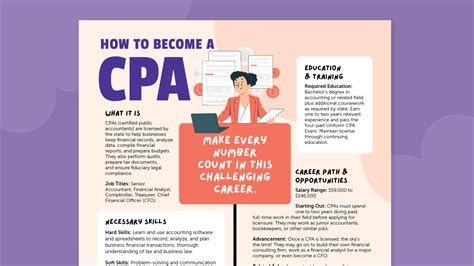

Becoming a Certified Public Accountant (CPA) is a prestigious milestone in the accounting profession, signifying expertise, integrity, and a high level of competence. The CPA designation is granted by the American Institute of Certified Public Accountants (AICPA) and is considered the gold standard in the accounting industry. To achieve this certification, candidates must meet specific educational, examination, and experience requirements, which can vary by state. Here, we will explore five key steps or ways to become a CPA, emphasizing the importance of understanding the specific requirements for your state and the value of the CPA credential in advancing your career in accounting.

Key Points

- Meet the Educational Requirements: Most states require 120-150 semester hours of college credit, typically a bachelor's degree in accounting or a related field.

- Pass the Uniform CPA Examination: The exam is developed and scored by the AICPA and is designed to assess the knowledge and skills necessary for a CPA.

- Gain the Necessary Experience: Requirements vary by state but typically involve one to two years of work experience in accounting under the supervision of a licensed CPA.

- Apply for Certification: Submit your application, which includes transcripts, examination scores, and experience verification, to your state's accountancy board.

- Maintain Your Certification: Complete Continuing Professional Education (CPE) courses to stay updated on accounting standards, laws, and regulations.

Understanding the CPA Certification Process

The journey to becoming a CPA involves several steps, each designed to ensure that candidates possess the academic background, technical knowledge, and professional experience necessary to perform as a competent public accountant. The process typically starts with meeting the educational requirements, which include completing a certain number of semester hours in accounting and related subjects. The specific educational requirements can vary by state, but most candidates will need to have at least a bachelor’s degree in accounting or a related field, with a total of 120-150 semester hours of college credit.

Step 1: Meet the Educational Requirements

The first step towards becoming a CPA is to ensure you meet the educational requirements set by your state’s accountancy board. Most states require candidates to complete 120-150 semester hours of college credit, which is equivalent to about four to five years of full-time study. The coursework should include classes in financial accounting, auditing, taxation, and other related subjects. Some states also require specific courses or credits in subjects like business law, ethics, or accounting research.

| State | Semester Hours Required |

|---|---|

| California | 150 |

| New York | 150 |

| Texas | 150 |

Passing the Uniform CPA Examination

After meeting the educational requirements, the next step is to pass the Uniform CPA Examination, which is developed and scored by the AICPA. The exam is designed to assess the knowledge and skills necessary for a CPA in areas such as auditing and attestation, financial accounting and reporting, regulation, and business environment and concepts. The exam is divided into four sections, each testing different aspects of accounting knowledge and professional skills.

Section Overview of the Uniform CPA Exam

The Uniform CPA Examination consists of four sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC). Each section is designed to test the candidate’s knowledge and skills in these critical areas of accounting. The AUD section, for example, tests a candidate’s ability to apply auditing procedures and concepts, while the FAR section focuses on financial accounting and reporting principles.

Preparation for the exam typically involves a combination of study materials, such as review courses and practice questions, and experience. Many candidates choose to enroll in a CPA review course to help them prepare for the exam, as these courses are designed to cover all the material that will be tested and provide practice exams and questions to help candidates assess their knowledge and identify areas where they need more study.

Gaining the Necessary Experience

Most states require CPA candidates to gain a certain amount of work experience in accounting before they can become certified. This experience can be gained in public accounting firms, private industry, government, or non-profit organizations, under the supervision of a licensed CPA. The experience requirement varies by state but typically involves one to two years of work experience. This practical experience is crucial as it provides candidates with the opportunity to apply their knowledge and skills in real-world situations, developing the professional competence and judgment expected of a CPA.

The Importance of Experience in Accounting

Gaining experience in accounting is not only a requirement for becoming a CPA but also a valuable way to develop the skills and judgment necessary for a successful career in accounting. Through work experience, candidates can apply theoretical knowledge in practical situations, learn from experienced professionals, and develop a deeper understanding of the profession. This experience can also help candidates decide which area of accounting they wish to specialize in, whether it be auditing, taxation, financial accounting, or another area.

What is the format of the Uniform CPA Examination?

+The Uniform CPA Examination consists of four sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC). Each section tests different aspects of accounting knowledge and professional skills.

How do I apply for CPA certification after passing the exam and gaining the necessary experience?

+To apply for CPA certification, submit your application, which includes transcripts, examination scores, and experience verification, to your state's accountancy board. Ensure you meet all the requirements set by your state, as these can vary.

In conclusion, becoming a CPA involves a deliberate and multifaceted process that includes meeting educational requirements, passing the Uniform CPA Examination, gaining necessary experience, applying for certification, and maintaining your certification through continuing professional education. Each step is designed to ensure that CPAs possess the knowledge, skills, and professional competence required to perform their duties with integrity and expertise. By understanding and following these steps, aspiring accountants can set themselves on the path to a rewarding and challenging career as a Certified Public Accountant.