As the tax season approaches, individuals and businesses alike must navigate the complex world of tax forms and regulations. One crucial form for certain entities is the IRS Form 147c, also known as the "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding." This form is essential for foreign individuals and entities that receive income from U.S. sources, as it helps determine their eligibility for tax treaty benefits and exemptions from U.S. withholding taxes. In this article, we will delve into the intricacies of the IRS Form 147c and provide five tips to ensure accurate and compliant submission.

Understanding the Purpose of IRS Form 147c

The primary purpose of the IRS Form 147c is to certify the foreign status of a beneficial owner, which is a person or entity that ultimately owns and controls the income received from U.S. sources. This form is typically required for foreign individuals and entities that receive income such as dividends, interest, rents, and royalties from U.S. payers. By submitting the Form 147c, foreign beneficial owners can claim benefits under U.S. tax treaties, such as reduced withholding rates or exemptions from U.S. tax withholding.

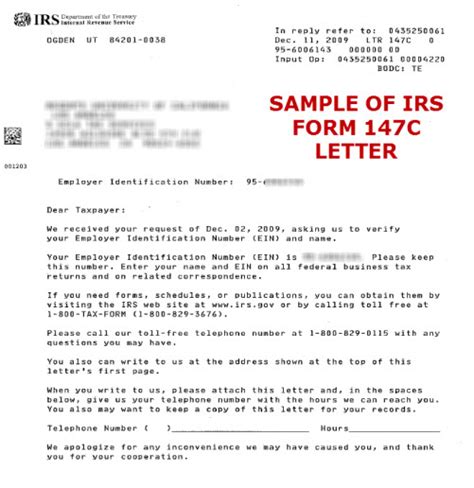

Key Components of the IRS Form 147c

The IRS Form 147c consists of several key components, including:

- Identification of the beneficial owner, including name, address, and tax identification number

- Country of residence and tax residence

- Type of income received from U.S. sources

- Claim for tax treaty benefits or exemptions

It is essential to accurately complete these components to ensure that the Form 147c is processed correctly and that the beneficial owner receives the applicable tax benefits.

| Component | Description |

|---|---|

| Part I | Identification of the beneficial owner |

| Part II | Claim for tax treaty benefits or exemptions |

| Part III | Certification and signature |

5 Tips for Completing the IRS Form 147c

To ensure accurate and compliant submission of the IRS Form 147c, follow these five tips:

- Verify the beneficial owner’s identity: Ensure that the beneficial owner’s name, address, and tax identification number are accurate and match the documentation on file.

- Determine the country of residence and tax residence: Verify the beneficial owner’s country of residence and tax residence, as this information is critical in determining eligibility for tax treaty benefits.

- Identify the type of income received: Accurately identify the type of income received from U.S. sources, such as dividends, interest, or royalties, as this information is necessary for determining the applicable withholding rate.

- Claim tax treaty benefits or exemptions: If the beneficial owner is eligible, claim the applicable tax treaty benefits or exemptions, such as reduced withholding rates or exemptions from U.S. tax withholding.

- Retain documentation: Retain a copy of the completed Form 147c and supporting documentation, such as identification documents and tax returns, in case of an audit or request for information from the IRS.

Key Points

- Accurately complete the IRS Form 147c to ensure compliance with U.S. tax laws and regulations

- Verify the beneficial owner's identity and country of residence and tax residence

- Identify the type of income received from U.S. sources

- Claim tax treaty benefits or exemptions, if eligible

- Retain documentation to support the Form 147c and tax returns

Common Challenges and Solutions

Despite the importance of the IRS Form 147c, many foreign individuals and entities face challenges in completing the form accurately and complying with the applicable tax laws and regulations. Some common challenges include:

- Lack of understanding of U.S. tax laws and regulations

- Inaccurate or incomplete documentation

- Difficulty in determining eligibility for tax treaty benefits

To overcome these challenges, it is essential to seek the advice of a qualified tax professional who has experience in international taxation and can provide guidance on completing the IRS Form 147c and ensuring compliance with the applicable tax laws and regulations.

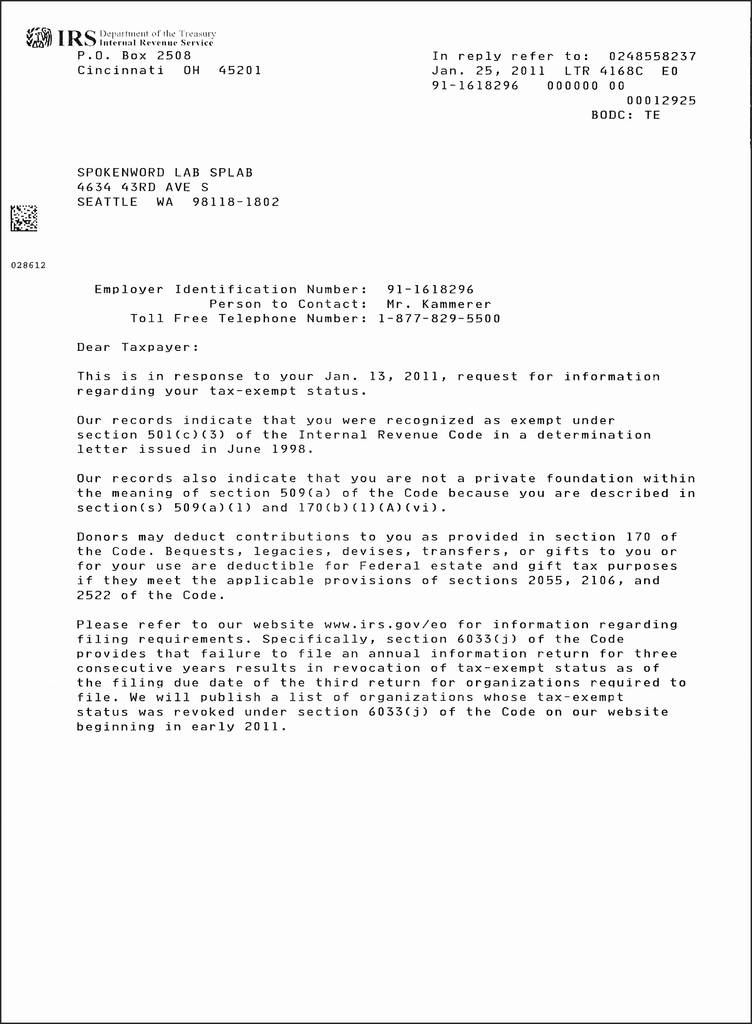

What is the purpose of the IRS Form 147c?

+The IRS Form 147c is used to certify the foreign status of a beneficial owner and claim tax treaty benefits or exemptions from U.S. withholding taxes.

Who is required to complete the IRS Form 147c?

+Foreign individuals and entities that receive income from U.S. sources are required to complete the IRS Form 147c.

What are the consequences of not completing the IRS Form 147c accurately?

+Failure to complete the IRS Form 147c accurately may result in delays or penalties, and may also affect the beneficial owner's eligibility for tax treaty benefits or exemptions.

In conclusion, the IRS Form 147c is a critical document for foreign individuals and entities that receive income from U.S. sources. By following the five tips outlined in this article and seeking the advice of a qualified tax professional, foreign beneficial owners can ensure accurate and compliant submission of the Form 147c and claim the applicable tax treaty benefits or exemptions. Remember to verify the beneficial owner’s identity, determine the country of residence and tax residence, identify the type of income received, claim tax treaty benefits or exemptions, and retain documentation to support the Form 147c and tax returns.