In today's complex financial landscape, understanding the intricacies of business entities and their legal implications is crucial. This article delves into the world of Insurance Limited Liability Companies (LLCs), a unique business structure that combines the advantages of limited liability with the flexibility of a traditional insurance company.

Unraveling the Concept of Insurance LLCs

An Insurance Limited Liability Company is a business entity that operates in the insurance industry while offering the protection of limited liability to its owners. This hybrid structure provides a distinct advantage over traditional corporations, making it an attractive option for insurance professionals and entrepreneurs alike.

Legal Framework and Formation

The formation of an Insurance LLC begins with a comprehensive understanding of the legal requirements specific to the insurance industry. These entities are governed by a combination of state insurance regulations and LLC laws, ensuring a robust framework for operation.

To establish an Insurance LLC, entrepreneurs must navigate a meticulous process that includes securing the necessary licenses and registrations. This process often involves close collaboration with state insurance departments and the completion of comprehensive documentation.

| Key Steps in Forming an Insurance LLC |

|---|

| 1. Choose a unique business name that complies with state regulations. |

| 2. File Articles of Organization with the state, outlining the company's structure and purpose. |

| 3. Obtain an Insurance Producer License for each individual involved in selling insurance products. |

| 4. Register with the National Association of Insurance Commissioners (NAIC) to ensure compliance with national standards. |

| 5. Secure an Insurance Company License specific to the type of insurance products offered. |

Advantages of the Insurance LLC Structure

The Insurance LLC structure offers a range of benefits that make it an appealing choice for those in the insurance industry.

- Limited Liability Protection: One of the most significant advantages is the protection of personal assets. In an Insurance LLC, owners' personal assets are generally shielded from business debts and liabilities, providing a crucial layer of security.

- Flexibility and Tax Efficiency: Insurance LLCs enjoy the flexibility of pass-through taxation, allowing profits and losses to be reported on personal tax returns. This structure can result in significant tax savings compared to traditional corporations.

- Professional Credibility: Operating as an Insurance LLC can enhance credibility in the eyes of clients and partners, demonstrating a commitment to the industry and a solid understanding of its legal requirements.

- Member Management and Ownership: Insurance LLCs offer flexibility in ownership and management structures, allowing for multiple members and the ability to tailor the company's governance to the needs of its owners.

Operational Considerations

While the Insurance LLC structure provides numerous advantages, it also comes with specific operational considerations that must be carefully managed.

- Regulatory Compliance: Insurance LLCs must adhere to a myriad of regulations, including those governing insurance practices, consumer protection, and financial reporting. Staying abreast of these regulations is crucial to avoid legal issues.

- Member Management: With the flexibility of multiple members, Insurance LLCs must establish clear operating agreements that define roles, responsibilities, and decision-making processes. Effective member management is key to the company's long-term success.

- Risk Management: The limited liability protection of an Insurance LLC does not eliminate all risks. Owners must implement robust risk management strategies to protect the company and its members from potential liabilities.

Performance Analysis and Industry Insights

The performance of Insurance LLCs can vary significantly based on factors such as industry niche, geographic location, and management expertise. A thorough analysis of key performance indicators (KPIs) is essential to understanding the success and potential of these entities.

| Insurance LLC Performance Metrics | Key Indicators |

|---|---|

| Financial Health |

|

| Operational Efficiency |

|

| Market Position |

|

Future Implications and Industry Trends

The insurance industry is undergoing significant transformations, and the role of Insurance LLCs is likely to evolve alongside these changes. Here are some key future implications and trends to consider:

- Technological Integration: The adoption of advanced technologies, such as artificial intelligence and blockchain, is expected to revolutionize the insurance industry. Insurance LLCs that embrace these innovations may gain a competitive edge.

- Regulatory Changes: As the insurance landscape evolves, so too will the regulatory environment. Insurance LLCs must stay abreast of these changes to ensure continued compliance and avoid potential disruptions.

- Collaborative Partnerships: The future may see increased collaboration between Insurance LLCs and traditional insurance companies, as well as other industry players. These partnerships could lead to enhanced services, improved risk management, and expanded market reach.

- Consumer Expectations: Shifting consumer preferences and expectations will shape the insurance industry. Insurance LLCs that adapt to changing consumer needs, such as offering personalized policies and digital-first experiences, are likely to thrive.

Conclusion: Embracing the Potential of Insurance LLCs

The Insurance Limited Liability Company structure offers a unique and powerful combination of limited liability protection, flexibility, and industry credibility. While the formation and operation of these entities require careful navigation of legal and operational considerations, the potential rewards are significant.

By understanding the advantages, challenges, and future implications of Insurance LLCs, entrepreneurs and industry professionals can make informed decisions about this innovative business structure. As the insurance industry continues to evolve, the role of Insurance LLCs is poised to grow, offering a dynamic and exciting path for those willing to explore its potential.

How do Insurance LLCs differ from traditional insurance companies?

+Insurance LLCs offer a distinct advantage over traditional insurance companies by providing limited liability protection to their owners. This means that personal assets are generally shielded from business debts and liabilities, a feature not typically found in traditional corporate structures.

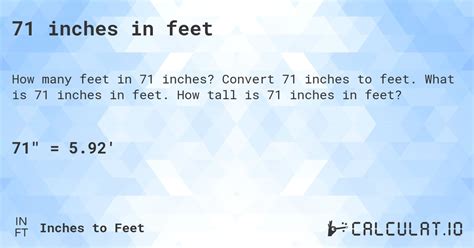

What are the key steps in forming an Insurance LLC?

+The formation process involves choosing a unique business name, filing Articles of Organization, obtaining Insurance Producer Licenses for individuals involved in selling insurance, registering with the National Association of Insurance Commissioners (NAIC), and securing an Insurance Company License specific to the type of insurance products offered.

What are the advantages of the Insurance LLC structure?

+Insurance LLCs provide limited liability protection, flexibility in tax efficiency and ownership management, and enhanced professional credibility. They offer a more personalized and adaptable approach to the insurance industry.