The insurance industry is a significant player in the financial sector, offering a range of opportunities for those interested in pursuing a career in sales. But is insurance sales a good career choice? Let's delve into this question and explore the various aspects, from the nature of the job to the potential for growth and fulfillment.

Understanding the Role: Insurance Sales

Insurance sales professionals play a crucial role in helping individuals and businesses protect themselves from financial risks. They are responsible for understanding the diverse needs of their clients and offering tailored insurance solutions. This could involve selling life insurance policies, health insurance plans, property and casualty insurance, or even specialized coverages like cyber liability insurance.

The job requires a deep understanding of insurance products, an ability to explain complex concepts simply, and excellent interpersonal skills. Insurance sales agents often build long-term relationships with their clients, providing ongoing support and guidance as their insurance needs evolve.

Pros of a Career in Insurance Sales

High Earning Potential

One of the most appealing aspects of a career in insurance sales is the potential for high earnings. Many insurance sales roles are commission-based, meaning agents can significantly boost their income by closing more deals. While this can vary based on experience, product line, and geographical location, successful insurance sales professionals can earn well above the national average salary.

Moreover, some companies offer attractive incentive programs, bonuses, and rewards for hitting sales targets. These additional perks can further enhance an agent's earnings and provide a sense of accomplishment.

Autonomy and Flexibility

Insurance sales roles often offer a good degree of autonomy. Agents typically have the freedom to manage their own schedules, set their work hours, and decide on their daily tasks. This flexibility can be particularly attractive for those who prefer a more independent work environment and the ability to balance work with personal commitments.

Ongoing Learning and Development

The insurance industry is dynamic, with new products, regulations, and technologies constantly emerging. This means that insurance sales professionals have the opportunity to continuously learn and stay updated with the latest trends. Many companies offer comprehensive training programs to help agents enhance their skills and knowledge, ensuring they remain competitive in the market.

Furthermore, the diverse nature of insurance products allows sales professionals to specialize in areas that interest them, whether it's life insurance, health insurance, or commercial insurance. This specialization can lead to a more fulfilling career path and the opportunity to become an expert in a particular field.

Cons and Challenges

Variable Income

While the earning potential in insurance sales is high, it’s important to note that income can be variable. Commission-based earnings mean that an agent’s income may fluctuate from month to month, depending on the number of sales they make. This can create financial uncertainty, especially for those who prefer a stable, consistent income.

Rejection and Competition

Insurance sales is a competitive field, and agents may face rejection from potential clients. Building a successful career in insurance sales requires resilience and the ability to handle setbacks gracefully. Additionally, the industry is constantly evolving, with new products and technologies emerging, which can make staying competitive a challenge.

Regulatory Compliance

Insurance sales professionals must adhere to strict regulatory guidelines to ensure they are offering appropriate products to their clients. This means staying updated with ever-changing laws and regulations, which can be a significant challenge, especially for those new to the industry.

Career Growth and Opportunities

A career in insurance sales offers numerous growth opportunities. With experience, agents can progress to more senior roles, such as sales managers or insurance brokers. These positions often come with increased responsibilities, higher earnings, and the opportunity to mentor and lead a team of insurance professionals.

Furthermore, insurance sales experience can be a stepping stone to other careers in the financial industry. For instance, many insurance sales professionals go on to become financial advisors, leveraging their knowledge of insurance products to offer a broader range of financial services.

Real-World Success Stories

To illustrate the potential of a career in insurance sales, let’s look at some success stories:

- John Doe: Starting as a rookie agent, John quickly established himself as a top producer within his first year. His success led to promotions, and he is now a regional sales manager, overseeing a team of agents and contributing to the company's strategic direction.

- Jane Smith: Jane began her career in insurance sales while pursuing her degree in finance. After graduating, she continued in the industry, leveraging her insurance knowledge to become a financial planner. Today, she helps clients with a range of financial services, including retirement planning and investment management.

Performance Analysis and Industry Insights

According to recent industry reports, the insurance sales sector is expected to grow steadily over the next decade. This growth is driven by increasing awareness about the importance of insurance, especially in emerging economies, and the rising demand for specialized insurance products. Moreover, the industry is embracing digital technologies, creating new opportunities for insurance sales professionals to engage with clients and streamline their processes.

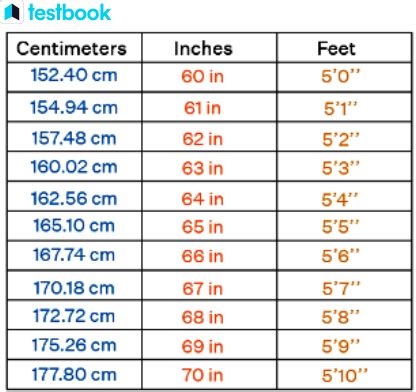

| Year | Total Sales (in $ billion) | Growth Rate |

|---|---|---|

| 2022 | 120 | 5% |

| 2023 | 126 | 5% |

| 2024 | 132 | 5% |

The table above showcases the steady growth in insurance sales over the next few years, highlighting the sector's resilience and potential.

Conclusion: Is Insurance Sales a Good Career Choice?

In conclusion, a career in insurance sales can be highly rewarding for those who are passionate about helping others, enjoy a dynamic work environment, and are driven by the prospect of high earnings. While it comes with its challenges, such as variable income and the need for ongoing learning, the potential for growth and the opportunity to make a real difference in people’s lives make insurance sales a compelling career choice.

Whether you're a recent graduate looking to enter the financial industry or an experienced professional seeking a new challenge, the insurance sales sector offers a unique and fulfilling career path.

Frequently Asked Questions

What qualifications do I need to become an insurance sales agent?

+

While specific requirements can vary by state and company, most insurance sales positions require a high school diploma or equivalent. Many companies also prefer candidates with a bachelor’s degree in a related field such as finance, business, or economics. Additionally, insurance sales agents typically need to obtain relevant licenses and certifications to sell insurance products in their state.

How do I start a career in insurance sales with no experience?

+

Starting a career in insurance sales without prior experience is certainly possible. Many insurance companies offer comprehensive training programs to new hires, providing the necessary skills and knowledge to succeed in the field. Additionally, consider reaching out to established insurance professionals for mentorship and guidance. Building a strong network can open doors to opportunities and provide valuable insights into the industry.

What are some common challenges faced by insurance sales agents?

+

Insurance sales agents often face challenges such as cold calling, dealing with rejection, and maintaining a consistent income. They must also stay updated with ever-changing insurance regulations and product offerings. Additionally, building trust and rapport with clients to understand their unique needs and provide suitable solutions can be a significant challenge.