In the realm of financial services and risk management, insurance agents play a pivotal role in guiding individuals and businesses through the complex world of insurance policies. Their expertise and counsel are invaluable in ensuring that clients are adequately protected against various life uncertainties and unforeseen risks. This article delves into the multifaceted role of insurance agents, exploring their responsibilities, qualifications, and the significant impact they have on their clients' financial security and peace of mind.

The Essential Role of Insurance Agents

Insurance agents, often referred to as insurance brokers or advisors, are professionals who specialize in guiding clients through the intricate process of selecting, purchasing, and managing insurance policies. These policies encompass a broad spectrum, including health, life, property, and liability insurance, to name a few. The primary objective of insurance agents is to provide their clients with personalized insurance solutions tailored to their unique needs and circumstances.

One of the key strengths of insurance agents lies in their ability to offer impartial advice. Unlike direct sales representatives employed by insurance companies, agents are independent and can provide unbiased recommendations across a range of insurance providers. This independence ensures that clients receive objective guidance, helping them make informed decisions about their insurance coverage.

Qualifications and Expertise

Becoming an insurance agent requires a combination of educational qualifications, professional training, and practical experience. While specific requirements may vary by jurisdiction, most agents are required to possess a high school diploma or equivalent as a minimum educational benchmark. However, many agents opt to pursue higher education, often obtaining bachelor’s or master’s degrees in fields such as finance, business administration, or insurance studies.

In addition to formal education, insurance agents must undergo rigorous professional training. This training equips them with a deep understanding of insurance products, policies, and regulations. They learn about various types of insurance, risk assessment, policy underwriting, and claims management. Agents also develop strong communication and interpersonal skills, enabling them to effectively interact with clients and insurance companies alike.

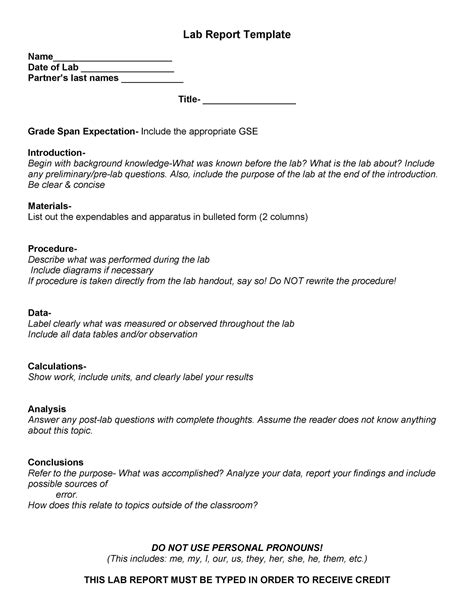

Licensing and Certifications

To practice as an insurance agent, individuals must obtain the necessary licenses and certifications. Licensing requirements typically involve passing comprehensive exams that test an agent’s knowledge of insurance principles, products, and legal regulations. These exams ensure that agents possess the requisite expertise to provide sound advice and manage insurance policies effectively.

Furthermore, insurance agents often pursue additional certifications to enhance their credentials and demonstrate advanced proficiency in specific insurance areas. Some popular certifications include the Certified Insurance Counselor (CIC), Chartered Property Casualty Underwriter (CPCU), and Associate in Insurance Services (AIS) designations. These certifications require agents to undergo advanced training and pass rigorous exams, further solidifying their expertise and standing within the industry.

| Certification | Description |

|---|---|

| Certified Insurance Counselor (CIC) | A comprehensive program focusing on various insurance aspects, including risk management, insurance law, and agency operations. |

| Chartered Property Casualty Underwriter (CPCU) | A specialized certification for agents dealing with property and casualty insurance, covering risk management, underwriting, and claims handling. |

| Associate in Insurance Services (AIS) | A foundational certification for insurance professionals, covering the basics of insurance principles, products, and regulations. |

Services Offered by Insurance Agents

Insurance agents provide a comprehensive range of services to their clients, ensuring they receive holistic insurance coverage and support. Here’s an overview of some key services:

Insurance Policy Selection

One of the primary responsibilities of insurance agents is to assist clients in selecting the most suitable insurance policies. This involves understanding the client’s unique circumstances, financial goals, and risk tolerance. Agents then leverage their expertise to recommend policies that align with these factors, ensuring adequate coverage without unnecessary costs.

Policy Purchase and Management

Once the appropriate insurance policies have been identified, insurance agents guide clients through the purchasing process. They assist with filling out necessary paperwork, explaining policy terms and conditions, and ensuring that clients understand their rights and obligations under the policy. Agents also help clients manage their policies over time, making adjustments as needed to reflect changing circumstances or market conditions.

Claims Assistance

In the event of an insured loss or accident, insurance agents provide invaluable support to their clients. They guide clients through the claims process, helping them understand their rights and responsibilities. Agents often facilitate communication between clients and insurance companies, ensuring that claims are processed efficiently and fairly. This assistance can be particularly crucial during stressful situations, providing clients with peace of mind and ensuring they receive the benefits they are entitled to.

Risk Management and Mitigation

Insurance agents play a proactive role in helping clients manage and mitigate risks. They assess potential risks and vulnerabilities associated with a client’s assets, business, or personal circumstances. By identifying these risks, agents can recommend appropriate insurance coverage to protect against potential losses. Additionally, they may provide risk management strategies and resources to help clients reduce the likelihood of adverse events.

Education and Awareness

Insurance agents serve as trusted sources of information and education for their clients. They help clients understand the complexities of insurance, explaining policy provisions, exclusions, and limitations in plain language. By demystifying insurance concepts, agents empower clients to make informed decisions about their coverage and financial security.

The Impact of Insurance Agents on Client Outcomes

The role of insurance agents extends beyond the simple transaction of insurance policies. Their impact on client outcomes is significant and far-reaching. Here are some key ways in which insurance agents contribute to positive client experiences and financial security:

Personalized Guidance

Insurance agents provide personalized advice and guidance tailored to each client’s unique needs. By understanding their clients’ circumstances, agents can recommend insurance solutions that address specific risks and concerns. This personalized approach ensures that clients receive coverage that aligns with their goals and provides the necessary protection.

Cost-Effective Coverage

Insurance agents are adept at finding the most cost-effective insurance solutions for their clients. They compare policies from various providers, negotiating rates and coverage terms to secure the best value for their clients. By leveraging their industry knowledge and relationships, agents can often obtain favorable rates and customized policies, ensuring clients receive comprehensive coverage without unnecessary expenses.

Streamlined Claims Process

When an insured event occurs, the claims process can be complex and stressful. Insurance agents provide invaluable support during this process, guiding clients through the necessary steps and advocating on their behalf. By facilitating communication with insurance companies, agents help ensure that claims are processed efficiently and fairly, minimizing delays and potential complications.

Risk Mitigation and Loss Prevention

Insurance agents go beyond providing insurance coverage; they also play a proactive role in helping clients mitigate risks and prevent losses. By identifying potential vulnerabilities, agents can recommend risk management strategies and resources to reduce the likelihood of adverse events. This proactive approach not only helps clients avoid losses but also contributes to a more sustainable and secure financial future.

Education and Financial Literacy

Insurance agents serve as educators, helping clients understand the intricacies of insurance and financial planning. By demystifying complex insurance concepts, agents empower clients to make informed decisions about their coverage and overall financial well-being. This education extends beyond insurance, providing clients with valuable knowledge and tools to navigate the broader financial landscape.

Conclusion

Insurance agents are indispensable professionals in the world of financial services, offering expertise, guidance, and support to individuals and businesses seeking insurance coverage. Their role extends beyond policy selection and purchase, encompassing personalized advice, risk management, and claims assistance. With their qualifications, certifications, and deep understanding of the insurance landscape, insurance agents play a crucial role in safeguarding their clients’ financial security and peace of mind. As the insurance industry continues to evolve, the expertise and services provided by insurance agents remain vital in helping clients navigate the complexities of risk management and financial planning.

What are the key responsibilities of insurance agents?

+Insurance agents have a diverse range of responsibilities, including guiding clients through policy selection, assisting with policy purchases and management, facilitating the claims process, providing risk management strategies, and offering educational support to clients.

How do insurance agents help with risk management?

+Insurance agents assess potential risks associated with a client’s assets or circumstances and recommend appropriate insurance coverage to mitigate those risks. They also provide resources and strategies to help clients proactively manage and reduce potential losses.

What are some popular certifications for insurance agents?

+Some popular certifications for insurance agents include the Certified Insurance Counselor (CIC), Chartered Property Casualty Underwriter (CPCU), and Associate in Insurance Services (AIS). These certifications demonstrate advanced proficiency in specific insurance areas.