Purchasing homeowners insurance is an essential step in protecting your home and assets. It provides financial security and peace of mind, covering a wide range of potential risks and liabilities. In this comprehensive guide, we will delve into the world of homeowners insurance, exploring the key considerations, the process of obtaining a policy, and the benefits it offers. Whether you're a first-time buyer or seeking to update your coverage, this article will equip you with the knowledge to make informed decisions.

Understanding Homeowners Insurance

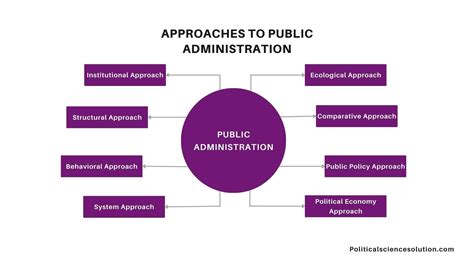

Homeowners insurance, also known as home insurance, is a vital form of property insurance designed to protect homeowners against various losses and damages. It offers coverage for the structure of your home, its contents, and potential liabilities. Understanding the different types of coverage and the specific needs of your home is crucial for obtaining adequate protection.

Types of Coverage

Homeowners insurance policies typically include several types of coverage, each catering to different aspects of homeownership. These include:

- Dwelling Coverage: Protects the physical structure of your home, including the walls, roof, and permanent fixtures.

- Personal Property Coverage: Covers the contents of your home, such as furniture, electronics, and personal belongings.

- Liability Coverage: Provides protection against lawsuits and medical claims for injuries that occur on your property.

- Additional Living Expenses: Covers the costs of temporary housing and additional expenses if your home becomes uninhabitable due to a covered event.

- Other Structures Coverage: Insures structures on your property that are separate from your home, like sheds or garages.

Each type of coverage has its own limits and exclusions, so it's important to review your policy carefully to ensure you have the right level of protection.

Factors Influencing Coverage

The cost and extent of your homeowners insurance coverage can be influenced by several factors, including:

- Location: Areas prone to natural disasters or with higher crime rates may have higher insurance premiums.

- Home Value: The replacement cost of your home and its contents will impact the overall coverage amount.

- Age and Condition of the Home: Older homes or those with outdated electrical or plumbing systems may require specialized coverage.

- Personal Belongings : High-value items like jewelry, artwork, or collectibles may require additional coverage.

- Previous Claims: A history of frequent or expensive claims can affect your insurance rates.

The Process of Buying Homeowners Insurance

Obtaining homeowners insurance involves several key steps to ensure you get the right policy for your needs. Here’s a detailed breakdown of the process:

Step 1: Research and Compare Policies

Start by researching different insurance providers and the policies they offer. Compare coverage options, limits, and premiums to find the best fit for your home. Consider factors such as financial stability, customer satisfaction, and the breadth of coverage offered.

Use online tools and resources to get quotes from multiple insurers. This will give you a clear idea of the market rates and the specific coverage options available.

Step 2: Assess Your Coverage Needs

Evaluate your unique needs and the specific risks associated with your home. Consider the following factors:

- The replacement cost of your home and its contents.

- Any high-value items that may require special coverage.

- The likelihood of natural disasters or crime in your area.

- Your personal liability risks, especially if you have frequent visitors or own a pet.

Assessing your needs will help you determine the appropriate coverage limits and deductibles.

Step 3: Understand Exclusions and Deductibles

Homeowners insurance policies often have exclusions, which are specific risks or events that are not covered. Common exclusions include:

- Flood damage

- Earthquake damage

- Water damage caused by poor maintenance

- War or nuclear incidents

Review the policy exclusions carefully to ensure you understand what is and isn't covered. Additionally, consider the deductibles, which are the amounts you must pay out of pocket before your insurance coverage kicks in.

Step 4: Obtain Quotes and Shop Around

Contact multiple insurance providers and request quotes based on your assessed coverage needs. Compare the quotes, ensuring you’re comparing policies with similar coverage limits and deductibles.

Don't be afraid to negotiate with insurers. You may be able to lower your premium by increasing your deductibles or making certain improvements to your home, such as installing security systems or fire prevention measures.

Step 5: Review and Choose a Policy

Once you’ve received quotes and assessed the coverage options, carefully review the policies. Consider the following factors when making your decision:

- Financial stability and reputation of the insurer

- Coverage limits and deductibles

- Exclusions and any endorsements (additional coverages) you may need

- Customer service and claims handling processes

- Any discounts or perks offered by the insurer

Choose the policy that provides the best combination of coverage, affordability, and reliability.

Benefits of Homeowners Insurance

Homeowners insurance offers a multitude of benefits that go beyond simply protecting your home’s structure. Here are some key advantages:

Financial Protection

In the event of a covered loss, homeowners insurance provides financial protection. It can cover the cost of repairing or rebuilding your home, replacing personal belongings, and covering liability claims.

For example, if a fire damages your home, homeowners insurance can help you rebuild and replace your belongings, ensuring you're not left with a significant financial burden.

Peace of Mind

Knowing that you have adequate insurance coverage can provide immense peace of mind. It allows you to focus on enjoying your home and your life without constant worry about potential risks.

Protection Against Liabilities

Homeowners insurance includes liability coverage, which protects you against lawsuits and medical claims resulting from injuries on your property. This can be especially crucial if you have frequent visitors or if your home is located in an area with high foot traffic.

Additional Living Expenses

If your home becomes uninhabitable due to a covered event, homeowners insurance can cover the costs of temporary housing and additional living expenses. This ensures you have a place to stay and can maintain your daily routine during the repair or rebuilding process.

FAQs

What is the difference between homeowners insurance and renters insurance?

+Homeowners insurance covers the structure of your home and its contents, as well as liabilities. Renters insurance, on the other hand, only covers your personal belongings and liabilities while renting a property. It does not cover the structure itself.

Do I need homeowners insurance if I have a mortgage?

+Most mortgage lenders require homeowners insurance as a condition of the loan. It protects their investment in your home and ensures you have the means to rebuild or repair in the event of a covered loss.

Can I customize my homeowners insurance policy?

+Yes, homeowners insurance policies can be customized to fit your specific needs. You can choose different coverage limits, deductibles, and add optional coverages like flood insurance or earthquake coverage.

How often should I review my homeowners insurance policy?

+It’s a good idea to review your policy annually, especially after major life changes like renovations, adding a room, or purchasing high-value items. Regular reviews ensure your coverage remains adequate and up-to-date.

Remember, homeowners insurance is an essential safeguard for your home and assets. By understanding the coverage options, researching providers, and choosing a policy that suits your needs, you can protect your investment and ensure a secure future.