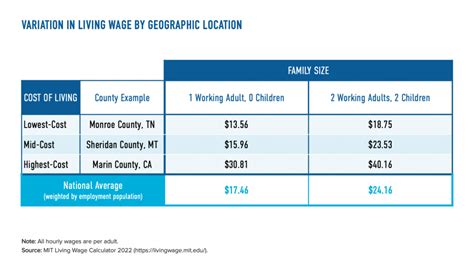

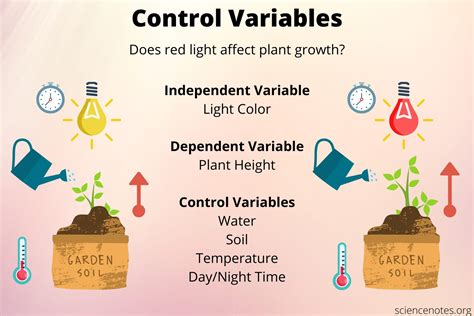

The concept of a livable wage has become a crucial aspect of modern economic discussions, as it directly impacts the quality of life of individuals and families. A livable wage is defined as the hourly wage rate that an individual must earn to support their family's basic needs, accounting for the cost of living in a specific geographic area. To calculate this, various factors such as housing costs, food, transportation, healthcare, and other necessities are considered. The development of livable wage calculator tools has simplified the process of determining the minimum income required for a decent standard of living in different locations.

These calculators take into account the specific costs associated with living in a particular city or region, providing a more accurate estimate than a one-size-fits-all approach. For instance, the cost of housing, which is a significant component of the livable wage calculation, varies substantially from one metropolitan area to another. By inputting factors such as family size, location, and the number of working adults in the household, individuals can use these tools to determine the hourly wage needed to maintain a basic yet decent standard of living.

Key Points

- A livable wage is the hourly wage rate needed to support a family's basic needs, considering the cost of living in a specific area.

- Livable wage calculator tools account for factors like housing, food, transportation, and healthcare costs to provide a location-specific estimate.

- These tools help individuals and families determine the minimum income required for a decent standard of living, facilitating informed decisions about employment, relocation, and budgeting.

- Understanding the livable wage is crucial for policy makers, employers, and individuals to address issues related to income inequality and poverty.

- The calculation of a livable wage can vary significantly depending on the size of the family, the number of working adults, and the specific geographic location.

Understanding the Livable Wage Calculator Tool

The livable wage calculator tool is designed to be user-friendly, allowing individuals to input their specific circumstances and receive an estimate of the hourly wage they need to earn. This estimate is based on comprehensive research and data analysis of the costs associated with living in different parts of the country. By considering the actual costs of necessities like housing, food, and healthcare in a given area, these tools provide a more personalized and accurate calculation of the livable wage.

Components of the Livable Wage Calculation

The calculation of a livable wage involves several key components, each reflecting a critical aspect of household expenses. These include:

- Housing Costs: This is often the largest expense for households, including rent or mortgage payments, utilities, and other housing-related costs.

- Food: The cost of purchasing basic food items necessary for a healthy diet, which can vary significantly depending on the location and availability of food sources.

- Transportation: Expenses related to commuting to work, including fuel, vehicle maintenance, and public transportation costs.

- Healthcare: The costs of health insurance, medical care, and other health-related expenses.

- Other Necessities: Expenses for clothing, childcare, entertainment, and savings, which are also factored into the livable wage calculation.

| Location | Family Size | Livable Wage Estimate |

|---|---|---|

| New York City | 2 Adults, 2 Children | $43.57 per hour |

| Los Angeles | 1 Adult, 1 Child | $34.19 per hour |

| Chicago | 2 Adults, 1 Child | $38.45 per hour |

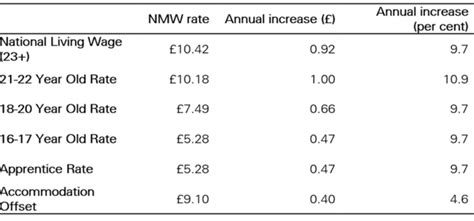

Implications of the Livable Wage Calculator

The implications of using a livable wage calculator are far-reaching, affecting not only individuals and families but also the broader economic and social landscape. For individuals, knowing the livable wage for their area can inform decisions about career choices, budgeting, and whether to relocate for better opportunities. Employers can use this information to set wages that are competitive and sustainable, potentially improving employee satisfaction and retention. From a policy perspective, understanding the livable wage can guide the development of minimum wage laws, social welfare programs, and economic development initiatives aimed at reducing poverty and promoting economic mobility.

Addressing Limitations and Challenges

While livable wage calculator tools provide valuable insights, they are not without limitations. The accuracy of the estimates depends on the quality and timeliness of the data used, as well as the assumptions made about household spending patterns. Additionally, these tools may not account for all variables that can affect the cost of living, such as access to affordable healthcare or the impact of local taxes. Despite these challenges, the livable wage calculator remains a powerful tool for advocating for fair wages, planning personal finances, and informing policy decisions.

What is the purpose of a livable wage calculator?

+The purpose of a livable wage calculator is to estimate the minimum hourly wage an individual must earn to support their family's basic needs, considering the cost of living in a specific geographic area.

How does the calculator determine the livable wage?

+The calculator considers various factors including housing costs, food, transportation, healthcare, and other necessities to provide a location-specific estimate of the livable wage.

Why is understanding the livable wage important for policy makers and employers?

+Understanding the livable wage is crucial for policy makers to develop effective strategies to address poverty and income inequality, and for employers to set fair and competitive wages, potentially improving employee satisfaction and retention.

In conclusion, the livable wage calculator tool offers a critical framework for assessing the minimum income necessary for a decent standard of living, tailored to the specific costs of different geographic locations. By providing a nuanced understanding of the financial realities faced by individuals and families, these tools can inform personal, policy, and business decisions, ultimately contributing to a more equitable and sustainable economic environment.