In the intricate world of insurance, a concept known as an insurance umbrella stands out as a powerful tool for individuals and businesses alike. This comprehensive coverage goes beyond the basic policies, offering an extra layer of protection that can prove invaluable in various scenarios. Understanding insurance umbrellas is essential for anyone seeking to secure their financial future and mitigate risks effectively.

Unveiling the Insurance Umbrella: An Overview

An insurance umbrella, often referred to simply as an umbrella policy, is an additional layer of liability insurance that provides coverage beyond the limits of standard policies. It acts as a safety net, offering protection for unforeseen events that may lead to significant financial liabilities. This type of insurance is particularly valuable for those who wish to safeguard their assets and future earnings from potential legal claims or unforeseen circumstances.

For instance, imagine a scenario where an individual faces a lawsuit resulting from an accident. Even with basic liability insurance, the damages awarded by the court might exceed the policy's coverage limits. This is where an insurance umbrella steps in, offering the necessary coverage to protect the individual's assets and ensuring they are not financially devastated by the legal proceedings.

The Benefits of Insurance Umbrellas

Enhanced Protection for Your Assets

One of the primary advantages of an insurance umbrella is the increased level of protection it provides for your assets. Whether you own a home, valuable investments, or a business, an umbrella policy ensures that these assets are shielded from potential financial losses. By extending your liability coverage, you gain peace of mind knowing that your financial stability is secured.

Consider a business owner who, despite having commercial liability insurance, faces a lawsuit alleging significant damages. Without an umbrella policy, the business owner might be forced to cover the excess costs out of pocket, potentially threatening the financial viability of their enterprise. An insurance umbrella prevents such scenarios, allowing businesses to operate with confidence.

Broader Coverage for Multiple Policies

Insurance umbrellas are versatile and can be tailored to cover a wide range of policies. This means you can consolidate your insurance needs under a single, comprehensive policy. Whether it’s auto, home, or business insurance, an umbrella policy can provide an extra layer of protection, simplifying your insurance portfolio and potentially reducing administrative burdens.

For example, a family with multiple properties and vehicles might find it convenient to have an umbrella policy that covers all these assets. This not only simplifies their insurance management but also ensures that their assets are protected across various potential liabilities.

Cost-Effective Solution for High-Risk Scenarios

While insurance umbrellas offer extensive coverage, they are often more cost-effective than one might expect, especially when compared to the potential financial risks they mitigate. For individuals or businesses operating in high-risk industries or facing unique liability concerns, an umbrella policy can be a prudent investment.

Take the case of a professional athlete who, despite having personal liability insurance, faces the risk of costly legal claims due to their high-profile status. An insurance umbrella can provide the necessary coverage to protect their earnings and assets, making it a strategic choice for managing their financial risks.

Understanding the Coverage and Limits

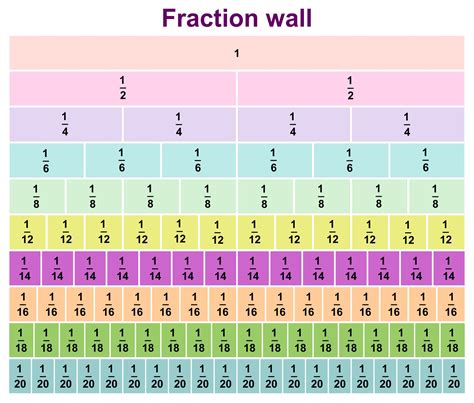

Insurance umbrellas are customizable, allowing policyholders to choose coverage limits that align with their specific needs. These limits can range from a few hundred thousand dollars to several million, depending on the individual’s or business’s financial capacity and potential liabilities.

| Policy Type | Coverage Limits |

|---|---|

| Standard Homeowner's Insurance | $100,000 - $300,000 |

| Standard Auto Insurance | $50,000 - $100,000 per person |

| Insurance Umbrella (Additional) | $1,000,000 - $5,000,000 |

It's important to note that the coverage provided by an insurance umbrella is triggered only after the underlying policies have been exhausted. This means that your basic insurance policies, such as auto or homeowner's insurance, must first reach their limits before the umbrella policy kicks in.

Real-World Applications: Case Studies

Business Liability Protection

Consider a small business owner who operates a popular local restaurant. Despite having commercial liability insurance, a customer slip-and-fall incident results in a lawsuit seeking substantial damages. The business owner’s insurance umbrella policy steps in, covering the excess costs and preventing the business from facing financial ruin.

Personal Injury Protection

An individual with an insurance umbrella policy faces a serious accident while driving. The accident results in significant injuries to multiple people. While their auto insurance covers the initial costs, the umbrella policy provides additional coverage, ensuring that the policyholder’s assets are protected and they can focus on their recovery.

Professional Liability Scenarios

A professional, such as a doctor or lawyer, faces a malpractice lawsuit. Even with professional liability insurance, the potential damages are substantial. Here, an insurance umbrella acts as a vital backup, providing the necessary coverage to protect the professional’s financial interests and reputation.

Frequently Asked Questions (FAQ)

How much does an insurance umbrella policy typically cost?

+

The cost of an insurance umbrella policy can vary depending on the policyholder’s location, the coverage limits chosen, and their existing insurance policies. On average, an umbrella policy can cost between 150 and 300 annually for each $1 million in coverage. However, it’s essential to consult with an insurance professional to determine the most suitable and cost-effective option for your specific needs.

Can an insurance umbrella policy be used for any type of liability claim?

+

Insurance umbrella policies are designed to provide broad liability coverage. However, certain types of claims, such as those related to intentional acts or criminal activities, may not be covered. It’s crucial to review the policy’s terms and conditions to understand the specific exclusions and limitations.

Are there any advantages to combining an insurance umbrella with other policies?

+

Yes, combining an insurance umbrella with other policies, such as homeowner’s or auto insurance, can offer several advantages. It simplifies your insurance portfolio, provides a more comprehensive level of protection, and may even result in cost savings due to potential discounts for bundling policies.

What happens if I need to make a claim under my insurance umbrella policy?

+

If you need to make a claim under your insurance umbrella policy, you’ll typically follow a similar process as with your other insurance policies. You’ll need to contact your insurance provider, provide details about the incident or claim, and work with them to resolve the issue. It’s important to have all the necessary documentation ready and to understand the specific claim process outlined in your policy.