The state of Indiana, like many other states in the United States, has its own set of minimum wage laws that dictate the lowest amount of money that employers can pay their employees per hour. These laws are designed to protect workers from exploitation and ensure that they are fairly compensated for their labor. In this article, we will delve into the specifics of Indiana's minimum wage rates, exploring the history, current rates, and any exemptions or exceptions that may apply.

Key Points

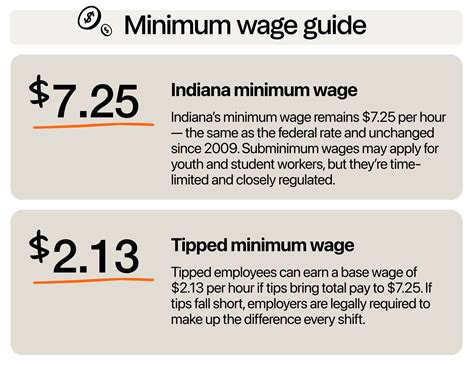

- Indiana's minimum wage rate is currently $7.25 per hour, which is the same as the federal minimum wage.

- The state's minimum wage applies to most employees, including those who work in the private and public sectors.

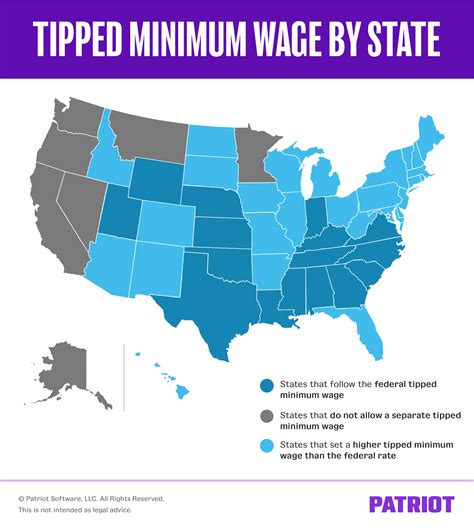

- Certain employees, such as tipped workers, students, and individuals with disabilities, may be subject to different minimum wage rates or exemptions.

- Employers in Indiana are required to pay overtime to employees who work more than 40 hours in a workweek, at a rate of at least 1.5 times the employee's regular rate of pay.

- Indiana's minimum wage laws are enforced by the Indiana Department of Labor, which is responsible for investigating complaints and imposing penalties on employers who violate the law.

History of Indiana’s Minimum Wage Rates

Indiana’s minimum wage laws have a long and varied history, dating back to the early 20th century. In 1938, the federal government established a national minimum wage of 0.25 per hour, which applied to all states, including Indiana. Over the years, the minimum wage has been increased numerous times, with the most recent increase occurring in 2009, when the federal minimum wage was raised to 7.25 per hour. Indiana’s minimum wage has remained at this level ever since, although there have been efforts to raise it in recent years.

Current Minimum Wage Rates in Indiana

As of 2023, the minimum wage rate in Indiana is $7.25 per hour, which is the same as the federal minimum wage. This rate applies to most employees, including those who work in the private and public sectors. However, there are some exceptions and exemptions, which we will discuss below.

| Minimum Wage Rate | Applicability |

|---|---|

| $7.25 per hour | Most employees, including private and public sector workers |

| $2.13 per hour | Tipped workers, such as restaurant and bar employees |

| $4.25 per hour | Students who work part-time or seasonal jobs |

Exemptions and Exceptions to Indiana’s Minimum Wage Laws

While Indiana’s minimum wage laws apply to most employees, there are some exemptions and exceptions. For example, tipped workers, such as restaurant and bar employees, may be paid a lower minimum wage of 2.13 per hour, as long as their tips bring their total hourly wage up to the standard minimum wage. Students who work part-time or seasonal jobs may also be subject to a lower minimum wage of 4.25 per hour. Additionally, individuals with disabilities may be paid a subminimum wage, with the approval of the Indiana Department of Labor.

Overtime Pay in Indiana

Employers in Indiana are required to pay overtime to employees who work more than 40 hours in a workweek, at a rate of at least 1.5 times the employee’s regular rate of pay. This means that if an employee is paid 7.25 per hour, their overtime rate would be 10.88 per hour. However, there are some exceptions to this rule, such as for employees who are exempt from overtime pay under federal or state law.

Enforcement of Indiana’s Minimum Wage Laws

Indiana’s minimum wage laws are enforced by the Indiana Department of Labor, which is responsible for investigating complaints and imposing penalties on employers who violate the law. Employers who fail to pay their employees the minimum wage may be subject to fines, penalties, and other sanctions, including back pay and damages. Employees who believe they have been underpaid or subjected to wage theft may file a complaint with the Indiana Department of Labor or seek private legal action.

What is the current minimum wage rate in Indiana?

+The current minimum wage rate in Indiana is $7.25 per hour, which is the same as the federal minimum wage.

Are there any exceptions to Indiana's minimum wage laws?

+Yes, there are some exceptions to Indiana's minimum wage laws, including for tipped workers, students, and individuals with disabilities.

How are Indiana's minimum wage laws enforced?

+Indiana's minimum wage laws are enforced by the Indiana Department of Labor, which is responsible for investigating complaints and imposing penalties on employers who violate the law.

In conclusion, Indiana’s minimum wage rates are an important aspect of the state’s labor laws, and employers and employees alike should be aware of the current rates and any exemptions or exceptions that may apply. By understanding and complying with these laws, employers can ensure that they are treating their employees fairly and providing them with the compensation they deserve. As the state’s economy continues to evolve, it will be important to monitor any changes or updates to Indiana’s minimum wage laws and to stay informed about any new developments or trends in the field.