Calculating cost is a fundamental aspect of business operations, as it directly impacts profitability, pricing, and investment decisions. Understanding the various methods to calculate cost is essential for managers, entrepreneurs, and investors to make informed decisions. The calculation of cost can be approached from different angles, each providing unique insights into the financial and operational health of an organization. This article explores five primary ways to calculate cost, including the absorption costing method, marginal costing, standard costing, activity-based costing (ABC), and the variable costing method.

Key Points

- Absorption costing method includes both fixed and variable costs in the cost of a product.

- Marginal costing focuses on variable costs to determine the cost of producing one more unit of a product.

- Standard costing involves setting standard costs for products based on efficient operating conditions.

- Activity-based costing (ABC) allocates costs to products based on the activities required to produce them.

- Variable costing method considers only the variable costs associated with the production of a product.

Absorption Costing Method

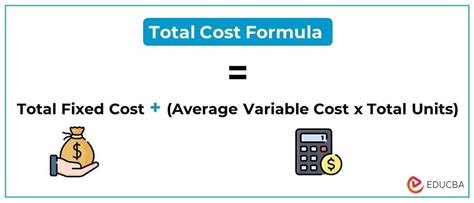

The absorption costing method, also known as full costing, is a technique where all costs—both fixed and variable—are absorbed by the product. This means that the cost of a product includes direct materials, direct labor, and both variable and fixed manufacturing overheads. The formula for calculating the cost of a product under the absorption costing method is: Cost = Direct Materials + Direct Labor + Variable Overheads + Fixed Overheads. This method is useful for inventory valuation and pricing decisions, as it provides a comprehensive view of the costs incurred to produce a product.

Example of Absorption Costing

Consider a manufacturing company that produces 10,000 units of a product. The direct materials cost per unit is 5, direct labor is 10, variable overheads are 3, and fixed overheads allocated per unit are 2. Using the absorption costing method, the total cost per unit would be 5 (direct materials) + 10 (direct labor) + 3 (variable overheads) + 2 (fixed overheads) = $20. This example illustrates how the absorption costing method allocates all types of costs to the product, providing a full cost picture.

| Cost Component | Cost per Unit |

|---|---|

| Direct Materials | $5 |

| Direct Labor | $10 |

| Variable Overheads | $3 |

| Fixed Overheads | $2 |

| Total Cost | $20 |

Marginal Costing

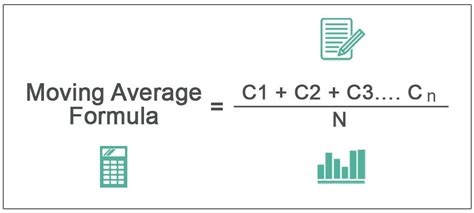

Marginal costing, on the other hand, focuses solely on the variable costs of producing a product. It ignores fixed costs, as they are incurred regardless of the production volume. The marginal cost is calculated as the change in total variable costs resulting from a one-unit change in output. This method is particularly useful for short-term decision-making, such as determining whether to accept a special order or deciding the optimal production level.

Example of Marginal Costing

For a company considering producing an additional 1,000 units of a product, where the variable cost per unit is 8, the marginal cost of producing these additional units would be 8,000 (1,000 units * $8 per unit). This calculation helps in understanding the additional cost incurred for increasing production, which is crucial for decisions related to production expansion or contraction.

Standard Costing

Standard costing involves setting standard costs for products based on efficient operating conditions. These standards are used as benchmarks against which actual costs are compared. The difference between the standard cost and the actual cost is known as a variance, which can be analyzed to identify areas of inefficiency. Standard costing is beneficial for budgeting, cost control, and performance evaluation.

Example of Standard Costing

A company sets a standard cost for a product at 15 per unit, based on projected efficient production conditions. If the actual cost of producing the product turns out to be 16 per unit, there is a variance of $1 per unit. This variance can be further analyzed to determine its cause, whether it be due to higher material costs, labor inefficiencies, or other factors.

| Cost Type | Standard Cost | Actual Cost | Variance |

|---|---|---|---|

| Material | $5 | $6 | $1 |

| Labor | $6 | $6 | $0 |

| Overheads | $4 | $4 | $0 |

| Total | $15 | $16 | $1 |

Activity-Based Costing (ABC)

Activity-based costing is a more detailed approach that allocates costs to products based on the activities required to produce them. It recognizes that different products use different activities at different rates. By assigning costs to activities and then to products based on their usage of those activities, ABC provides a more accurate picture of product costs. This method is particularly useful in environments where products have significantly different production processes or requirements.

Example of Activity-Based Costing

A manufacturing plant produces two products, A and B. Product A requires more complex assembly and inspection processes than product B. Using ABC, the costs of these activities (such as machinery operation, labor, and quality control) are allocated to each product based on the extent to which each product uses these activities. For instance, if product A requires twice as many hours of assembly as product B, it will be allocated twice the assembly cost.

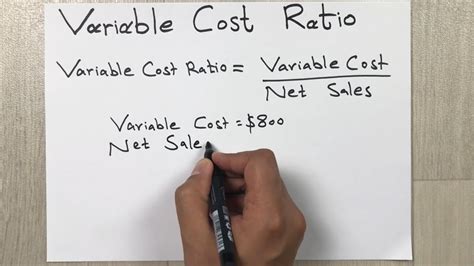

Variable Costing Method

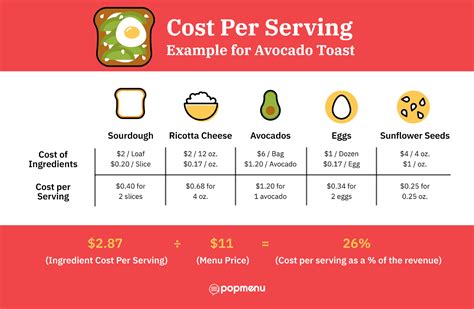

The variable costing method, also known as direct costing, only considers the variable costs associated with the production of a product. Variable costs include direct materials, direct labor, and variable manufacturing overheads. This method is useful for decision-making related to pricing, production levels, and make-or-buy decisions, as it highlights the costs that will change with different levels of production or sales.

Example of Variable Costing

A company produces a product with variable costs of 10 per unit (consisting of 6 for direct materials, 3 for direct labor, and 1 for variable overheads). If the company is considering a special order that would require producing an additional 5,000 units, the variable cost of fulfilling this order would be 50,000 (5,000 units * 10 per unit). This calculation helps in evaluating the profitability of the special order by comparing the variable costs against the potential revenue.

What is the primary difference between absorption costing and marginal costing?

+The primary difference is that absorption costing includes both fixed and variable costs in the product cost, whereas marginal costing only considers variable costs.

How does activity-based costing differ from traditional costing methods?

+Activity-based costing differs by allocating costs to products based on the specific activities required for their production, rather than using a blanket overhead rate.

What are the advantages of using standard costing?

+The advantages include better budgeting, cost control, and performance evaluation, as it provides a benchmark against which actual costs can be compared.

In conclusion, calculating cost is a multifaceted task that can be approached through various methods, each with its unique advantages and applications. Whether it’s the absorption costing method, marginal costing, standard costing, activity-based costing, or the variable costing method, understanding these techniques is essential for making informed business decisions. By applying the appropriate costing method to specific business scenarios, organizations can better manage their costs, optimize production, and ultimately enhance their profitability.