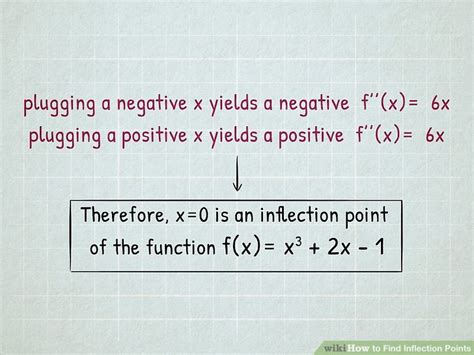

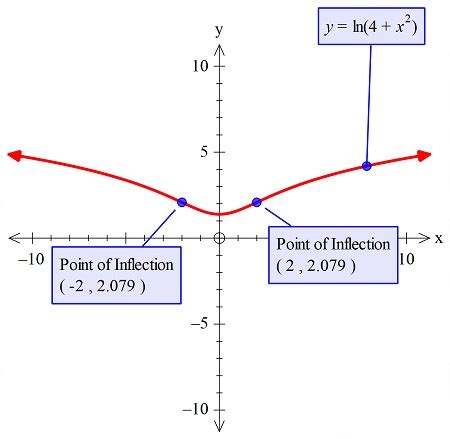

The concept of an inflection point, a moment of significant change in a business, market, or economy, has been a focal point of discussion among entrepreneurs, investors, and economists. Identifying such points can be crucial for making informed decisions, whether it's about investing, expanding a business, or adapting to market trends. However, pinpointing these moments of change can be challenging due to the complexity and unpredictability of economic systems. In this article, we'll explore five ways to find an inflection point, helping you navigate through the intricacies of market shifts and economic fluctuations.

Key Points

- Understanding market trends and their potential for reversal or acceleration

- Analyzing financial data for patterns that precede inflection points

- Identifying changes in consumer behavior and preferences

- Recognizing the role of technological innovation in driving market shifts

- Utilizing predictive analytics and machine learning models to forecast potential inflection points

Understanding Market Trends

Market trends can often signal an impending inflection point. By closely monitoring these trends, businesses and investors can prepare for significant changes. For instance, a sustained upward trend might eventually reach an inflection point where it reverses, and what was once a booming market becomes a declining one. Conversely, a downward trend could inflect into an upward trajectory, signaling a recovery or growth phase. The key is to understand the factors driving these trends and recognize the signs that an inflection point is near. This could involve analyzing economic indicators, such as GDP growth rates, inflation rates, and employment figures, to gauge the overall health and direction of the economy.

Financial Data Analysis

Financial data is another crucial area of focus for identifying inflection points. Patterns in financial statements, stock prices, and other economic metrics can provide early warnings of significant changes. For example, a company’s declining profit margins might signal an inflection point where it needs to adapt its business model to remain competitive. Similarly, sudden spikes or drops in stock prices can indicate market reactions to news or trends that might lead to an inflection point. By closely analyzing these financial data points and recognizing patterns that have historically preceded inflection points, businesses and investors can make more informed decisions.

| Financial Metric | Pre-Inflection Point Pattern |

|---|---|

| Profit Margins | Consistent decline over quarters |

| Stock Price | Sudden and significant increases or decreases |

| Revenue Growth | Slowing growth rate despite increasing investments |

Consumer Behavior and Preferences

Changes in consumer behavior and preferences can also signal an inflection point. As consumers increasingly demand more sustainable, ethical, and technologically advanced products, businesses that fail to adapt might find themselves at an inflection point, facing significant decline. Monitoring consumer trends, conducting market research, and engaging with customers can provide valuable insights into emerging preferences and behaviors. For instance, the shift towards online shopping and digital services has been a significant inflection point for many retail businesses, forcing them to reimagine their business models and invest heavily in e-commerce platforms.

Technological Innovation

Technological innovation is a powerful driver of inflection points. New technologies can disrupt entire industries, creating opportunities for growth and innovation while posing significant challenges to established businesses. The rise of fintech, for example, has led to an inflection point in the banking and finance sector, with digital payment systems and online banking services becoming the norm. Businesses must stay ahead of the curve by investing in research and development, adopting new technologies, and exploring how these innovations can enhance their operations and offerings.

Predictive Analytics and Machine Learning

Predictive analytics and machine learning models offer sophisticated tools for forecasting potential inflection points. By analyzing historical data, market trends, and other relevant factors, these models can identify patterns and predict future changes. For instance, predictive models might analyze economic indicators, consumer behavior, and technological trends to forecast when an inflection point is likely to occur. While these models are not foolproof, they can provide valuable insights that help businesses and investors make more informed decisions and prepare for significant market shifts.

In conclusion, finding an inflection point requires a combination of market trend analysis, financial data scrutiny, understanding of consumer behavior, recognition of technological innovation, and the use of predictive analytics. By leveraging these strategies, businesses and investors can better navigate the complexities of economic systems, anticipate significant changes, and position themselves for success in a rapidly evolving market landscape.

What is an inflection point in business and economics?

+An inflection point refers to a moment of significant change in a business, market, or economy, often driven by factors such as technological innovation, shifts in consumer behavior, or economic trends.

How can businesses prepare for an inflection point?

+Businesses can prepare by staying agile, investing in innovation, monitoring market trends, and engaging with consumers to understand their evolving needs and preferences.

What role does predictive analytics play in identifying inflection points?

+Predictive analytics and machine learning models can forecast potential inflection points by analyzing historical data, market trends, and other relevant factors, providing businesses with valuable insights to make informed decisions.