In today's healthcare landscape, managing chronic conditions like type 2 diabetes is a top priority for many individuals and healthcare providers. Ozempic, a prescription medication, has gained significant attention for its effectiveness in treating diabetes. One of the critical factors influencing patients' access to medications like Ozempic is insurance coverage. In this comprehensive article, we will delve into the world of insurance coverage for Ozempic, exploring the various aspects that affect patient access and affordability.

Understanding Ozempic: A Glimpse into its Efficacy

Before we explore the intricacies of insurance coverage, let’s briefly understand why Ozempic has become a focal point in diabetes management. Ozempic, also known by its generic name Semaglutide, is a glucagon-like peptide-1 (GLP-1) receptor agonist. This medication is specifically designed to improve glycemic control in adults with type 2 diabetes. It works by stimulating insulin production and reducing glucagon secretion, thereby helping to regulate blood sugar levels.

The efficacy of Ozempic has been well-documented in clinical trials and real-world studies. Its ability to provide sustained blood sugar control has made it a popular choice among healthcare professionals. However, the cost of prescription medications can be a significant barrier for many patients, which is where insurance coverage becomes crucial.

Insurance Coverage Landscape for Ozempic

The insurance coverage landscape for Ozempic is diverse and can vary significantly depending on various factors, including the patient’s insurance plan, their specific medical needs, and the pharmaceutical benefits offered by their insurer. Let’s explore the key aspects that influence whether Ozempic is covered by insurance.

1. Insurance Plan Details

The first step in understanding Ozempic’s insurance coverage is to carefully examine your insurance plan’s details. Different insurance providers, whether they are private companies or government-sponsored programs, offer varying levels of coverage for prescription medications. Here are some key plan-specific factors to consider:

- Prescription Drug Formulary: Most insurance plans maintain a list of covered medications known as a formulary. This list outlines the drugs that are covered by the insurance provider and often categorizes them into tiers based on their cost and medical necessity. Ozempic's position on this formulary will determine its coverage and cost to the patient.

- Tier Placement: Medications are typically categorized into tiers within a formulary. Tier 1 usually includes the most cost-effective and commonly prescribed drugs, while higher tiers may involve higher copays or coinsurance for the patient. Ozempic's tier placement will impact its affordability for patients.

- Specialty Medication Coverage: Some insurance plans categorize medications like Ozempic as specialty drugs, which are typically used to treat complex or chronic conditions. Specialty medications often have separate coverage and cost-sharing structures, so understanding your plan's specialty drug benefits is crucial.

- Prior Authorization Requirements: Many insurance providers require prior authorization (PA) for certain medications, including Ozempic. This means that your healthcare provider must obtain approval from the insurance company before prescribing the medication. PA requirements can impact the time it takes to obtain Ozempic and may involve additional paperwork.

2. Medical Necessity and Physician’s Role

The medical necessity of Ozempic for an individual patient is a critical factor in insurance coverage. Insurance providers typically evaluate the medical necessity of a medication based on the patient’s specific health condition and treatment history. Here’s how this factor comes into play:

- Prescriber's Assessment: Your healthcare provider plays a pivotal role in determining the medical necessity of Ozempic for your condition. They will consider factors such as your current diabetes management, response to previous treatments, and overall health to determine if Ozempic is the most appropriate medication for you.

- Evidence-Based Guidelines: Insurance companies often refer to evidence-based guidelines and clinical criteria when assessing medical necessity. These guidelines help ensure that medications are prescribed for conditions where they are most effective and necessary. Adhering to these guidelines can strengthen the case for Ozempic coverage.

- Documentation and Communication: Clear and comprehensive documentation of your medical history and treatment plans is essential. Your healthcare provider should maintain detailed records and be prepared to communicate the rationale for prescribing Ozempic to the insurance company if prior authorization is required.

3. Cost-Sharing and Patient Responsibility

Even when Ozempic is covered by insurance, patients may still be responsible for a portion of the cost through cost-sharing mechanisms. Understanding these costs is essential for financial planning. Here’s a breakdown of common cost-sharing structures:

- Copayment (Copay): A copay is a fixed amount that the patient pays for a prescription medication each time it is filled. The copay amount can vary depending on the medication's tier within the insurance plan's formulary. For example, a patient might pay $40 as a copay for Ozempic if it falls under Tier 2.

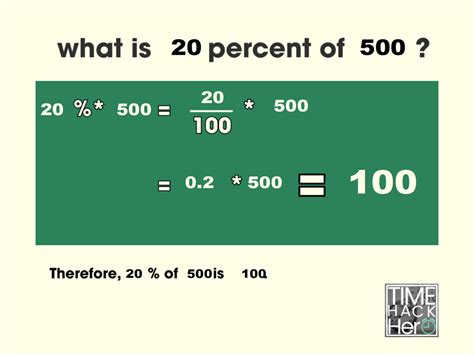

- Coinsurance: Unlike a copay, coinsurance is a percentage of the medication's cost that the patient pays. For instance, if Ozempic is covered with 20% coinsurance, the patient would pay 20% of the medication's cost, while the insurance provider covers the remaining 80%.

- Deductible: Some insurance plans require patients to meet a deductible before coverage for prescription medications kicks in. Until the deductible is met, the patient pays the full cost of the medication. After the deductible is satisfied, the insurance coverage applies.

- Maximum Out-of-Pocket (MOOP): MOOP limits the amount a patient has to pay out of pocket for covered services, including prescription medications. Once the MOOP is reached, the insurance provider covers 100% of the cost for the remainder of the plan year.

4. Navigating Insurance Challenges

Despite the best efforts of patients and healthcare providers, navigating insurance coverage for medications like Ozempic can be challenging. Here are some common hurdles and strategies to overcome them:

- Prior Authorization Denials: If your insurance provider denies prior authorization for Ozempic, don't lose hope. Work closely with your healthcare provider to understand the reasons for the denial and gather additional evidence or documentation to support the medical necessity of the medication. Sometimes, appealing the denial can lead to a successful outcome.

- High Out-of-Pocket Costs: For patients with high copays or coinsurance, the cost of Ozempic can be a significant financial burden. In such cases, exploring patient assistance programs, manufacturer coupons, or discount cards can help reduce the financial impact. Additionally, discussing cost-saving strategies with your healthcare provider can be beneficial.

- Formulary Changes: Insurance plans may periodically update their formularies, which can impact medication coverage and costs. Staying informed about these changes and discussing them with your healthcare provider can help you prepare for any potential disruptions in coverage.

Real-World Impact and Patient Experiences

The insurance coverage landscape for Ozempic has a tangible impact on patients’ lives and their ability to manage their diabetes effectively. Here are some real-world examples and patient experiences that illustrate the significance of insurance coverage:

| Patient Story | Insurance Coverage Impact |

|---|---|

| John, a 45-year-old with type 2 diabetes, was prescribed Ozempic by his endocrinologist. His insurance plan covered Ozempic with a $50 copay, making it affordable for him to manage his condition effectively. | John's insurance coverage ensured he had access to Ozempic at a reasonable cost, allowing him to maintain his diabetes control and overall health. |

| Sarah, a 32-year-old with diabetes, struggled to afford Ozempic due to its high out-of-pocket cost. She explored patient assistance programs and found a manufacturer-sponsored program that provided Ozempic at a significantly reduced price, making it more accessible for her. | Access to patient assistance programs helped Sarah overcome financial barriers, enabling her to continue her diabetes treatment and maintain her health. |

| Michael, a 58-year-old with complex medical needs, was prescribed Ozempic as part of his diabetes management. His insurance provider required prior authorization, which his healthcare team successfully obtained, ensuring he could access the medication without delay. | Efficient prior authorization processes allowed Michael to start his Ozempic treatment promptly, demonstrating the importance of timely insurance approvals. |

Future Perspectives and Industry Insights

As the healthcare industry evolves, the landscape of insurance coverage for medications like Ozempic is likely to change as well. Here are some future perspectives and industry insights to consider:

- Advancements in Diabetes Management: The field of diabetes management is constantly evolving, with new medications and technologies emerging. Insurance providers may adapt their coverage policies to incorporate these advancements, offering patients access to the latest treatments.

- Value-Based Insurance Models: Some insurance companies are shifting towards value-based models, where coverage decisions are based on the expected health outcomes and cost-effectiveness of treatments. This approach could influence the coverage of medications like Ozempic, prioritizing their inclusion based on their demonstrated value.

- Pharmaceutical Industry Dynamics: The pharmaceutical industry's pricing strategies and negotiations with insurance providers can impact medication coverage. Ongoing discussions and negotiations may lead to changes in formulary placements and cost-sharing structures, affecting patient access.

Conclusion

Understanding the insurance coverage landscape for Ozempic is crucial for patients and healthcare providers alike. By exploring the various factors that influence coverage, patients can better navigate the healthcare system and access the medications they need. While insurance coverage can present challenges, a combination of advocacy, awareness, and collaboration between patients, healthcare providers, and insurance companies can lead to improved access and better diabetes management.

Frequently Asked Questions

How do I know if Ozempic is covered by my insurance plan?

+

To determine if Ozempic is covered by your insurance plan, you can check your plan’s formulary or contact your insurance provider directly. They can provide specific information about medication coverage, including any prior authorization requirements.

What happens if my insurance denies coverage for Ozempic?

+

If your insurance provider denies coverage for Ozempic, you can work with your healthcare provider to gather additional medical evidence and submit an appeal. Appealing the denial may involve providing detailed documentation supporting the medical necessity of the medication.

Are there any patient assistance programs available for Ozempic?

+

Yes, there are patient assistance programs and financial support initiatives available for Ozempic. These programs are designed to help patients with limited financial means access the medication. You can explore these options with your healthcare provider or directly through the medication’s manufacturer.

Can I expect changes in Ozempic’s insurance coverage over time?

+

Insurance coverage for medications can change over time due to various factors, including formulary updates and insurance plan modifications. It’s essential to stay informed about these changes and discuss any concerns with your healthcare provider to ensure uninterrupted access to your medications.

What are some alternative funding sources for Ozempic if insurance coverage is limited?

+

If insurance coverage for Ozempic is limited, you can explore alternative funding sources such as patient assistance programs, manufacturer-sponsored coupons or discount cards, or even fundraising initiatives. Discussing these options with your healthcare team can help you find the most suitable solution for your financial situation.