Landlord insurance is a specialized type of property insurance designed to protect property owners who rent out their residential or commercial properties. It provides comprehensive coverage tailored to the unique risks and liabilities faced by landlords. Unlike standard home insurance, landlord insurance offers enhanced protection, covering not only the physical structure but also the associated legal and financial responsibilities.

In the world of property management, where unexpected events can have significant financial implications, having the right insurance coverage is crucial. Landlord insurance serves as a safety net, ensuring that landlords can continue to operate their rental businesses smoothly, even in the face of unforeseen circumstances. This article aims to delve into the intricacies of landlord insurance, exploring its various components, benefits, and real-world applications.

Understanding Landlord Insurance

Landlord insurance is a vital component of the rental property business, offering a range of coverage options to safeguard landlords against potential losses and liabilities. It is designed to address the specific risks associated with renting out properties, providing financial protection and peace of mind.

Key Components of Landlord Insurance

- Building Coverage: This is the foundation of landlord insurance, providing protection for the physical structure of the rental property. It covers damages caused by perils such as fire, storms, vandalism, and natural disasters.

- Liability Protection: Landlord insurance includes liability coverage, which is essential for protecting landlords from legal claims and lawsuits arising from accidents or injuries that occur on the rental property.

- Rental Income Protection: In the event that the rental property becomes uninhabitable due to a covered loss, this coverage ensures that landlords continue to receive income, covering the loss of rent during the repair or reconstruction period.

- Additional Coverages: Depending on the policy and the landlord’s specific needs, additional coverages may include protection for personal property within the rental unit, coverage for legal expenses, and even rent guarantee insurance, which provides financial support if tenants fail to pay rent.

The exact coverage and limits of landlord insurance policies can vary significantly, making it crucial for landlords to carefully review and customize their policies to align with their unique circumstances and risks.

Benefits of Landlord Insurance

Landlord insurance offers a multitude of benefits that contribute to the financial security and peace of mind of property owners. By investing in comprehensive landlord insurance, landlords can enjoy the following advantages:

Financial Protection Against Losses

Landlord insurance provides financial coverage for a wide range of potential losses, including damages to the rental property, legal liabilities, and loss of rental income. This protection ensures that landlords can recover from unexpected events without incurring significant financial burdens.

Peace of Mind for Landlords

Knowing that their rental properties are adequately insured brings a sense of security and peace of mind to landlords. With landlord insurance, property owners can focus on managing their rental businesses confidently, knowing that they are protected against unforeseen circumstances.

Enhanced Rental Property Management

Landlord insurance not only provides financial protection but also contributes to more effective rental property management. With the right coverage in place, landlords can make informed decisions, negotiate leases with confidence, and attract high-quality tenants, ultimately enhancing the overall management of their rental properties.

Real-World Applications of Landlord Insurance

Landlord insurance plays a crucial role in protecting rental properties and the interests of both landlords and tenants. Let’s explore some real-world scenarios where landlord insurance has proven its value:

Natural Disasters and Severe Weather Events

In regions prone to natural disasters such as hurricanes, floods, or earthquakes, landlord insurance is invaluable. It provides coverage for damages caused by these events, helping landlords recover and rebuild their rental properties. For instance, a landlord in a hurricane-prone area may find their insurance policy covering the cost of repairs after a storm, ensuring the property is safe and habitable once again.

Tenant-Related Incidents

Landlord insurance also steps in to protect landlords from tenant-related incidents. For example, if a tenant accidentally starts a fire in the rental unit, the landlord’s insurance policy can cover the cost of repairs and provide temporary accommodation for the tenant. Additionally, liability coverage ensures that landlords are protected against legal claims arising from tenant injuries on the property.

Loss of Rental Income

In the event of a covered loss, such as a fire or severe water damage, the rental property may become uninhabitable, resulting in a loss of rental income for the landlord. Rental income protection, a component of landlord insurance, steps in to cover this loss, ensuring that landlords continue to receive income while the property is being repaired or reconstructed.

| Scenario | Coverage Provided |

|---|---|

| Natural Disaster | Building coverage, liability protection, rental income protection |

| Tenant-Caused Damage | Building coverage, liability protection |

| Loss of Rental Income | Rental income protection |

Choosing the Right Landlord Insurance

Selecting the appropriate landlord insurance policy is a critical decision that requires careful consideration. Landlords should assess their specific risks and needs to ensure they obtain adequate coverage. Here are some key factors to keep in mind when choosing landlord insurance:

Assessing Your Risks

Start by evaluating the potential risks associated with your rental property. Consider factors such as the location, the type of property (residential or commercial), and any specific hazards or vulnerabilities. Understanding these risks will help you choose the right coverage limits and policy options.

Comparing Policies and Providers

Research and compare different landlord insurance policies and providers. Look for reputable insurance companies that specialize in landlord insurance and have a strong track record of claims handling. Compare coverage options, policy limits, deductibles, and additional benefits to find the best fit for your rental business.

Understanding Policy Exclusions

Carefully review the policy exclusions to ensure you are aware of what is not covered. Common exclusions may include flood damage, earthquake damage, or damage caused by pests or vermin. If you identify specific risks that are not covered, consider purchasing additional endorsements or separate policies to address those gaps.

Customizing Your Policy

Landlord insurance policies can be customized to meet your unique needs. Work closely with your insurance agent or broker to tailor your policy. This may involve adjusting coverage limits, adding optional coverages, or selecting specific endorsements to enhance your protection. A customized policy ensures that you have the right coverage in place without unnecessary expenses.

Regular Policy Reviews

As your rental business grows and circumstances change, it is essential to review your landlord insurance policy regularly. Changes in the property value, the addition of new rental units, or changes in occupancy rates may impact your insurance needs. Regular policy reviews allow you to ensure that your coverage remains up-to-date and adequate.

Future Implications and Innovations

The world of landlord insurance is evolving, with ongoing innovations and emerging trends that are shaping the industry. Here’s a glimpse into the future of landlord insurance:

Digitalization and Technology Integration

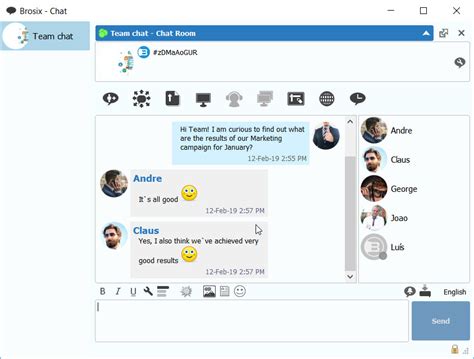

The insurance industry is embracing digitalization, and landlord insurance is no exception. Insurance providers are leveraging technology to streamline the insurance process, making it more efficient and accessible. Online platforms and mobile apps are being developed to allow landlords to easily manage their policies, file claims, and receive real-time updates.

Data-Driven Risk Assessment

Advanced data analytics and artificial intelligence are being utilized to assess risks more accurately. Insurance companies are leveraging data-driven insights to identify potential hazards and vulnerabilities associated with rental properties. This enables more precise risk assessment and tailored insurance solutions.

Enhanced Policy Customization

Landlord insurance providers are recognizing the diverse needs of property owners and are offering increased policy customization options. Landlords can now choose from a wider range of coverage options and endorsements to create a policy that aligns perfectly with their specific rental business.

Focus on Prevention and Risk Mitigation

Insurance companies are shifting their focus from solely providing financial protection to actively promoting risk mitigation and prevention. They are offering resources and guidance to landlords on implementing safety measures, maintaining properties, and managing tenant relationships to reduce the likelihood of claims and losses.

Sustainability and Green Initiatives

With growing environmental concerns, the insurance industry is embracing sustainability and green initiatives. Landlord insurance policies are starting to incorporate incentives and discounts for landlords who adopt energy-efficient practices and implement eco-friendly measures in their rental properties.

What is the difference between landlord insurance and standard home insurance?

+Landlord insurance is specifically designed for rental properties and provides coverage for the unique risks associated with renting, such as tenant-related incidents and loss of rental income. Standard home insurance, on the other hand, is primarily intended for owner-occupied residences and typically does not cover these rental-specific risks.

How can landlord insurance benefit tenants?

+Landlord insurance indirectly benefits tenants by ensuring that the rental property is adequately protected. In the event of a covered loss, such as a fire or severe weather damage, landlord insurance covers the cost of repairs, allowing tenants to continue living in a safe and habitable environment. Additionally, liability coverage provided by landlord insurance protects tenants from potential legal claims arising from accidents on the property.

Can landlord insurance cover rental properties in multiple locations?

+Yes, landlord insurance policies can often be customized to cover multiple rental properties in different locations. This allows landlords who own and manage properties in various areas to have comprehensive coverage for all their rental investments. However, it is important to review the policy’s terms and conditions to ensure that all properties are adequately insured and that there are no geographic restrictions.

What should landlords consider when choosing deductibles for their insurance policy?

+When selecting deductibles for landlord insurance, landlords should carefully consider their financial capabilities and risk tolerance. A higher deductible may result in lower insurance premiums, but it also means that landlords will have to pay a larger portion of the costs in the event of a claim. On the other hand, a lower deductible provides more financial protection but may result in higher premiums. Landlords should assess their financial situation and choose a deductible that aligns with their ability to cover potential out-of-pocket expenses.

Are there any endorsements or additional coverages that landlords should consider for their policies?

+Yes, there are several endorsements and additional coverages that landlords may want to consider based on their specific needs and risks. Some common options include: flood insurance (if the property is in a high-risk flood zone), earthquake insurance (for properties in earthquake-prone areas), loss of rental income insurance (to cover potential loss of income during repairs), and personal property coverage (to protect the landlord’s belongings within the rental unit). It is advisable to consult with an insurance professional to determine the most suitable endorsements for your rental business.