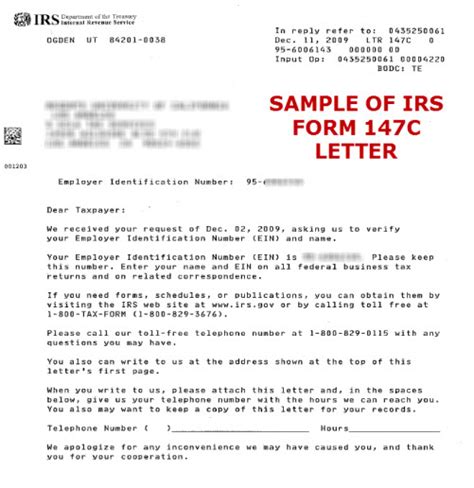

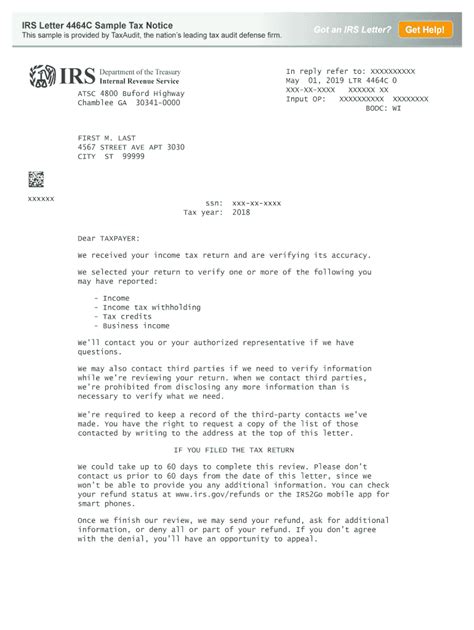

The IRS 147c letter is a notice sent by the Internal Revenue Service (IRS) to taxpayers who have been identified as having a potential issue with their tax return or account. This letter is part of the IRS's efforts to verify the identity of taxpayers and prevent fraudulent activities, such as identity theft and tax refund scams. The IRS 147c letter is typically sent to taxpayers who have submitted a tax return that the IRS suspects may be fraudulent or who have been victimized by identity theft.

Key Points

- The IRS 147c letter is a notice sent to taxpayers who have potential issues with their tax return or account.

- The letter is part of the IRS's efforts to verify taxpayer identity and prevent fraudulent activities.

- Taxpayers who receive the IRS 147c letter must respond promptly to avoid delays in processing their tax return.

- The IRS uses various methods to verify taxpayer identity, including phone calls, emails, and in-person interviews.

- Taxpayers can take steps to protect themselves from identity theft and tax scams, such as monitoring their credit reports and using strong passwords.

What to Expect from the IRS 147c Letter

The IRS 147c letter will typically include a request for the taxpayer to verify their identity by providing specific documentation or information. This may include a copy of their driver’s license, passport, or social security card, as well as proof of income and residency. The letter will also provide instructions on how to respond to the notice and what steps to take next. It is essential for taxpayers to respond promptly to the IRS 147c letter to avoid delays in processing their tax return.

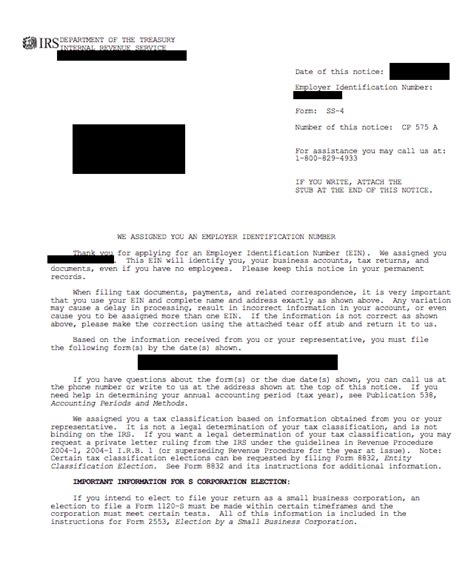

Why the IRS Sends the 147c Letter

The IRS sends the 147c letter to taxpayers who have been identified as having a potential issue with their tax return or account. This may be due to a variety of factors, including:

- Suspicious activity on the taxpayer’s account, such as multiple tax returns filed under the same name.

- Inconsistencies in the taxpayer’s return, such as a mismatch between the name and social security number.

- A report of identity theft or tax fraud from the taxpayer or a third party.

The IRS uses various methods to verify taxpayer identity, including phone calls, emails, and in-person interviews. Taxpayers who receive the IRS 147c letter should be prepared to provide documentation and answer questions to verify their identity.

| Documentation | Description |

|---|---|

| Driver's License | A valid government-issued ID with the taxpayer's name and photo. |

| Passport | A valid passport with the taxpayer's name and photo. |

| Social Security Card | A valid social security card with the taxpayer's name and social security number. |

| Proof of Income | Documentation of the taxpayer's income, such as a W-2 or 1099 form. |

| Proof of Residency | Documentation of the taxpayer's residency, such as a utility bill or lease agreement. |

Steps to Take After Receiving the IRS 147c Letter

Taxpayers who receive the IRS 147c letter should take the following steps:

- Read the letter carefully and follow the instructions provided.

- Gather the required documentation and information to verify their identity.

- Respond promptly to the IRS, either by phone, email, or mail, as instructed in the letter.

- Be prepared to answer questions and provide additional information to verify their identity.

- Consider contacting a tax professional or the IRS directly if they have questions or concerns about the notice.

Protecting Yourself from Identity Theft and Tax Scams

Taxpayers can take steps to protect themselves from identity theft and tax scams, including:

- Monitoring their credit reports and credit card statements for suspicious activity.

- Using strong passwords and keeping their personal and financial information secure.

- Being cautious of phishing scams and unsolicited emails or phone calls from the IRS.

- Filing their tax return electronically and using a secure internet connection.

- Keeping their tax-related documents and information in a safe and secure location.

By understanding the purpose and content of the IRS 147c letter, taxpayers can take the necessary steps to verify their identity and avoid delays in processing their tax return. It's also essential to take proactive steps to protect themselves from identity theft and tax scams, which can help prevent the need for the IRS 147c letter in the first place.

What is the purpose of the IRS 147c letter?

+The IRS 147c letter is sent to taxpayers who have been identified as having a potential issue with their tax return or account. The purpose of the letter is to verify the taxpayer’s identity and prevent fraudulent activities, such as identity theft and tax refund scams.

What documentation is required to respond to the IRS 147c letter?

+The documentation required to respond to the IRS 147c letter may include a copy of the taxpayer’s driver’s license, passport, or social security card, as well as proof of income and residency.

How can I protect myself from identity theft and tax scams?

+Taxpayers can protect themselves from identity theft and tax scams by monitoring their credit reports and credit card statements, using strong passwords, and being cautious of phishing scams and unsolicited emails or phone calls from the IRS.