In the United States, insurance is an essential aspect of personal and commercial life, providing individuals and businesses with financial protection against various risks and unforeseen events. Among the many types of insurance available, State Insurance plays a crucial role in safeguarding residents and their assets. This article aims to delve into the intricacies of State Insurance, exploring its definition, coverage options, benefits, and the impact it has on individuals and communities.

Understanding State Insurance

State Insurance, often referred to as state-based insurance or state-regulated insurance, is a system where insurance policies and regulations are primarily governed and administered by individual states rather than the federal government. Each state in the US has its own set of insurance laws, regulations, and oversight bodies, resulting in a diverse landscape of insurance coverage and practices across the nation.

The primary objective of State Insurance is to ensure that residents have access to affordable and comprehensive insurance options tailored to their specific needs and the unique characteristics of their state. This approach allows for a more localized and flexible insurance market, adapting to the diverse requirements of different regions and populations.

Key Features of State Insurance

- State-Specific Coverage: State Insurance policies are designed to address the unique risks and challenges specific to each state. For instance, a state with a high risk of natural disasters may offer specialized coverage for residents to protect against such events.

- Localized Regulation: State insurance departments oversee and regulate insurance companies operating within their state boundaries. This localized regulation ensures that insurance providers adhere to specific state requirements and standards.

- Consumer Protection: State insurance laws often include consumer protection measures, such as requirements for clear and concise policy language, fair claim handling practices, and measures to prevent insurance fraud.

- Community Support: State Insurance often includes provisions for supporting local communities, such as funding for disaster relief efforts or programs to assist low-income residents with insurance access.

Coverage Options and Benefits

State Insurance offers a wide range of coverage options to meet the diverse needs of residents. Here are some key areas where State Insurance provides valuable protection:

1. Property Insurance

State Insurance typically includes property insurance policies, covering homes, businesses, and personal belongings. These policies provide financial protection against damages caused by various perils, including fire, theft, natural disasters, and more. Many states have specific requirements for property insurance, ensuring residents have adequate coverage to rebuild and recover in the event of a loss.

2. Health Insurance

State-based health insurance plays a critical role in providing access to healthcare services. Many states have implemented programs and initiatives to expand healthcare coverage, especially for low-income residents and those with pre-existing conditions. State-regulated health insurance plans often offer essential health benefits, including doctor visits, hospital stays, prescription drugs, and preventive care.

3. Auto Insurance

Auto insurance is a mandatory requirement in most states. State Insurance ensures that drivers have adequate coverage to protect themselves and others in the event of an accident. This typically includes liability coverage, personal injury protection (PIP), and options for comprehensive and collision coverage. State-regulated auto insurance helps maintain road safety and provides financial security for drivers and their passengers.

4. Life Insurance

State Insurance also offers life insurance policies, providing financial support to beneficiaries in the event of the policyholder’s death. Life insurance can help cover funeral expenses, pay off debts, and provide ongoing financial support for loved ones. State-regulated life insurance policies often include term life and permanent life insurance options, allowing individuals to choose coverage based on their specific needs.

5. Business Insurance

For businesses, State Insurance provides a range of coverage options to protect against various risks. This includes commercial property insurance, liability insurance, workers’ compensation, and business interruption insurance. These policies help businesses mitigate financial losses, protect their assets, and ensure the well-being of their employees.

The Impact of State Insurance

State Insurance has a profound impact on the lives of residents and the overall well-being of communities. Here are some key ways in which State Insurance makes a difference:

1. Financial Security

State Insurance provides individuals and businesses with the financial security they need to recover from unexpected events. Whether it’s a house fire, a serious illness, or a business disruption, insurance coverage ensures that people have the resources to rebuild, seek medical treatment, or continue operating their businesses.

2. Access to Healthcare

State-based health insurance programs have expanded access to healthcare services for millions of Americans. By regulating insurance providers and implementing initiatives like Medicaid expansion, states have made healthcare more affordable and accessible, especially for vulnerable populations.

3. Community Resilience

State Insurance plays a vital role in building community resilience. In the face of natural disasters or widespread emergencies, insurance coverage helps communities recover more quickly. State-regulated insurance programs often include provisions for rapid claim processing and disaster relief, ensuring that residents can rebuild their homes and lives.

4. Economic Stability

The insurance industry, driven by state regulations, contributes significantly to the economy. It provides employment opportunities, stimulates economic growth, and supports various industries. Additionally, insurance coverage encourages businesses to invest and expand, knowing they have protection against potential risks.

5. Consumer Empowerment

State insurance regulations empower consumers by ensuring transparency and fairness in the insurance market. Residents have the right to understand their policies, file claims without discrimination, and seek redress for any unfair practices. State oversight bodies play a crucial role in protecting consumer rights and promoting ethical insurance practices.

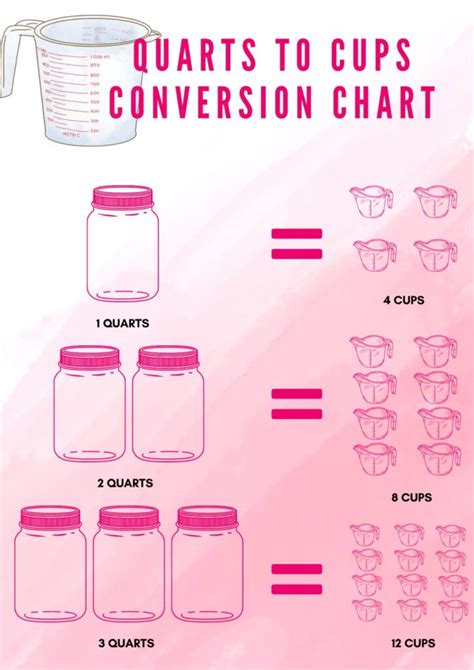

| State | Insurance Focus |

|---|---|

| California | Earthquake Insurance |

| Florida | Hurricane and Flood Insurance |

| New York | Renters Insurance and Cyber Insurance |

How does State Insurance differ from Federal Insurance?

+State Insurance and Federal Insurance operate at different levels of government, with State Insurance being regulated by individual states and Federal Insurance being governed by the federal government. State Insurance focuses on localized needs and risks, while Federal Insurance often addresses nationwide concerns, such as social security and Medicare.

What are the benefits of having state-regulated insurance?

+State-regulated insurance offers several benefits, including localized coverage tailored to specific state risks, consumer protection measures, and support for community initiatives. It also allows for more flexibility and adaptability in insurance practices, ensuring residents have access to affordable and comprehensive coverage.

How can I find out more about my state’s insurance regulations and coverage options?

+You can visit your state’s insurance department website, which provides detailed information on insurance laws, regulations, and coverage options. Additionally, insurance agents and brokers can offer guidance on state-specific insurance policies and help you find the right coverage for your needs.