The Health Savings Account (HSA) Max Contribution is a crucial aspect of health care planning for individuals and families in the United States. Established as part of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, HSAs are designed to help individuals with high-deductible health plans (HDHPs) save for medical expenses on a tax-free basis. The maximum contribution limits to HSAs are adjusted annually for inflation, making it essential for contributors to stay updated on these figures to maximize their savings.

Understanding HSA Contribution Limits

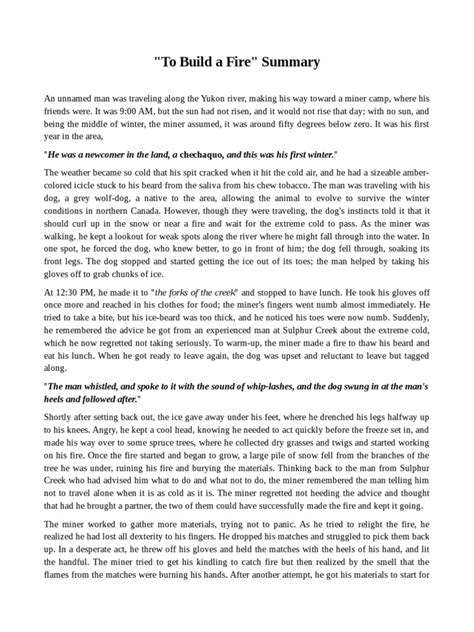

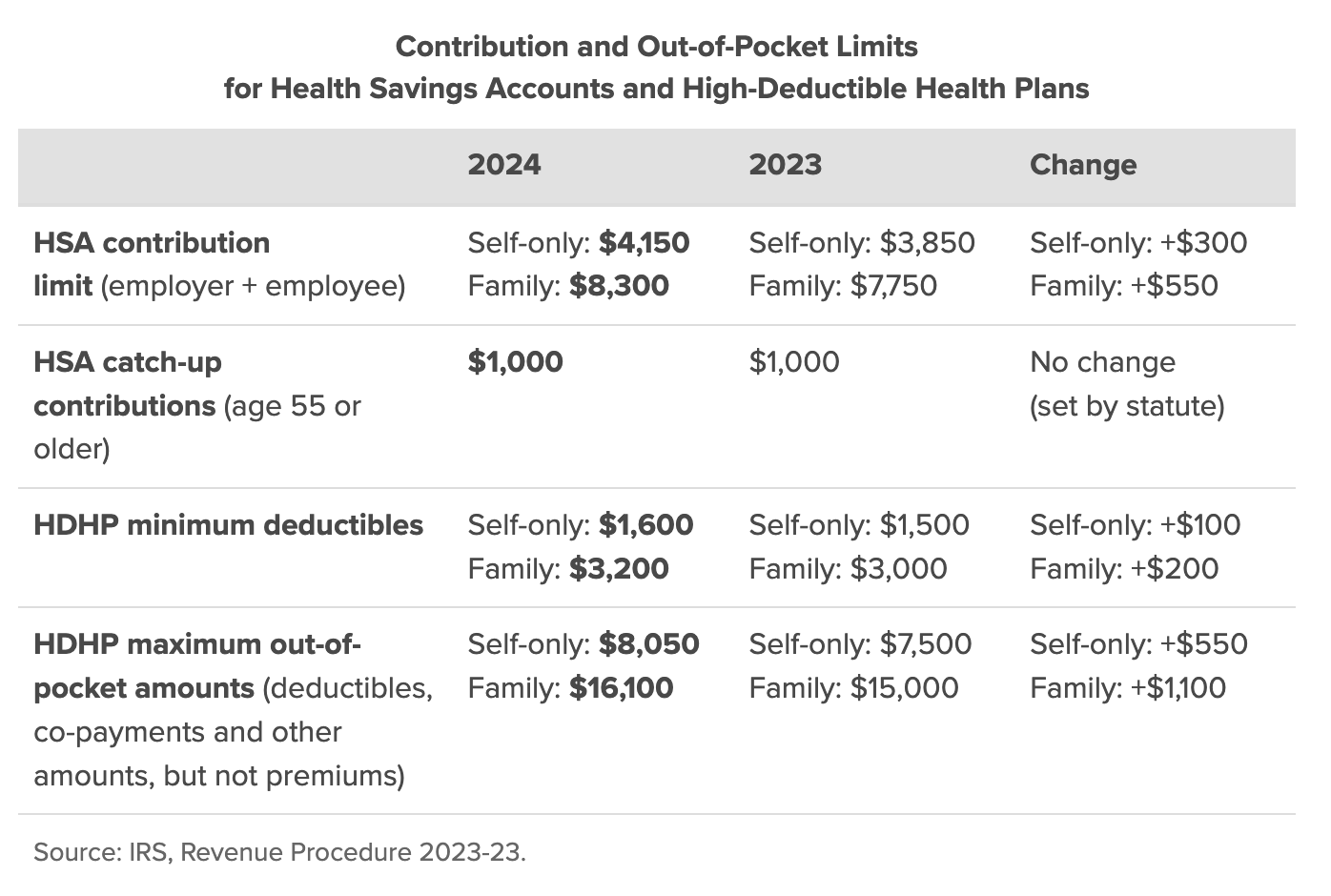

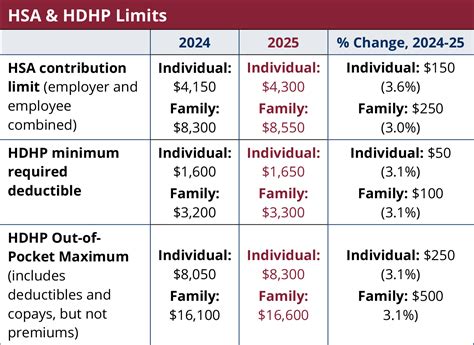

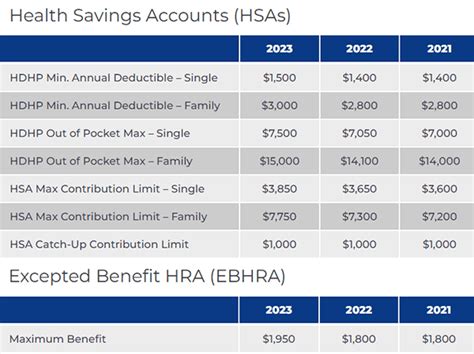

For the calendar year 2023, the IRS announced that the annual contribution limit for individuals with self-only HDHP coverage is 3,850, while for those with family HDHP coverage, the limit is 7,750. It’s also important to note that individuals aged 55 or older by the end of the tax year can contribute an additional $1,000 as a catch-up contribution, which does not count towards the annual limit. These figures are crucial for planning purposes, as they dictate how much can be set aside on a tax-advantaged basis for health care expenses.

Importance of Maximizing HSA Contributions

Maximizing HSA contributions can have significant long-term benefits. Contributions are made with pre-tax dollars, reducing taxable income for the year. The funds grow tax-free, and withdrawals for qualified medical expenses are tax-free as well. This triple tax advantage makes HSAs an attractive option for health care savings. Furthermore, unlike Flexible Spending Accounts (FSAs), HSA funds roll over from year to year, allowing individuals to build a substantial health care savings nest egg over time.

| Year | Individual Limit | Family Limit | Catch-up Contribution |

|---|---|---|---|

| 2022 | $3,650 | $7,300 | $1,000 |

| 2023 | $3,850 | $7,750 | $1,000 |

Key Points

- The HSA max contribution for individuals in 2023 is $3,850, and for families, it is $7,750.

- Individuals aged 55 or older can make an additional $1,000 catch-up contribution.

- HSA contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses.

- Contributions should be maximized each year to take full advantage of the tax benefits and long-term savings potential.

- Understanding and utilizing the annual contribution limits is vital for effective health care financial planning.

Strategic Planning for HSA Contributions

When planning for HSA contributions, it’s essential to consider not just the current year’s limits but also long-term health care needs. Since HSA funds can be used in retirement for medical expenses, maximizing contributions during working years can provide a significant source of funds for health care costs when they are likely to be higher. Additionally, considering the HDHP premiums and out-of-pocket costs alongside the HSA contributions can help in making informed decisions about health insurance choices.

Impact of HSA on Retirement Planning

The role of HSAs in retirement planning cannot be overstated. By maximizing HSA contributions and allowing the funds to grow over time, individuals can create a dedicated source of funds for health care expenses in retirement, which are often among the most significant expenses retirees face. This can help in mitigating the impact of health care costs on retirement savings, ensuring that more of the retirement portfolio can be dedicated to living expenses and other retirement goals.

In conclusion, understanding and maximizing the HSA max contribution is a critical component of a comprehensive financial plan, particularly for managing health care expenses. By leveraging the tax advantages and long-term growth potential of HSAs, individuals can better prepare for current and future health care needs, ultimately enhancing their financial security and peace of mind.

What are the eligibility requirements for contributing to an HSA?

+To be eligible for an HSA, an individual must have a high-deductible health plan (HDHP) and cannot be enrolled in any other health coverage, such as a health Flexible Spending Account (FSA) or a health reimbursement arrangement (HRA), that provides benefits before the HDHP deductible is met. They also cannot be eligible for Medicare or be claimed as a dependent on someone else’s tax return.

How can HSA funds be used?

+HSA funds can be used to pay for qualified medical expenses, which include a wide range of health care services and products, such as doctor visits, hospital stays, prescription medications, and medical equipment. Funds can also be used for certain health insurance premiums, such as COBRA premiums or health insurance premiums while receiving unemployment benefits.

What happens to HSA funds upon retirement or death?

+Upon retirement, HSA funds can continue to be used for qualified medical expenses without penalty or taxes. If used for non-medical expenses after age 65, the withdrawal is subject to income tax but not penalties. Upon death, if the beneficiary is a spouse, the HSA becomes the spouse’s HSA, and they can use it as their own. If the beneficiary is not a spouse, the HSA ceases to be an HSA as of the date of death, and the beneficiary is subject to income tax on the fair market value of the assets as of the date of death.