

After passing the Uniform CPA Examination, the final step is to obtain a CPA license from the state’s accountancy board. This involves submitting an application and paying the required fees. The license is typically valid for a certain period, after which it must be renewed. The AICPA requires CPAs to complete continuing professional education (CPE) courses to stay up-to-date with the latest developments in the field. This ensures that CPAs have the knowledge and skills required to provide high-quality accounting services.

Maintaining a CPA License

Maintaining a CPA license requires ongoing effort and commitment. CPAs must complete continuing professional education (CPE) courses to stay up-to-date with the latest developments in the field. For example, the AICPA offers a range of CPE courses that can help CPAs meet their ongoing education requirements. It’s also essential to adhere to the AICPA’s code of professional conduct and to maintain the highest standards of integrity and ethics.

What are the educational requirements to become a CPA?

+The educational requirements to become a CPA vary by state, but typically include completing a minimum of 120-150 semester hours of college credit, including a bachelor's degree in accounting or a related field.

How do I prepare for the Uniform CPA Examination?

+Preparing for the Uniform CPA Examination requires a significant amount of time and effort. Candidates should start by reviewing the exam content and format, and then develop a study plan that includes a combination of self-study and formal education.

What are the benefits of becoming a CPA?

+The benefits of becoming a CPA include increased career opportunities, higher salaries, and greater respect and recognition within the accounting profession.

In conclusion, becoming a CPA is a challenging and rewarding career goal that requires dedication, hard work, and a commitment to ongoing education and professional development. By meeting the educational requirements, gaining relevant work experience, passing the Uniform CPA Examination, and obtaining a CPA license, individuals can achieve the prestigious CPA designation and enjoy a successful and rewarding career in accounting.