Calculating assets is a crucial process in various fields, including finance, accounting, and business management. Assets refer to anything of value that is owned or controlled by an individual, company, or organization. The calculation of assets can be complex and depends on the type of asset, its value, and the purpose of the calculation. In this article, we will explore five ways to calculate assets, including their applications, advantages, and limitations.

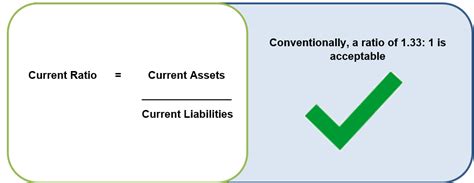

1. Current Asset Calculation

The current asset calculation is a method used to determine the value of a company’s short-term assets, such as cash, accounts receivable, inventory, and prepaid expenses. This calculation is essential for determining a company’s liquidity and ability to meet its short-term obligations. The formula for calculating current assets is:

Current Assets = Cash + Accounts Receivable + Inventory + Prepaid Expenses

For example, suppose a company has $100,000 in cash, $200,000 in accounts receivable, $300,000 in inventory, and $50,000 in prepaid expenses. The total current assets would be $650,000.

Importance of Current Asset Calculation

The current asset calculation is crucial for businesses to determine their ability to meet their short-term obligations, such as paying bills and salaries. It also helps investors and creditors to assess a company’s liquidity and creditworthiness.

| Asset Category | Value |

|---|---|

| Cash | $100,000 |

| Accounts Receivable | $200,000 |

| Inventory | $300,000 |

| Prepaid Expenses | $50,000 |

| Total Current Assets | $650,000 |

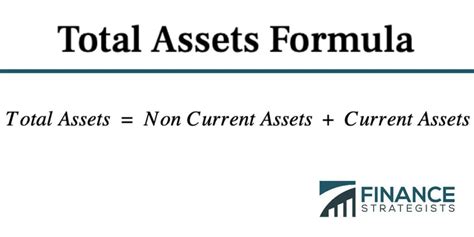

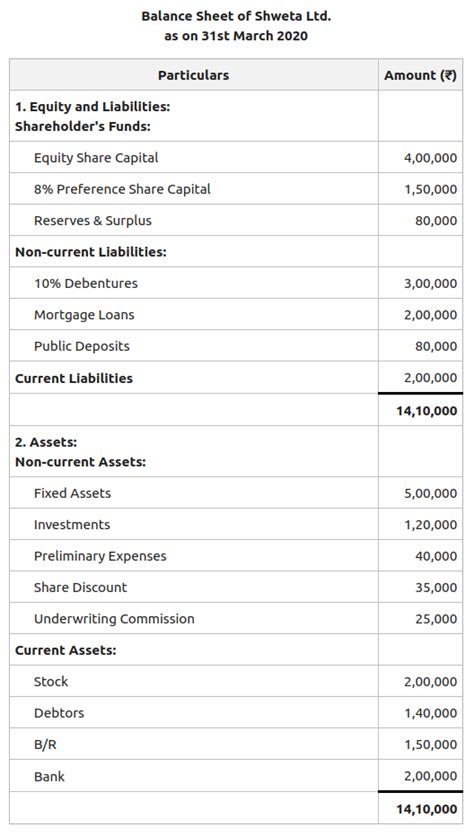

2. Total Asset Calculation

The total asset calculation is a method used to determine the value of all assets owned by a company, including both current and non-current assets. This calculation is essential for determining a company’s overall financial position and net worth. The formula for calculating total assets is:

Total Assets = Current Assets + Non-Current Assets

Non-current assets include long-term assets, such as property, plant, and equipment, investments, and intangible assets.

Example of Total Asset Calculation

Suppose a company has 650,000 in current assets and 1,000,000 in non-current assets. The total assets would be $1,650,000.

Key Points

- The total asset calculation is essential for determining a company's overall financial position and net worth.

- Non-current assets, such as property, plant, and equipment, are essential for a company's long-term operations and growth.

- The total asset calculation is used in various financial ratios, such as the debt-to-equity ratio and the return on assets (ROA) ratio.

- Accurate calculation of total assets is crucial for financial reporting and decision-making.

- The total asset calculation is a critical component of a company's balance sheet.

3. Asset Valuation Calculation

Asset valuation calculation is a method used to determine the value of a specific asset, such as a piece of property or a piece of equipment. This calculation is essential for determining the value of an asset for financial reporting, tax purposes, or insurance purposes. The formula for calculating asset valuation is:

Asset Valuation = Cost - Accumulated Depreciation

Accumulated depreciation is the total depreciation expense recorded over the life of the asset.

Example of Asset Valuation Calculation

Suppose a company purchased a piece of equipment for 100,000 and has recorded 20,000 in depreciation expense over its life. The asset valuation would be $80,000.

4. Intangible Asset Calculation

Intangible asset calculation is a method used to determine the value of intangible assets, such as patents, copyrights, and trademarks. This calculation is essential for determining the value of a company’s intellectual property and goodwill. The formula for calculating intangible assets is:

Intangible Assets = Cost - Amortization

Amortization is the process of expensing the cost of an intangible asset over its useful life.

Example of Intangible Asset Calculation

Suppose a company purchased a patent for 50,000 and has recorded 10,000 in amortization expense over its life. The intangible asset value would be $40,000.

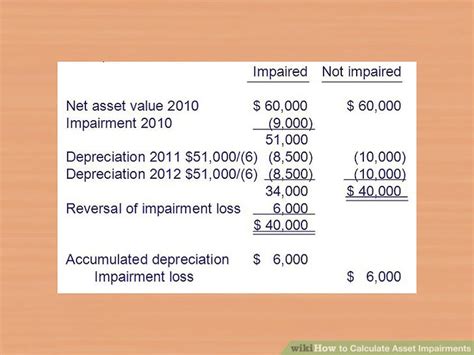

5. Asset Impairment Calculation

Asset impairment calculation is a method used to determine the value of an asset that has been impaired or damaged. This calculation is essential for determining the value of an asset that is no longer recoverable. The formula for calculating asset impairment is:

Asset Impairment = Carrying Value - Recoverable Amount

The carrying value is the value of the asset on the balance sheet, and the recoverable amount is the amount that the asset can be sold for or used to generate cash flows.

Example of Asset Impairment Calculation

Suppose a company has a piece of equipment with a carrying value of 100,000, but it can only be sold for 60,000. The asset impairment would be $40,000.

What is the purpose of calculating assets?

+The purpose of calculating assets is to determine the value of a company's assets, which is essential for financial reporting, decision-making, and taxation.

What are the different types of asset calculations?

+The different types of asset calculations include current asset calculation, total asset calculation, asset valuation calculation, intangible asset calculation, and asset impairment calculation.

Why is it essential to calculate assets accurately?

+Accurate calculation of assets is essential for financial reporting, decision-making, and taxation. Inaccurate asset calculations can lead to financial misstatements, poor decision-making, and tax penalties.

In conclusion, calculating assets is a critical process in finance and accounting. The five methods of calculating assets discussed in this article, including current asset calculation, total asset calculation, asset valuation calculation, intangible asset calculation, and asset impairment calculation, are essential for determining the value of a company’s assets. Accurate calculation of assets is crucial for financial reporting, decision-making, and taxation. As a financial analyst or accountant, it’s essential to understand these methods and apply them accurately to ensure the financial health and stability of a company.